What drives cryptocurrency prices up and down?

Cryptocurrency prices are highly volatile, and can be driven up or down by a variety of factors. These include news events, government regulation, and even the time of day.

What's Really Driving Crypto Prices Up and Down

Cryptocurrencies are experiencing rapid price fluctuations due to a variety of factors. Some of these drivers are fundamental while others are circumstantial.

Fundamental Drivers

1. Increased Investor Interest: Cryptocurrencies are becoming more popular among investors and the general public. This has led to increased demand and higher prices.

2. Regulatory Uncertainty: Cryptocurrencies are still relatively new, and their legality and status is still uncertain in many jurisdictions. This has led to volatility as investors wait to see what will happen next.

3. Increased Supply: Approximately 1,600 new cryptocurrencies have been created in the past year, which has led to a glut of supply and decreased prices.

Circumstantial Drivers

1. Exchange Crashes: A number of major exchanges have crashed in recent months, which has caused coins to lose value.

2. Pump and Dump Schemes: A few unscrupulous traders are using a technique called “pump and dump” to artificially drive up prices and then sell off their holdings. This causes the price to drop, making them money but causing other investors to lose money.

3. The Bitcoin Bubble: Bitcoin is the most well-known and expensive cryptocurrency, and its value has been driven up by speculation. If the bubble bursts, the value of all cryptocurrencies could decline.

