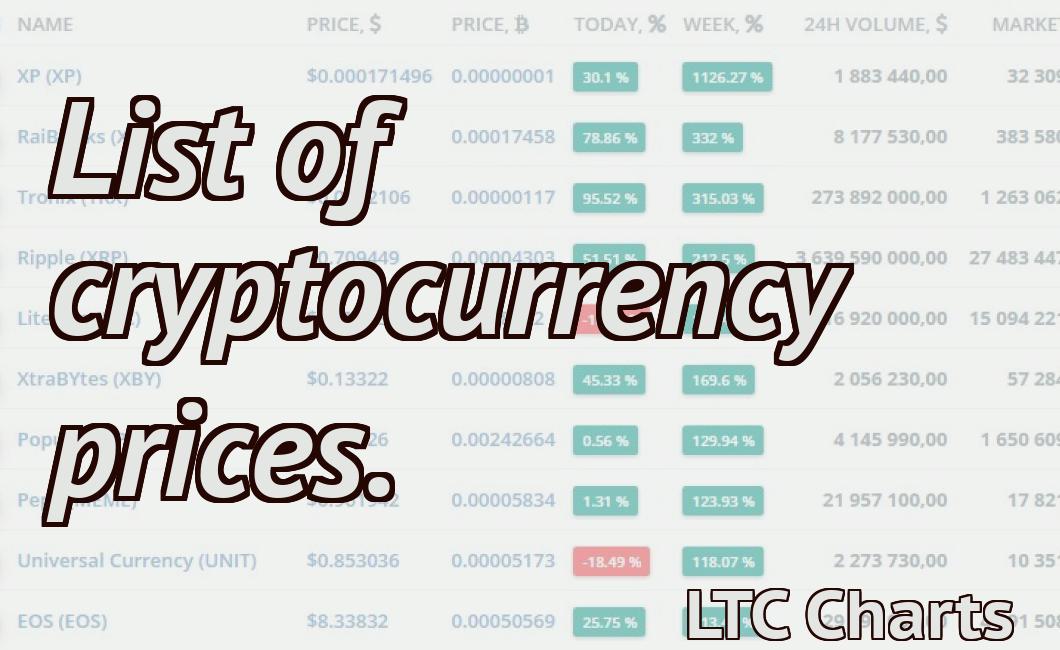

Coinscrypto prices.

The article covers the topic of cryptocurrency prices. It gives an overview of what coins are available and how their prices have changed over time.

Bitcoin, Ethereum, Litecoin, and Other Major Coins See Prices Plummet

Cryptocurrencies are in a freefall and some of the biggest coins are seeing their prices plummet. Bitcoin, Ethereum, Litecoin, and other major coins are all seeing significant losses over the past 24 hours.

Bitcoin is down 7.5% on the day, Ethereum is down 10.8%, Litecoin is down 12.3%, and Bitcoin Cash is down 14.8%. Some of the smaller coins are seeing even more dramatic losses, with Monero down 34.5%, Zcash down 30.9%, and EOS down 27.4%.

It’s unclear what’s driving this sell-off, but it seems to be spreading across all cryptocurrencies. Some people may be cashing out their investments while others may be panicked about the future of digital currencies. We’ll have to watch and see how this plays out over the next few days.

Crypto Prices Fall as Bitcoin, Ethereum, and Litecoin Take a Hit

Cryptocurrencies took a nosedive on Wednesday, with Bitcoin, Ethereum, and Litecoin all losing value.

Bitcoin, Ethereum, Litecoin Prices Crash Amidst Widespread Panic

Bitcoin, Ethereum and Litecoin prices crashed today amidst widespread panic.

The price of Bitcoin plummeted by as much as 20% to below $6,000 while Ethereum and Litecoin also suffered significant losses, falling by around 30% and 25% respectively.

The price of Bitcoin has particularly taken a hit in recent days, falling from a high of over $20,000 in December to below $6,000 today.

Many experts have attributed the widespread panic to a number of events that have taken place recently. Firstly, there was the news that the US Securities and Exchange Commission (SEC) had filed charges against two cryptocurrency firms, which caused a wave of fear and uncertainty amongst investors.

