Crypto exchanges manipulate prices no matter what you buy.

Crypto exchanges are known for manipulating prices, no matter what you're buying. This is because they want to make a profit off of your purchase, and will often times inflate prices to do so. However, there are some exchanges that are more reputable than others, and it's important to do your research before buying anything on an exchange.

Crypto Exchanges Manipulate Prices No Matter What You Buy

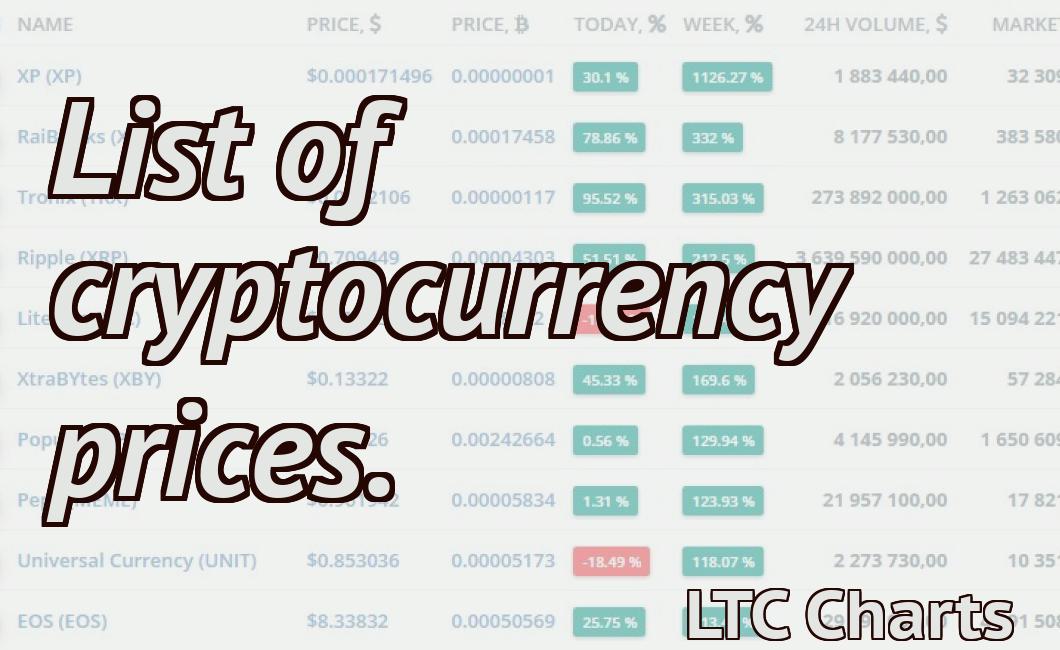

Cryptocurrencies are volatile, so it’s important to do your research before investing. However, some cryptos are more volatile than others. This means that even if you buy a digital currency that is considered to be less volatile, the price of that currency could still rise or fall.

For example, if you buy Bitcoin, Ethereum, or Litecoin, those digital currencies are all considered to be less volatile than Bitcoin Cash, Bitcoin Gold, or Ethereum Classic. However, if you buy Bitcoin Cash, Bitcoin Gold, or Ethereum Classic, the price of those digital currencies could rise or fall more than the price of Bitcoin, Ethereum, or Litecoin.

This is why it’s important to do your research before investing. If you buy a digital currency and the price of that currency goes down, you can still make money by selling that digital currency and buying another digital currency that is considered to be less volatile.

How Crypto Exchanges Manipulate Prices

Cryptocurrencies are electronic tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

