Crypto Prices Across Exchanges

Crypto Prices Across Exchanges is a quick guide to show you the price differences of popular cryptocurrencies across different exchanges.

The Different Prices of Cryptocurrency on Exchanges

One of the first things to consider when purchasing cryptocurrency is the price. Cryptocurrency exchanges offer a variety of prices for different cryptocurrencies.

The most common type of cryptocurrency exchange is a centralized exchange. A centralized exchange is a company that holds all of the customer’s cryptocurrencies and allows them to trade them with other users. Centralized exchanges are generally more expensive than decentralized exchanges, but they offer a higher degree of security and stability.

Decentralized exchanges are exchanges that do not hold any of the user’s cryptocurrencies. Instead, they rely on a peer-to-peer network to trade cryptocurrencies. This means that decentralized exchanges are generally cheaper than centralized exchanges, but they may not offer the same degree of security and stability.

Cryptocurrency prices can also vary depending on the market conditions. For example, if there is a significant crash in the price of a cryptocurrency, the price at an exchange may be lower than usual.

How Cryptocurrency Prices Vary Across Exchanges

Cryptocurrency prices on different exchanges can vary significantly. For example, one exchange may have a higher price for a given cryptocurrency than another. This can be due to a variety of factors, such as the location of the exchange, the liquidity of the cryptocurrency, and the trading volume.

It’s important to do your research when choosing an exchange to buy or sell cryptocurrencies, as some exchanges may have better prices than others.

The Impact of Exchange Rates on Cryptocurrency Prices

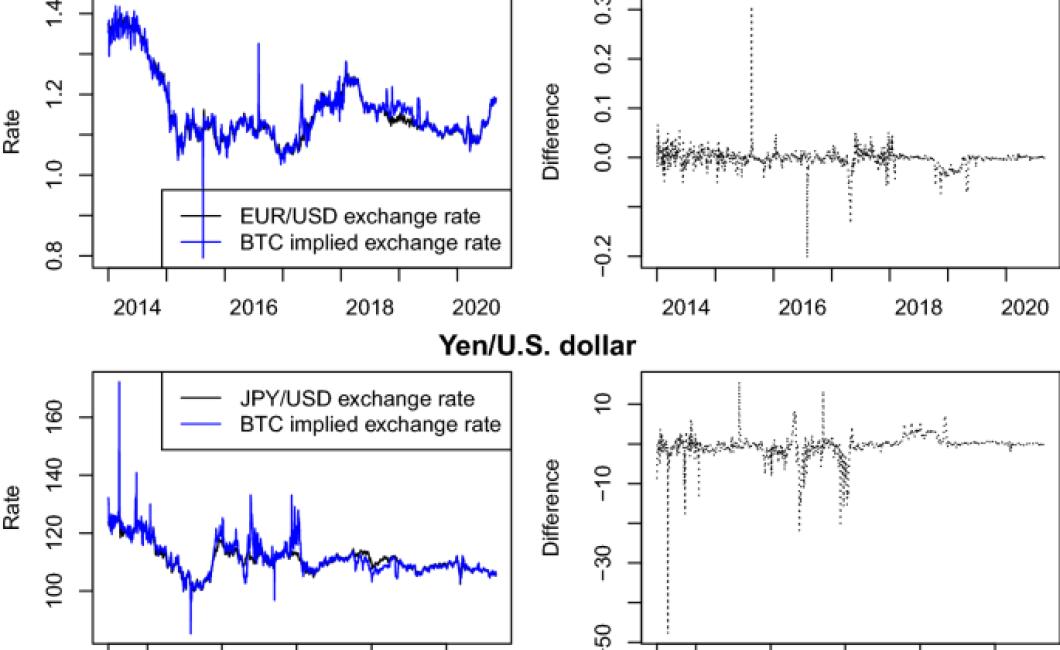

Cryptocurrency prices are largely affected by exchange rates. When one currency's value rises relative to another currency, demand for that currency rises, and its price tends to rise. Conversely, when one currency's value falls relative to another currency, demand for that currency falls, and its price tends to fall.

How Exchange Rates Affect Cryptocurrency Prices

Foreign exchange rates play a significant role in the prices of cryptocurrencies. When the value of a cryptocurrency falls, it is usually because the currency has fallen in value against one or more foreign currencies. Conversely, when the value of a cryptocurrency rises, it is usually because the currency has increased in value against one or more foreign currencies.

The Relationship Between Exchange Rates and Cryptocurrency Prices

Cryptocurrencies are volatile, meaning their prices can change rapidly. This volatility is caused by a number of factors, including the supply and demand for cryptocurrencies, news events affecting the market, and changes in global financial markets.

One of the main drivers of cryptocurrency prices is the exchange rate. The exchange rate is the price of one cryptocurrency in relation to another. For example, if the exchange rate is $1,000 USD to one cryptocurrency, that means that the price of that cryptocurrency is $1,000 per unit.

Cryptocurrencies are often traded on exchanges, where buyers and sellers come together to trade. When buyers want to buy a cryptocurrency, they offer money in exchange for the currency. When sellers want to sell a cryptocurrency, they offer the currency in exchange for money.