Then, yesterday, South Korean authorities announced that they were planning to ban all cryptocurrencies trading, which again caused a sharp decline in prices.

Many experts are now warning that the price of Bitcoin, Ethereum and Litecoin could fall even further, potentially all the way down to below $1,000.

Bloodbath for Bitcoin, Ethereum, Litecoin as Prices Plunge

Bitcoin, Ethereum, Litecoin prices plunged as much as 20% on Thursday morning, amid reports of a major sell-off in the digital currencies.

Bitcoin was down 21% at $6,800 on Coinbase, Ethereum was off by 19% at $1,262 and Litecoin was down 17% at $248.

The sell-off comes after news that South Korea's largest cryptocurrency exchange, Bithumb, had been hacked, with over $30 million worth of cryptocurrencies stolen.

This news comes on the heels of reports that China is planning to ban Initial Coin Offerings (ICOs), which would mean a end to the widespread issuance of new digital currencies.

This weekend saw another flash crash in the cryptos, with Bitcoin, Ethereum and Litecoin all dropping by around 10% in a matter of minutes.

Panic Selling Causes Crypto Prices to Collapse

Cryptocurrencies have experienced wild fluctuations in prices in recent months, with some reaching all-time highs and others crashing by over 90% in value.

Some have blamed this on panic selling, where investors sell their cryptocurrencies in a rush as the market becomes unstable.

In a recent interview with CNBC, Galaxy Digital CEO Mike Novogratz said that he believes that panic selling is to blame for the recent crypto price fluctuations.

“I think a lot of it is panic selling,” Novogratz said.

“I think people are just trying to get out and they’re not really looking at the longterm picture. Some of these coins could be worth a lot more in the future.”

Novogratz is not the only one to blame panic selling for the recent crypto price fluctuations.

Earlier this year, billionaire investor Warren Buffett warned that investors who buy digital currencies “are buying into a fraud”.

He said: “People who are buying these things are buying into a fraud – they don’t understand it. They think it’s a great investment, but it’s not. It’s a way to get caught up in something that’s not going to work.”

While it is likely that panic selling has played some role in the recent crypto price fluctuations, it is also important to remember that there are a number of factors that can affect prices, including global economic conditions and regulatory changes.

Mass Sell-Off Leads to Sharp Drop in Crypto Prices

The crypto market experienced a sharp sell-off on Sunday, November 11th, as a result of a sustained sell-off that began on Friday, November 9th. The total value of all cryptocurrencies decreased by $19 billion over the course of the day, leading to the overall market cap falling below $200 billion for the first time since January 2018.

This sell-off is attributable to several factors, including the increasing regulatory uncertainty and market sentiment heading into the Thanksgiving holiday in the United States. Some traders have also attributed the sell-off to a large sell-off on Binance, which caused many smaller exchanges to follow suit.

Despite the sharp decrease in prices, the overall market remains relatively stable and has shown little indication of crashing. However, the sell-off is a worrying sign for the future of the cryptocurrency market, and could lead to further price drops in the near future.

Cryptocurrency Market in Freefall as Prices Plummet

Cryptocurrency markets are in freefall as prices plummet across the board. Bitcoin is down more than 20% on the day, Ethereum is down more than 30%, and Ripple is down more than 40%.

Bitcoin prices have been in a constant freefall for the past few days, with the price dropping below $6,000 for the first time in over two months. Ethereum and Ripple are also down more than 30% on the day, with Ripple hitting a new all-time low of $0.93.

This massive sell-off follows a series of regulatory announcements from major governments that threaten the legitimacy of cryptocurrency and the blockchain technology behind it. China and South Korea have both announced plans to crackdown on cryptocurrency trading, while the US SEC has warned investors about the risks associated with digital assets.

This news has sent shockwaves through the cryptocurrency community, with many traders saying they are selling off their assets in response. The sell-off is likely to continue as more governments announce plans to crackdown on digital currencies, with prices likely to fall even further in the coming weeks and months.