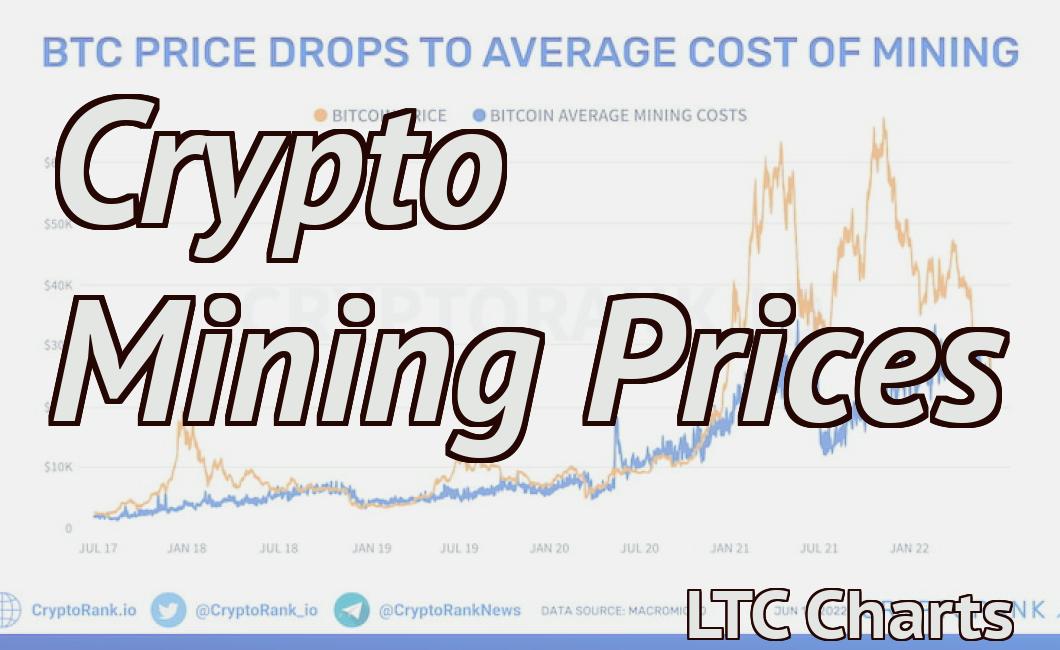

Cryptocurrencies are traded on centralized exchanges, which allow users to buy and sell cryptocurrencies with fiat currency (USD, EUR, etc.). These exchanges often manipulate the prices of cryptocurrencies in order to make a profit.

For example, an exchange may raise the price of a cryptocurrency in order to attract more users, which will result in increased demand and increased prices. Alternatively, an exchange may lower the price of a cryptocurrency in order to reduce demand and bring down prices.

The Truth About Crypto Exchanges and Price Manipulation

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Many people believe that crypto exchanges are responsible for price manipulation, whereby exchanges artificially inflate or deflate the prices of cryptocurrencies in order to make a profit. However, there is little evidence to support this assertion. In fact, research suggests that price manipulation does not occur on crypto exchanges with large volumes.

Why Is It Important to Know Whether or Not Crypto Exchanges Are Manipulating Prices?

The perception of crypto exchanges as price manipulators could have a negative impact on the overall market value of cryptocurrencies. If investors believe that crypto exchanges are engaged in price manipulation, they may choose to invest in other cryptocurrencies that are not subject to manipulation. This could lead to a decrease in the overall value of all cryptocurrencies.

What Should You Do If You Suspect That a Crypto Exchange Is Manipulating Prices?

If you believe that a crypto exchange is engaging in price manipulation, you should contact the exchange and provide evidence of the manipulation. You may also want to consider withdrawing your funds from the exchange and investing in a cryptocurrency that is not subject to price manipulation.

Why Crypto Exchanges Manipulate Prices

Cryptocurrency exchanges are a vital part of the cryptocurrency ecosystem, and they play an important role in setting the price of cryptocurrencies. However, some exchanges have been accused of manipulating the prices of cryptocurrencies in order to make profits.

One example of this is the case of Bitfinex, which was accused of manipulating the prices of bitcoin and other cryptocurrencies in order to make profits. Bitfinex is one of the largest cryptocurrency exchanges in the world, and it has been accused of engaging in price manipulation on a large scale.

In an effort to combat price manipulation, some cryptocurrency exchanges have implemented strict rules on how trading can take place. These rules are designed to prevent exchanges from artificially manipulating the prices of cryptocurrencies.

What You Need to Know About Crypto Exchange Price Manipulation

Crypto exchange price manipulation is a problem that has been cropping up in the digital currency industry. This problem occurs when traders use bots or other automated trading tools to artificially influence the prices of digital currencies on exchanges.

Price manipulation can have a negative impact on the overall value of cryptocurrencies and can create a false sense of security among investors. It can also lead to unfair advantages for those who are able to manipulate the prices of digital currencies.

Crypto exchange price manipulation is illegal and can result in financial penalties for those who are found guilty of engaging in this practice. In some cases, traders who engage in price manipulation may also be subject to criminal charges.

What Are the Types of Crypto Exchange Price Manipulation?

There are two main types of crypto exchange price manipulation: artificial supply and demand and spoofing.

Artificial supply and demand refers to the practice of traders using bots or other automated tools to artificially increase or decrease the number of coins available for purchase on an exchange. This can artificially drive up or down the prices of cryptocurrencies on the exchange.

Spoofing refers to the use of fake orders to illegally manipulate the prices of digital currencies on an exchange. Spoofing can involve placing orders with the intention of cancelling them immediately so that the order appears to have been filled at a higher price than it actually was. This can artificially drive up the prices of digital currencies on the exchange.

