What causes crypto prices to fluctuate?

Cryptocurrencies are volatile because they are new and largely unregulated. Their prices can fluctuate wildly in response to news and global events.

Seasonality in the cryptocurrency market

Cryptocurrencies are often considered to be a volatile and risky investment, but what is the reason for this?

There are a few reasons why cryptocurrencies are often considered to be a volatile and risky investment. Firstly, cryptocurrencies are not regulated by governments or financial institutions, which means that their value is highly dependent on the opinion of the market. Secondly, cryptocurrencies are often traded on decentralized exchanges, which means that there is no guarantee of liquidity - if there is not enough demand for a particular cryptocurrency, the price may be suppressed. Finally, cryptocurrencies are often traded on unregulated markets, which makes them vulnerable to price manipulation.

The influence of news on cryptocurrency prices

The price of a cryptocurrency is strongly influenced by news events and announcements. For example, when a new cryptocurrency is released, the price of that coin may rise significantly in the initial days and weeks after its release. This is because new coins are often considered to be more valuable than older coins, and because people may believe that the new coin has greater potential for growth.

Similarly, when a major cryptocurrency exchange announces that it is going to start trading a new coin, the price of that coin may spike significantly. This is because many people believe that the new coin will be more valuable on that exchange than on other exchanges, and because the news may cause other people to invest in the new coin.

The role of whales in the cryptocurrency market

Whales are a large part of the cryptocurrency market and play an important role in the overall growth of the market. whales are large investors who are able to invest a significant amount of money into the market and can have a significant impact on the prices of cryptocurrencies.

Whales are able to invest in cryptocurrencies because they understand the potential of the market and the importance of blockchain technology. They are also willing to take risks, which is why they are a key part of the cryptocurrency market.

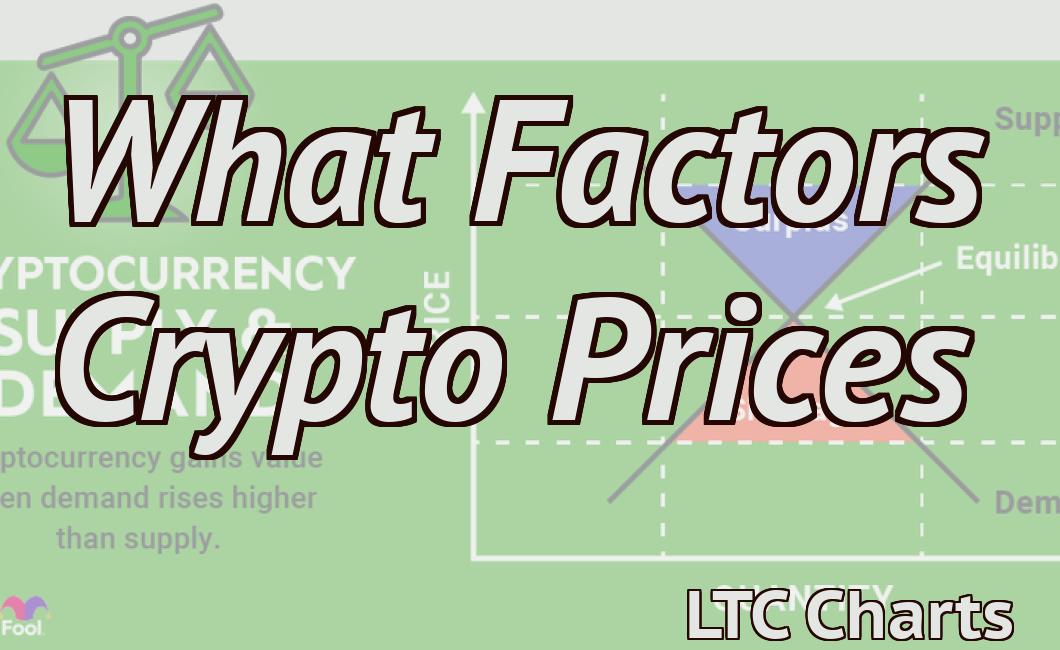

How cryptocurrency prices are determined

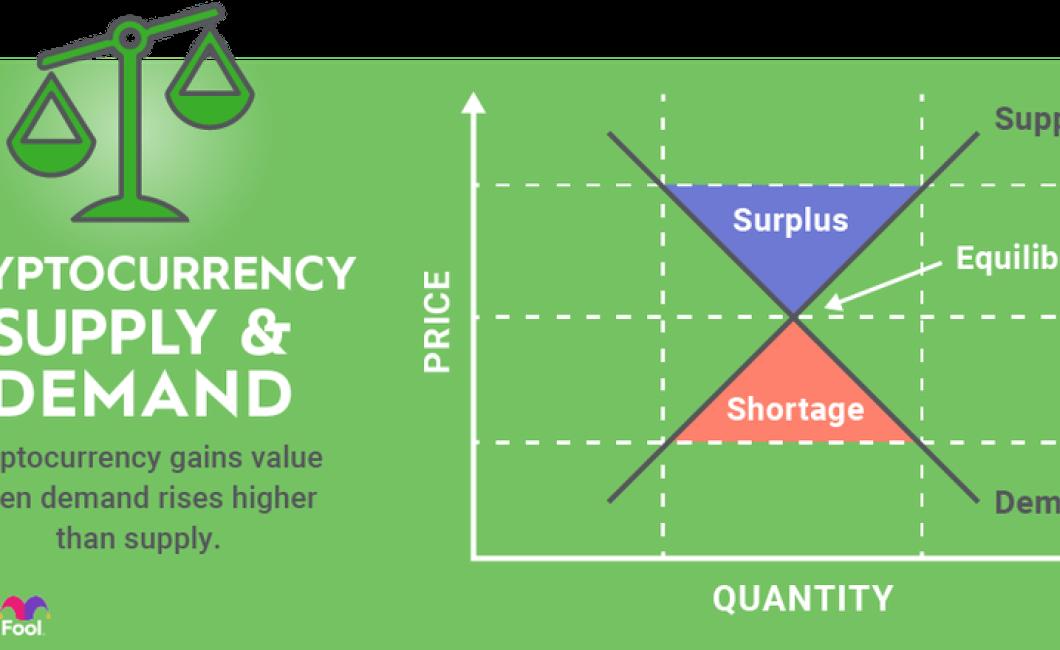

Cryptocurrency prices are determined by a number of factors, including demand from buyers and sellers, supply and demand on exchanges, and global economic conditions.

Why do cryptocurrency prices fluctuate?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. They can be traded on decentralized exchanges and can also be used to purchase goods and services. Cryptocurrencies are often associated with Bitcoin, but there are dozens of different cryptocurrencies. Prices of cryptocurrencies vary widely, and can be affected by a variety of factors, including global economic conditions, political events, and technical developments.

The impact of regulation on cryptocurrency prices

There is no definitive answer to this question as the impact of regulation on cryptocurrency prices is highly dependent on the specific regulations in place. However, some research suggests that regulation may have a negative impact on prices, as investors may be discouraged from investing in cryptocurrencies due to the uncertainty around the regulatory landscape.

The supply and demand of cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most popular cryptocurrency, has been in circulation for more than 10 years.

The volatility of cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. As of early 2018, there were over 1,500 cryptocurrencies in existence.

Cryptocurrencies are extremely volatile. This means that their prices can fluctuate a great deal from day to day, and from week to week. The price of a cryptocurrency can also change dramatically over the course of a single day. This volatility makes cryptocurrencies difficult to invest in, and it can be difficult for people to know whether the price of a particular cryptocurrency is worth investing in.