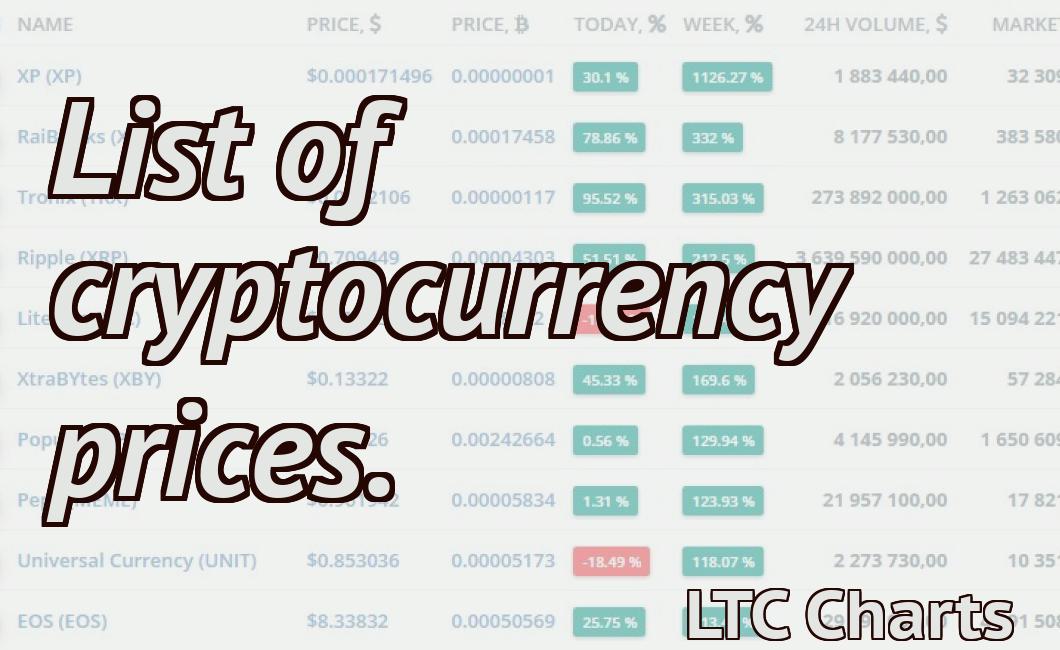

Crypto Market Prices Data

Crypto Market Prices Data is a website that provides data on the prices of cryptocurrencies. The site includes a chart of the prices of the top 100 cryptocurrencies, as well as a list of the top 10 exchanges by volume.

Understanding the Crypto Market Prices Data

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrency prices are determined by supply and demand. When more people want a cryptocurrency, the price goes up. Conversely, when fewer people want a cryptocurrency, the price goes down.

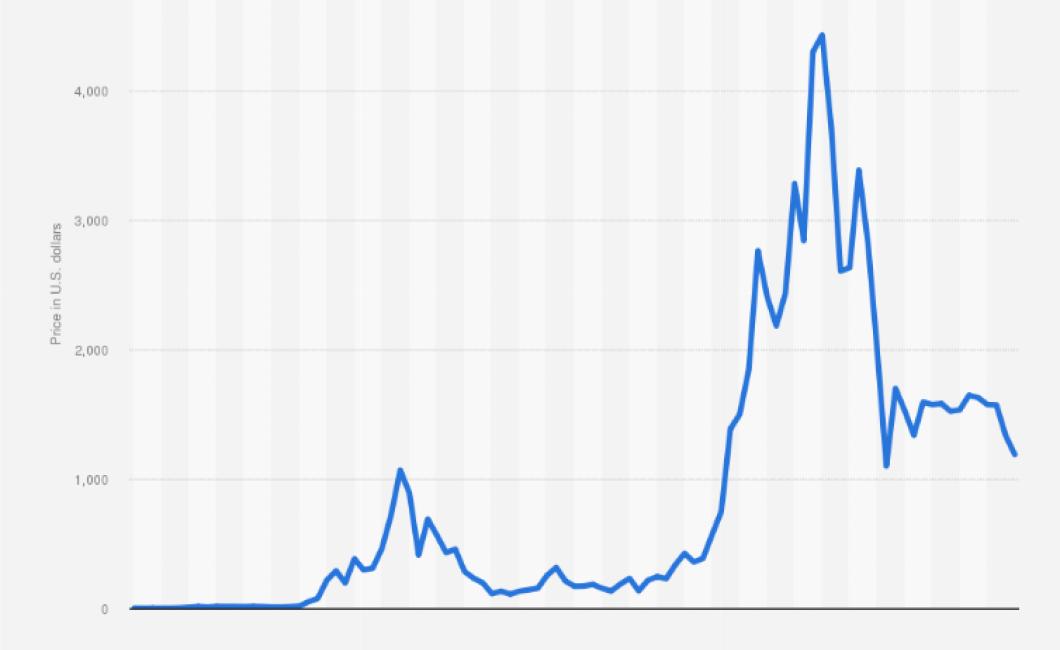

Cryptocurrencies are not backed by any physical asset, but by the trust of the community. While some cryptocurrencies have experienced significant price fluctuations, overall they have grown in value over time.

