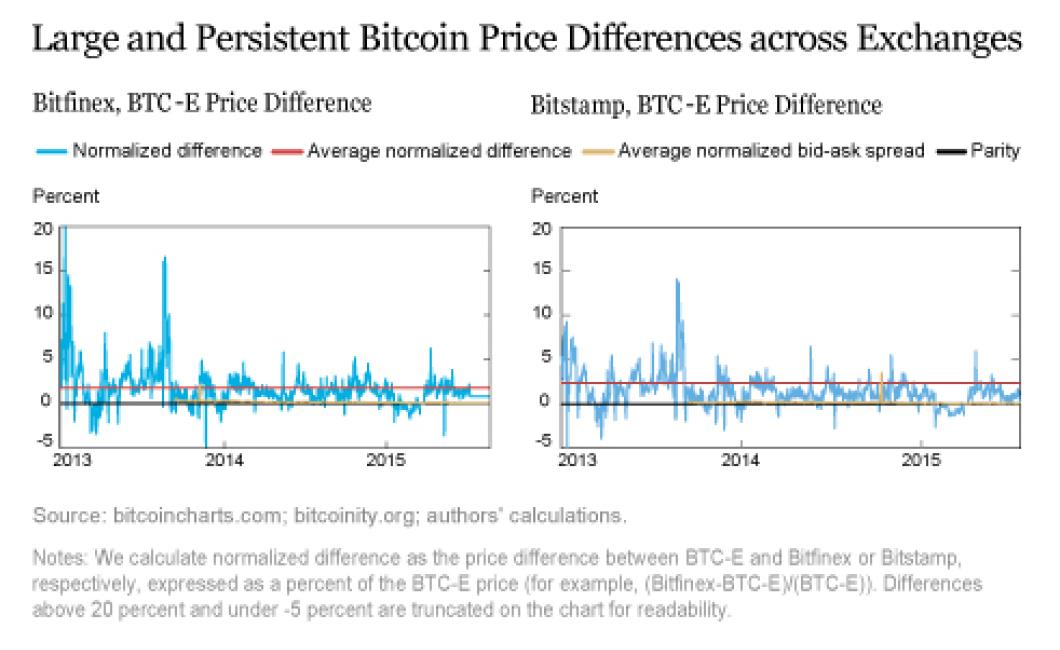

Crypto prices differ on different exchanges.

Different exchanges offer different prices for cryptocurrencies. This is due to the fact that each exchange has a different supply and demand for each currency.

Why do crypto prices differ on different exchanges?

Cryptocurrency prices on different exchanges can differ because of a variety of reasons. Some exchanges may have more liquidity, meaning they are able to buy and sell more cryptocurrencies than other exchanges. Other factors that can contribute to price differences include the location of an exchange, the type of exchange, and the fees that an exchange charges.

How do exchange differences impact cryptocurrency prices?

Exchange rates can impact cryptocurrency prices because they affect the value of cryptocurrencies relative to each other. When one cryptocurrency is trading at a higher exchange rate than another, it is worth more on that exchange. Conversely, when one cryptocurrency is trading at a lower exchange rate than another, it is worth less on that exchange.

The price of Bitcoin on different exchanges

The price of Bitcoin on different exchanges can vary a lot. For example, some exchanges may be more expensive than others.

The price of Ethereum on different exchanges

The price of Ethereum on different exchanges has varied a great deal over the past year. Here is a list of the prices for Ethereum on some of the most popular exchanges.

The price of Ethereum on Coinbase

The price of Ethereum on Coinbase has ranged from $300 to $1100 over the past year.

The price of Litecoin on different exchanges

As of writing, the price of Litecoin on different exchanges ranges from $129.92 to $157.48.

How do trading volumes affect cryptocurrency prices on different exchanges?

There are a few factors that affect cryptocurrency prices on different exchanges. One of the most important factors is the trading volume. Trading volumes determine how much demand there is for a particular cryptocurrency and how much supply there is. When there is a lot of demand for a cryptocurrency, the price will usually be higher than when there is less demand. Conversely, when there is less demand for a cryptocurrency, the price will usually be lower than when there is more demand.

How do order books affect cryptocurrency prices on different exchanges?

Different exchanges have different policies on how they handle order books. For example, some exchanges allow orders to remain open until they are filled, while others allow orders to be filled as soon as they are placed. This can affect cryptocurrency prices on the exchange, as different buyers and sellers may be able to execute trades at different prices.

What other factors influence cryptocurrency prices on different exchanges?

There are a number of other factors that influence cryptocurrency prices on different exchanges. These include the availability of liquidity, regulatory uncertainty, and the overall health of the cryptocurrency market.