What Are the Effects of Crypto Exchange Price Manipulation?

Crypto exchange price manipulation can have a number of negative effects on the value of cryptocurrencies.

First, price manipulation can artificially drive up the prices of cryptocurrencies on exchanges. This can lead to investors believing that these cryptocurrencies are overvalued and may lead them to sell their holdings at a lower price than they would have if they had not been manipulated.

Second, price manipulation can create a false sense of security among investors. This can lead them to invest more money in cryptocurrencies than they would otherwise do, which can lead to further price manipulation.

Third, price manipulation can create unfair advantages for those who are able to manipulate the prices of digital currencies. This can lead to an increase in the market share of these cryptocurrencies and an increase in their value.

Fourth, price manipulation can create a loss of trust in digital currencies and in the exchanges on which they are traded. This can lead to a decrease in the overall market value of cryptocurrencies and an increase in the value of cryptocurrencies that are not subject to price manipulation.

How Can You Tell if You're Experiencing Crypto Exchange Price Manipulation?

You can't always tell if you're experiencing crypto exchange price manipulation, but there are some indicators that you may be.

One indicator is if you're seeing a sudden increase or decrease in the value of your cryptocurrencies on the exchange. This may be due to artificial supply and demand or spoofing activity.

Another indicator is if you're seeing abnormal trading activity that you don't understand. This could be due to bots or other automated trading tools being used to manipulate the prices of cryptocurrencies on the exchange.

If you suspect that you're experiencing crypto exchange price manipulation, you should contact your financial institution or the authorities to report this activity.

How to Protect Yourself From Crypto Exchange Price Manipulation

There is no surefire way to protect yourself from price manipulation, but following some basic precautions can go a long way.

1. Do your research

Before investing in any cryptocurrency, it is important to do your research and understand the risks. This includes understanding how exchanges work and how they are likely to be manipulated.

2. Use a reputable exchange

It is important to use a reputable exchange if you want to avoid being manipulated. Exchanges that are well-established and have a good reputation are less likely to be manipulated.

3. Don’t invest more than you can afford to lose

Never invest more than you are willing to lose. If you are worried about being manipulated, it is best to only invest a small amount of money at a time. This will help to reduce the risk of losing all of your investment.

4. Store your cryptocurrency in a secure wallet

Never store your cryptocurrency in an online wallet or on an exchange. Instead, store it in a secure offline wallet. This will help to reduce the risk of theft or loss.

What Causes Crypto Exchanges to Manipulate Prices?

Crypto exchanges manipulate prices for a number of reasons. Some exchanges may do this to make it easier for people to buy or sell cryptocurrencies, while others may do it to make sure that their own platform is the most popular.

How to Avoid Getting Scammed by a Crypto Exchange

There are a few things you can do to help avoid getting scammed by a crypto exchange.

Make sure you research the exchange thoroughly before trading. Look for reviews from other users to get an idea of the quality of service offered.

Only trade what you can afford to lose. Do not trade more than you can afford to lose, as this could lead to financial ruin.

Never send money to an exchange without first verifying their legitimacy. Use a trusted third-party service like TrustPilot to check the authenticity of the exchange.

Do not allow anyone you do not know to access your account. If you do not feel comfortable with someone you met online, do not allow them access to your account.

Be careful when downloading software or apps from unknown sources. Always make sure you know who you are downloading software from and always use caution when downloading anything online.

Never give out your personal information such as your address, credit card number, or social security number to anyone you do not know.

Do not send money to an exchange until you have received a confirmation from the exchange that your funds have been transferred. This will help prevent fraud.

10 Tips to Keep Your Cryptocurrency Safe from Hackers

1. Use a strong password

2. Store your cryptocurrency in a secure offline wallet

3. Only use known and trusted exchanges

4. Keep an eye on your transaction history and only make transactions you know are safe

5. Be suspicious of any unsolicited emails or messages asking for your personal information

6. Always keep your software up to date and security patched

7. Don’t share your cryptocurrency with anyone you don’t trust

8. Don’t store large amounts of cryptocurrency in one place

9. Use multiple authentication methods, including 2-factor authentication

10. Always contact your financial institution if you experience any suspicious activity

5 Ways to Secure Your Cryptocurrency Wallets

1. Use a strong password

2. Keep your cryptocurrency wallets offline and secure

3. Use a hardware wallet

4. Store your cryptocurrency in a cold storage wallet

5. Use a VPN to keep your cryptocurrency safe