The True Drivers of Cryptocurrency Prices

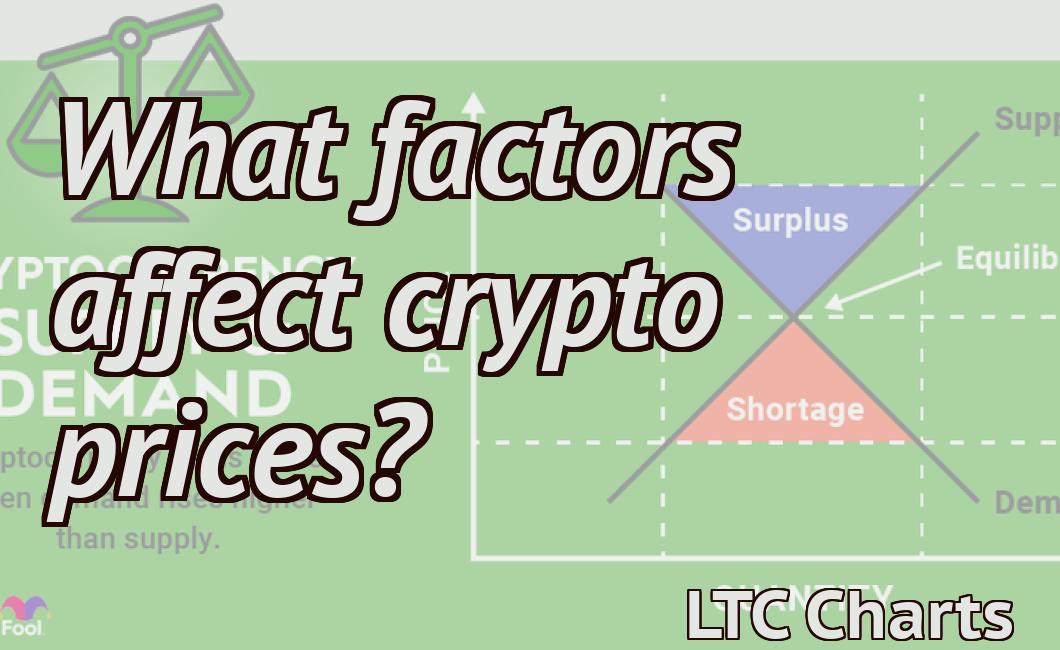

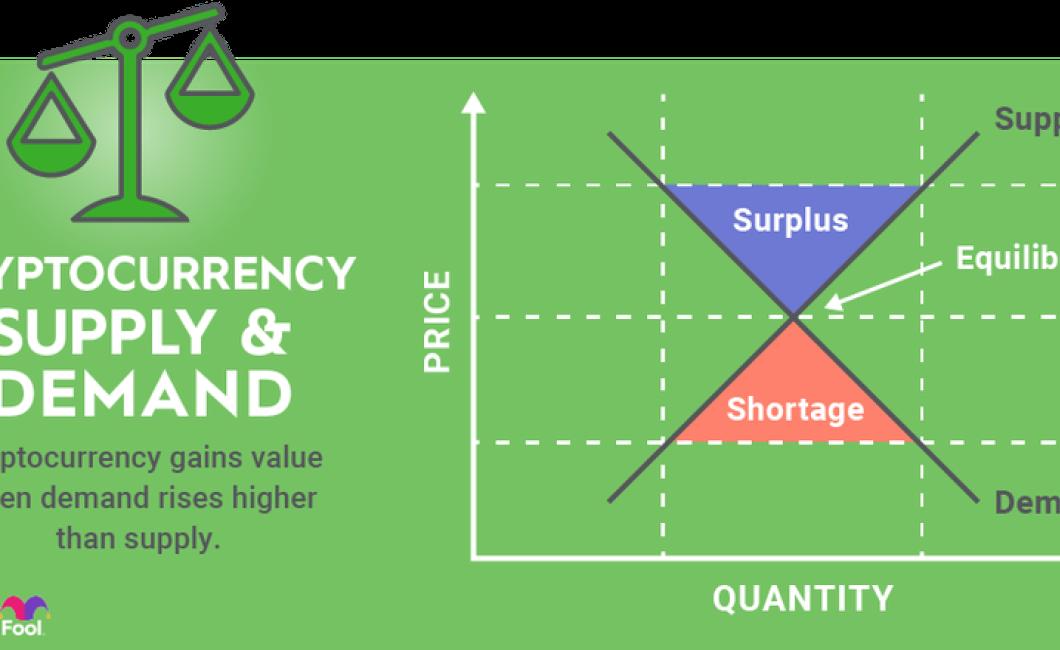

Cryptocurrency prices are driven by supply and demand.

Supply is the number of coins that are available for purchase. This is determined by the number of coins that are created and released into circulation.

demand is the number of people who are interested in buying a coin. This is determined by the current market conditions, including the price of other cryptocurrencies, the popularity of the coin, and the news related to the coin.

The Real Reasons Why Crypto Prices Fluctuate

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin and other cryptocurrencies are often traded on exchanges and can also be used to purchase goods and services.

Cryptocurrencies are often subject to price fluctuations, which may be caused by a variety of factors. Factors that can influence cryptocurrency prices include global economic conditions, news events, regulatory changes, and hype or hysteria. Many people believe that price fluctuations are a sign of an underlying asset's validity, and that the fluctuations reflect the market's confidence in the cryptocurrency.

The Hidden Factors That Affect Crypto Prices

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

There are a number of factors that affect the prices of cryptocurrencies, including global economic conditions, technological advances, regulatory changes, and market sentiment.

The True Causes of Volatility in Cryptocurrencies

The volatility in cryptocurrencies like Bitcoin and Ethereum is a common phenomenon that has been witnessed across different digital assets since their inception. It is important to understand the true causes of volatility in order to make informed decisions about whether or not to invest in these digital assets.

There are a number of factors that can contribute to the volatility of cryptocurrencies. These include:

1. The overall supply and demand for cryptocurrencies.

2. Changes in regulatory environment surrounding cryptocurrencies.

3. News events that impact the prices of cryptocurrencies.

4. Changes in the value of fiat currencies against cryptocurrencies.

5. Inflation or deflation of the overall cryptocurrency market.

6. Volatility of individual cryptocurrencies.

7. Technical issues with cryptocurrencies.

8. Human behavior in the cryptocurrency market.

The Secret Forces Behind Crypto Prices

Cryptocurrencies are a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

There is no one definitive answer to who or what creates Bitcoin prices. Various factors, including global economic conditions and news events, contribute to the movements of Bitcoin prices. Some people believe that governments or financial institutions can manipulate the value of cryptocurrencies, while others argue that the market is driven by genuine demand from investors.