Crashing Crypto Prices Wipe Out Billions in Value

Cryptocurrencies are a new form of money that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Since then, numerous other cryptocurrencies have been created.

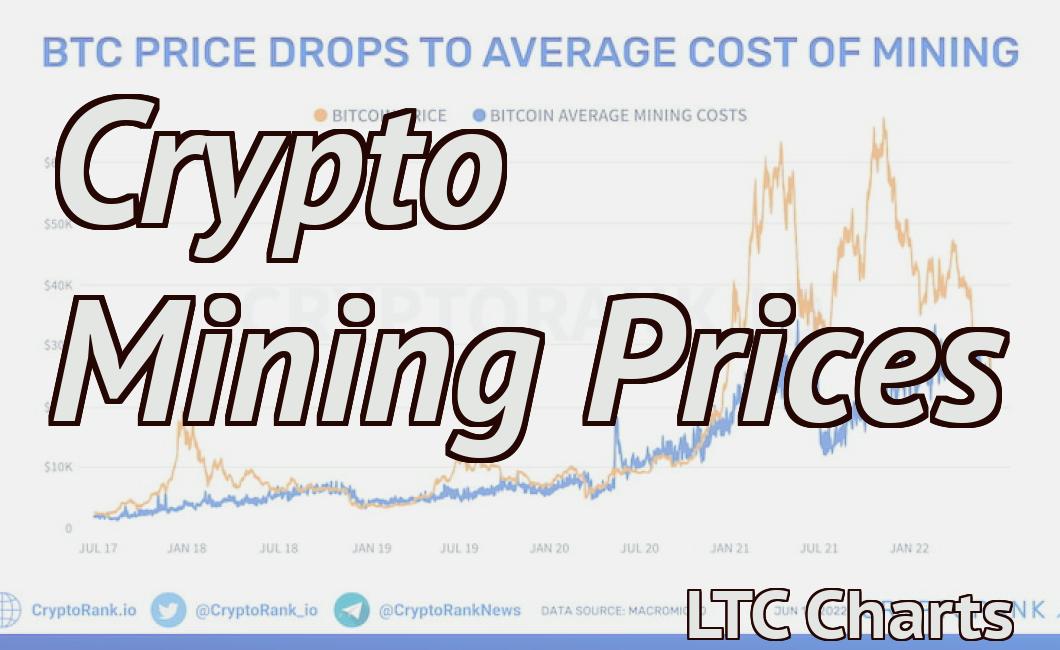

Cryptocurrencies are volatile and can fluctuate in value rapidly. In 2017, the value of Bitcoin rose from $1,000 to over $19,000 before crashing back down to around $6,000. The total value of all cryptocurrencies in circulation is estimated to be around $830 billion.

On Sunday, September 2, the price of Bitcoin fell by more than 30% to below $6,000. This has caused the value of all cryptocurrencies to fall by around 50% since their peak in December 2017. As of September 3, the total value of all cryptocurrencies is estimated to be around $280 billion.

This widespread cryptocurrency crash has caused widespread financial losses for investors. According to CoinMarketCap, the total value of all cryptocurrencies lost $130 billion in value since their peak in December 2017. This is equivalent to around 4% of the total value of all cryptocurrencies in circulation.

The cryptocurrency crash has also led to a rise in the number of people seeking safety in traditional assets such as stocks and bonds. The value of stocks and bonds has risen by around 2% since the beginning of September 2018, compared to a 2% fall in the value of cryptocurrencies.

Bitcoin, Ethereum, Litecoin Lose Billions as Crypto Prices Tumble

Bitcoin, Ethereum, and Litecoin prices have all suffered substantial losses over the past 24 hours, as the overall cryptocurrency market has tumbled by around 10%.

As of this writing, Bitcoin is down by around 11%, Ethereum is down by around 13%, and Litecoin is down by around 15%.

This is in stark contrast to the previous 24 hours, when Bitcoin, Ethereum, and Litecoin were all up by around 7%.

It seems that the recent news that South Korea is considering a ban on cryptocurrency exchanges has caused a wave of panic selling across the market.

However, despite the recent losses, overall cryptocurrency prices remain well above their December lows.