Bid Ask Prices Of Exchanges Crypto

The article discusses the bid and ask prices of exchanges for cryptocurrencies. It explains how these prices are determined and why they may differ between exchanges.

Crypto Exchanges' Bid-Ask Prices: A Comprehensive Guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges, which are platforms that allow users to buy and sell cryptocurrencies with each other. The price of a cryptocurrency is determined by the supply and demand on the exchange.

Cryptocurrency exchanges offer a variety of trading options, including:

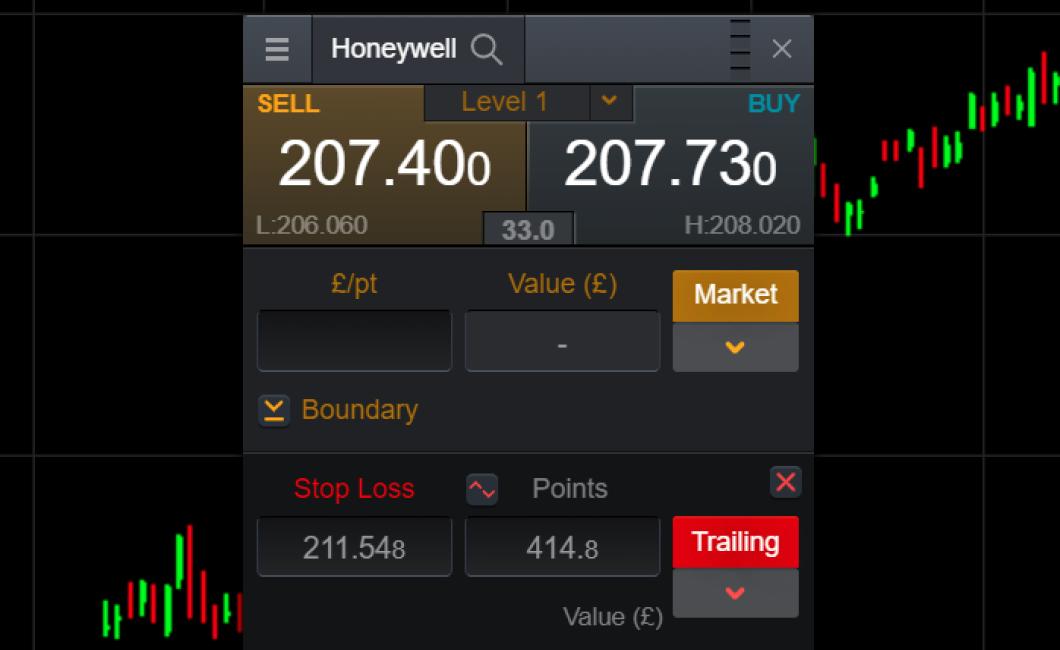

Bid/ask prices: These are the prices at which buyers and sellers are willing to exchange cryptocurrencies. Bid/ask prices are always lower than the market price.

These are the prices at which buyers and sellers are willing to exchange cryptocurrencies. Bid/ask prices are always lower than the market price. Limit orders: An order that allows buyers or sellers to buy or sell a cryptocurrency at a specific price. A limit order will only be filled if the price is below the limit.

An order that allows buyers or sellers to buy or sell a cryptocurrency at a specific price. A limit order will only be filled if the price is below the limit. Market orders: An order that will be filled at the lowest available price.

An order that will be filled at the lowest available price. Stop orders: An order that allows buyers or sellers to purchase or sell a cryptocurrency at a specific price, but will not be filled if the price falls below the specified price.

An order that allows buyers or sellers to purchase or sell a cryptocurrency at a specific price, but will not be filled if the price falls below the specified price. Margin trading: Trading with a margin allows you to increase your investment by borrowing money from a broker.

Trading with a margin allows you to increase your investment by borrowing money from a broker. Withdrawal restrictions: Some exchanges require users to withdraw cryptocurrencies within a certain time period.

Some exchanges require users to withdraw cryptocurrencies within a certain time period. Deposit restrictions: Some exchanges do not allow users to deposit cryptocurrencies.

Here is a list of 10 popular cryptocurrency exchanges:

1. Coinbase

2. Binance

3. Bitfinex

4. Gemini

5. Bitstamp

6. Bithumb

7. OKEx

8. Kraken

9. Poloniex

10. Gatehub

How do Crypto Exchanges Set Their Bid-Ask Prices?