How the Crypto Market Prices Data is Used

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrency prices are calculated by using a variety of methods, including exchanging rates, news, and fundamentals. The most popular method is called CoinMarketCap, which gathers data from a variety of exchanges and uses a weighted average to calculate prices. Cryptocurrencies are often traded on decentralized exchanges, which make it difficult for governments or financial institutions to track or regulate prices.

What the Crypto Market Prices Data Means

When looking at the prices of different cryptocurrencies, it is important to note that the data is not always accurate or up-to-date. This means that the prices you see in the market may not be accurate at the time you are reading this article. Additionally, it is worth noting that the prices of some cryptocurrencies have risen a lot more than others, and this can lead to differences in how much value each cryptocurrency has.

The Significance of the Crypto Market Prices Data

Cryptocurrency prices data is an important component of the blockchain industry. It provides a snapshot of the current market conditions and can be used to make informed investment decisions.

Cryptocurrency prices data can also be used to track the performance of individual cryptocurrencies and entire markets. This information can be used to identify trends and make informed investment decisions.

The Importance of the Crypto Market Prices Data

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. The value of a cryptocurrency is based on the supply and demand for that cryptocurrency and on the belief that it has future potential.

Cryptocurrency prices are important because they can be a indicator of investor sentiment. If the markets believe that a cryptocurrency is in a bull market, then its prices will be higher than if the markets believe that the cryptocurrency is in a bear market.

The Benefits of the Crypto Market Prices Data

Cryptocurrencies have become a global phenomenon in recent years, with prices soaring and then crashing numerous times. The prices data provided by CoinMarketCap.com offers insights into the dynamics of the crypto market, which can be useful for investors, traders, and other interested parties.

Below are some of the benefits of CoinMarketCap.com's prices data:

1. It provides a comprehensive overview of the current state of the crypto market.

2. It allows for analysis of past prices to better understand how the market has behaved.

3. It provides an objective measure of the value of various cryptocurrencies.

4. It is a valuable tool for market forecasting.

5. It can help to identify potential investments and trends in the crypto market.

The Advantages of the Crypto Market Prices Data

There are many advantages to using cryptocurrency market prices data. These advantages include the ability to monitor trends, understand market sentiment, and make informed investment decisions.

1. Monitoring Trends

One of the main benefits of using cryptocurrency market prices data is the ability to monitor trends. This is especially useful for investors who want to stay ahead of the curve and make informed investment decisions.

2. Understanding Market Sentiment

Another advantage of using cryptocurrency market prices data is the ability to understand market sentiment. This is essential for making informed decision about whether or not to buy or sell a particular cryptocurrency.

3. Making Informed Investment Decisions

Cryptocurrency market prices data can also be used to make informed investment decisions. This is especially helpful for those who are new to the cryptocurrency market.

The Pros and Cons of the Crypto Market Prices Data

When looking at the cryptocurrency market prices data, there are some pros and cons to consider. On one hand, it can be helpful for investors to have a snapshot of the current prices of different cryptocurrencies. This can help them to make informed decisions about which cryptocurrencies to invest in.

However, the cryptocurrency market prices data can also be volatile and difficult to predict. This means that it can be difficult to make accurate investments based on this information. Additionally, the prices of some cryptocurrencies can be very volatile, which can make it difficult for investors to make significant profits.

The Pitfalls of the Crypto Market Prices Data

There are a few potential pitfalls with relying on crypto market prices data to make investment decisions.

1. Lack of Transparency

One of the biggest problems with crypto market prices data is that it is often not transparent. This means that it is difficult to know how reliable the data is.

2. Volatility

Crypto market prices can be very volatile, which can make it difficult to make accurate investment decisions.

3. Lack of Historical Data

Another problem with relying on crypto market prices data is that it is often not historical. This means that it is difficult to know how the market has behaved in the past.

The Risks of the Crypto Market Prices Data

There are a few risks associated with the price data in the crypto market.

The first risk is that the prices are not accurate. This could be due to a variety of reasons, including errors in the data or manipulation by traders.

The second risk is that the prices could be subject to volatility. This means that they could change rapidly, which could make it difficult to make accurate investment decisions.

The third risk is that the prices could be subject to price manipulation. This means that traders could try to artificially increase or decrease the prices of cryptocurrencies, which could lead to losses for investors.