The exchange rate affects the price of cryptocurrencies because it affects how much money people are willing to spend on a given currency. If people are spending a lot of money buying cryptocurrencies, their demand will increase the price of that cryptocurrency. Conversely, if people are spending less money buying cryptocurrencies, their demand will decrease the price of that cryptocurrency.

The exchange rate also affects the price of cryptocurrencies because it affects how much money people are willing to sell them for. If people are selling cryptocurrencies for more money than they bought them for, their demand will increase the price of that cryptocurrency. Conversely, if people are selling cryptocurrencies for less money than they bought them for, their demand will decrease the price of that cryptocurrency.

Why Do Cryptocurrency Prices Differ Across Exchanges?

Cryptocurrency prices differ across exchanges because each exchange operates in a different way. Some exchanges allow users to buy and sell cryptocurrencies instantly, while others may require a longer wait time. Additionally, some exchanges may offer a greater selection of cryptocurrencies than others.

The Pros and Cons of Cryptocurrency Price Variation Across Exchanges

There are pros and cons to cryptocurrency price variation across exchanges. On one hand, this allows for greater liquidity and price discovery in the market. This can help to ensure that buyers and sellers have a fair opportunity to find a good deal and that the overall market is efficiently functioning.

However, variation can also lead to instability and unpredictability in the market. This can make it difficult for investors to assess the long-term viability of a particular cryptocurrency or exchange platform. Additionally, it can lead to arbitrage opportunities between different exchanges, which can create further price distortions.

How to Make the Most Out of Crypto Price Differences Across Exchanges

Cryptocurrency prices can vary quite a bit across different exchanges. This can make it difficult to make the most out of your investments. Here are some tips on how to make the most out of cryptocurrency price differences across exchanges:

1. Compare Cryptocurrency Prices Across Exchanges

One way to make the most out of cryptocurrency price differences across exchanges is to compare prices. This can help you get an idea of which exchange offers the best deal for your coins.

2. Consider Buying Cryptocurrency on a Low-Volume Exchange

If you're looking to buy cryptocurrency on a low-volume exchange, you may be able to get a better deal. This is because low-volume exchanges tend to offer lower prices.

3. Consider Buying Cryptocurrency with a Credit Card

Many people prefer to buy cryptocurrency with a credit card because the process is quick and easy. This means you can buy cryptocurrency without having to wait for an exchange to open up for business.

3 Tips for Trading Cryptocurrency Across Multiple Exchanges

1. Do your research.

Before you start trading cryptocurrency on multiple exchanges, make sure you understand the different trading platforms and how they work. Each one has its own set of rules and regulations, so it’s important to familiarize yourself with them before you get started.

2. Set up an account on each exchange.

Once you know the basics of each exchange, it’s time to set up an account. This will allow you to buy and sell cryptocurrencies without having to worry about transferring funds between exchanges.

3. Do your research on each coin.

Once you have an account on each exchange, it’s time to do your research. Each coin has its own set of features and properties, so it’s important to understand what those are before you start trading.

How to Exploit Crypto Price Gaps Between Exchanges

The first step in exploiting a crypto price gap is to identify an exchange that is experiencing a price discrepancy. Once you have identified an exchange, you need to research the price differences between the exchanges.

Once you have identified an exchange with a price discrepancy, you can use the following steps to exploit the price gap.

1. Identify the Price Differences

The first step in exploiting a price gap is to identify the price differences between the exchanges. The price difference may be due to a variety of factors, including but not limited to:

Location

Circulation Supply

Trading Volume

Exchange Fees

Once you have identified the price differences, you can use this information to your advantage.

2. Use Price Manipulation to Increase Your Profits

The second step in exploiting a price gap is to use price manipulation to increase your profits. Price manipulation may include but is not limited to:

Buying on One Exchange and Selling on Another

False Advertising

spoofing

3. Wait for the Right Moment to Sell Your Shares

The third step in exploiting a price gap is to wait for the right moment to sell your shares. The right moment may include but is not limited to:

When the Price Gap Is Widest

When the Price Gap Appears to Be Fixed

When the Market Is Most Volatile

5 Ways to Take Advantage of Crypto Price Fluctuations Across Exchanges

1. Use a Crypto Trading Platform

Crypto trading platforms allow you to trade cryptocurrencies and fiat currencies simultaneously. This allows you to take advantage of price fluctuations across exchanges.

2. Use Margin Trading

Margin trading allows you to borrow money from a broker to buy cryptocurrencies. When the price of the cryptocurrency goes up, you can sell the cryptocurrency and use the proceeds to pay back the borrowed money. This allows you to make money from price fluctuations even if you don’t own the cryptocurrency.

3. day trade

Day trading is the practice of trading cryptocurrencies over a short period of time. This allows you to take advantage of short-term price fluctuations.

4. hold cryptocurrencies

Holding cryptocurrencies allows you to take advantage of price stability. This is because cryptocurrencies are not subject to fiat currency inflation or deflation.

5. invest in cryptocurrencies

Investing in cryptocurrencies is a long-term investment. This is because cryptocurrencies are not subject to fiat currency inflation or deflation.