Crypto exchanges set their bid-ask prices by ranking the highest bids and lowest asks for a particular cryptocurrency. The exchange then sets the price at which it will buy or sell that cryptocurrency.

The Relationship Between Exchange Rates & Bid-Ask Prices

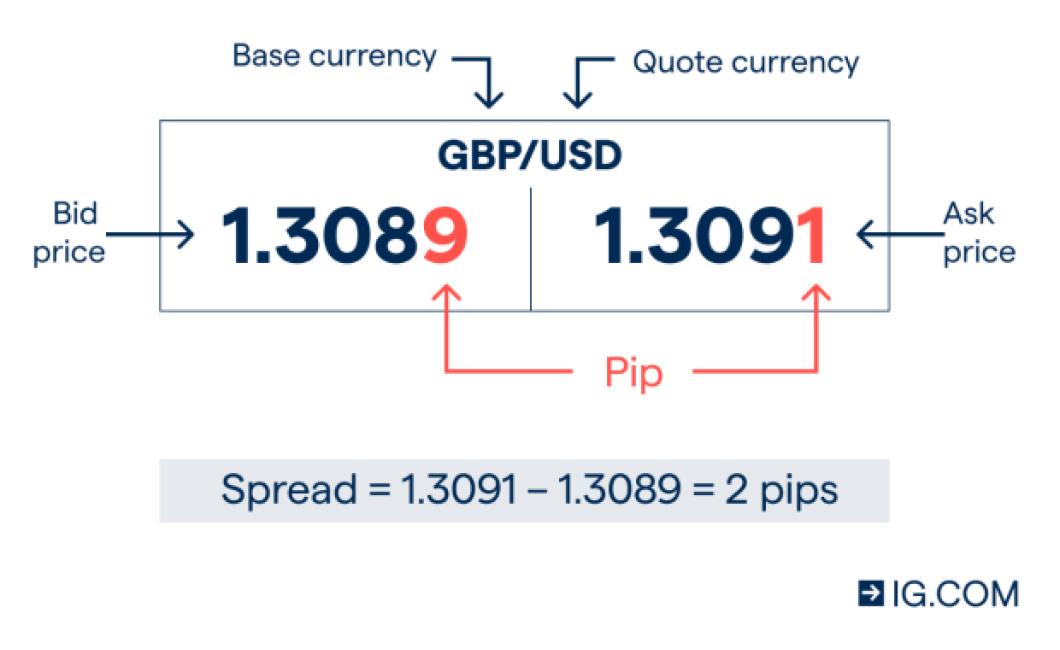

There is a close relationship between exchange rates and bid-ask prices. Bid-ask prices are the prices at which buyers and sellers are willing to exchange currencies. The higher the exchange rate, the higher the bid-ask price. Conversely, a lower exchange rate will cause the bid-ask price to be lower.

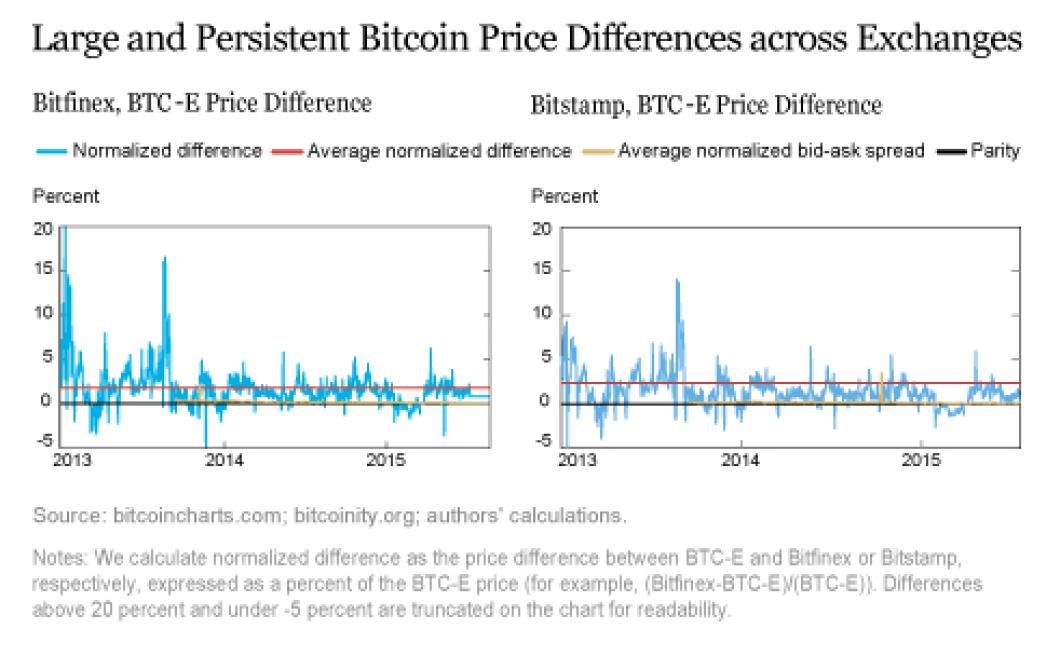

Why do Crypto Exchanges Have Different Bid-Ask Prices?

Crypto exchanges have different bid-ask prices because they charge different fees for buying and selling cryptocurrencies.

How to Use Bid-Ask Prices to Your Advantage When Trading Cryptocurrency

There are a few ways that you can use bid-ask prices to your advantage when trading cryptocurrency.

One way is to use them to determine the value of an asset. By knowing the bid-ask prices for a specific cryptocurrency, you can determine how much it is worth.

Another way to use bid-ask prices is to determine the best time to buy or sell an asset. By knowing the current bid-ask prices, you can decide when to buy or sell an asset.

Lastly, you can use bid-ask prices to determine the level of supply and demand for an asset. By knowing the current bid-ask prices, you can determine how much supply there is and how much demand there is for an asset.

What You Need to Know About Crypto Exchange Bid-Ask Prices

Cryptocurrency exchanges offer bid-ask prices which are a trading tool used to help buyers and sellers find each other. Bid-ask prices are displayed in two columns: the bid price (the highest price at which someone is willing to sell) and the ask price (the lowest price at which someone is willing to buy).

Bid-ask prices are important because they provide an accurate snapshot of the market sentiment. When the bid-ask price is close to the equilibrium price, there is a lot of interest in buying and selling the cryptocurrency, indicating that there is strong demand for the asset. Conversely, when the bid-ask price is far from the equilibrium price, there is little interest in buying or selling the asset, indicating that there is little or no demand for the asset.

How to Profit From Exchange Rate Fluctuations Using Bid-Ask Prices

When the exchange rate between two currencies changes, it can cause a difference between the prices at which goods and services are exchanged. This difference is known as the "bid-ask" spread.

Bid-ask spreads can be profitably exploited by purchasing foreign currency when the exchange rate is low and selling it when the exchange rate is high, thereby earning a profit on the difference in prices.

To profit from exchange rate fluctuations using bid-ask prices, follow these steps:

1. Research the current exchange rate between the two currencies you wish to exploit.

2. Check the bid-ask spread for the desired currency pair on a number of different exchanges.

3. Compare the lowest bid price (the price at which someone is willing to sell the currency) and the highest ask price (the price at which someone is willing to buy the currency).

4. Buy the currency when the bid price is lower than the ask price and sell the currency when the bid price is higher than the ask price.

5. Make a profit on the difference between the buy and sell prices.

What are the Implications of Wide Bid-Ask Spreads in the Crypto Market?

Wide bid-ask spreads can indicate that there is a lack of liquidity in the market, which can lead to higher prices and less price discovery. In addition, wide bid-ask spreads can also lead to illiquidity and higher trading costs.

How to Interpret Bid-Ask Prices When Making Crypto Trades

When you are making crypto trades, you will want to know what the bid-ask prices are. Bid-ask prices are the price at which buyers and sellers are trading. They are a good indicator of the current market conditions and can help you make informed decisions when trading cryptocurrencies.

To find the bid-ask prices for a cryptocurrency, you will need to find the buy and sell orders. The buy order is the highest price that a seller is willing to sell the cryptocurrency at and the sell order is the lowest price that a buyer is willing to purchase the cryptocurrency at. The bid-ask prices for cryptocurrencies are usually found just below the buy and sell orders, respectively.

When making a trade, you should always aim to buy cryptocurrencies below the bid-ask price and sell cryptocurrencies above the bid-ask price. This will ensure that you are making profits and that you are not being taken advantage of by the market conditions.

What's Behind the Scenes of a Crypto Exchange's Bid-Ask Price Mechanism?

The bid-ask price mechanism is a price-setting mechanism used in stock and commodities markets. The bid-ask price is the price at which buyers and sellers offer and ask for goods and services.