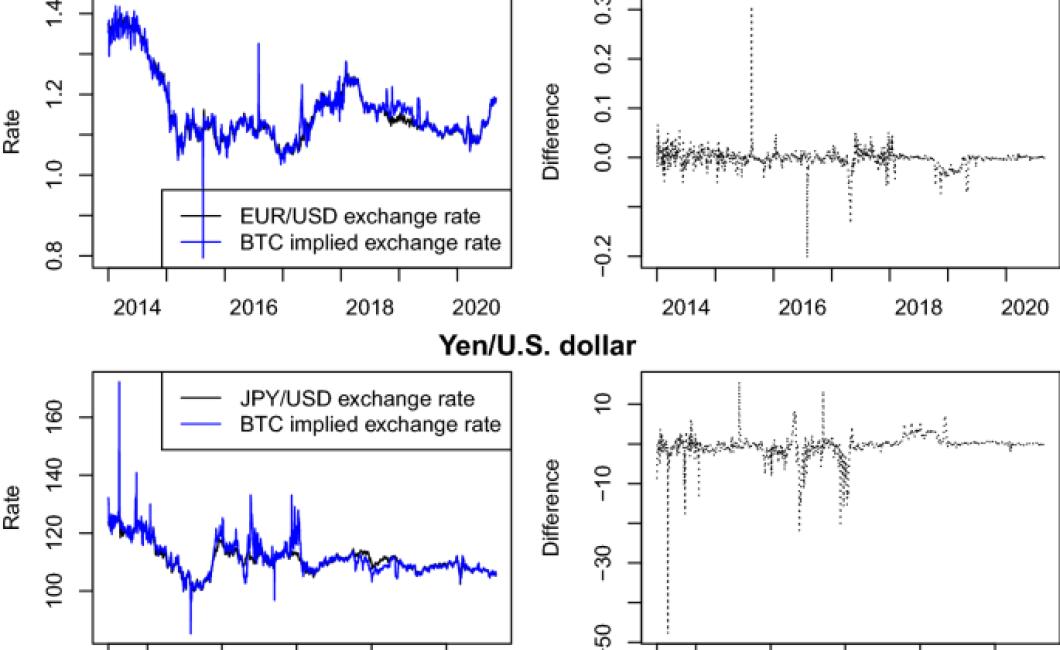

All prices on crypto exchange rates.

The article discusses the different prices of cryptocurrencies on different exchanges. It explains how these prices are determined and why they vary from exchange to exchange.

How to find the best prices on exchange rate crypto

There is no one definitive answer to this question. Some factors that you may want to consider include the country in which the exchange is located, the currency pair that you are looking to trade, and the liquidity of the market.

How to get the most out of your investment in crypto

There are a few things you can do to maximise the potential of your investment in crypto.

1. Join a community

One of the best ways to get the most out of your investment is to join a community of like-minded people. This will allow you to connect with other investors, learn from their experiences and make more informed decisions.

2. Seek advice from an expert

If you’re not sure what to do with your crypto, it’s always a good idea to seek advice from an expert. They can help you understand the risks and rewards associated with investing in crypto, and guide you towards the best strategy for you.

3. Stay up to date

It’s important to stay up to date with the latest news and developments in the crypto world. This will help you understand how the market is changing and make more informed decisions.

How to avoid getting scammed when buying crypto

There are a few ways to avoid getting scammed when buying crypto.

1. Do your research.

Before you make any purchases, do your research and be sure that the crypto you are buying is reputable and has a good track record. There are a lot of scams out there, so be sure to do your research before buying.

2. Only buy what you can afford to lose.

Never invest more than you are willing to lose. This is especially important when it comes to cryptocurrency, because there is a high risk of losing your investment.

3. Use a trusted platform.

When you are buying crypto, use a trusted platform. This will help to ensure that the transaction is safe and secure.

4. Don’t send your coins directly to someone you don’t know.

Never send your coins directly to someone you don’t know. Instead, use a platform like Coinbase or Binance to buy and sell crypto. This way, you will have more protection against scams.

The benefits of investing in crypto

Cryptocurrencies are a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. As a result, they may be more reliable and secure than traditional financial systems.

Cryptocurrencies can be used to purchase goods and services, and can also be exchanged for other currencies or used as an investment. Cryptocurrencies may be volatile and may experience price changes, but this volatility may also make them an attractive investment.

The risks of investing in crypto

There are a few risks associated with investing in crypto. First, crypto is still a relatively new and volatile investment format, which means that there is a high potential for significant losses. Second, crypto is not regulated by any government or financial institution, which means that there is a higher risk of fraud and theft. Finally, crypto is not backed by any tangible assets, so there is a greater risk of it losing value over time.

What to look for when choosing a crypto exchange

There are a few things you should look for when choosing a crypto exchange.

The first is the exchange’s security features. You want an exchange that has strong security measures in place, including a strong user account system and multiple layers of security.

Another important factor to consider is the exchange’s customer support. You want an exchange that is responsive to customer queries and can provide help when needed.

Finally, you want an exchange that offers a variety of trading options, including both tradable and non-tradable cryptocurrencies.

How to trade crypto like a pro

Start by researching the best exchanges for your coins. You can find great information on CoinMarketCap.com.

Next, gather your trading tools. You will need a crypto wallet to store your coins, as well as an exchange platform to trade them. Some popular exchanges include Binance, Coinbase, and Bitfinex.

Once you have your tools, it’s time to find a good trade. Look for coins that are trading at a higher price than they were a few weeks ago. This will indicate that the demand for the coin is high.

Once you have found a coin that you want to trade, research the market conditions. Are there any major news events that could affect the price of the coin? Is there a big competition happening between different coins?

Once you have a good understanding of the market conditions, it’s time to make your trade. Begin by buying the coin from the exchange and storing it in your wallet. Then, sell the coin to the market and make your profit.

The beginner's guide to making money with crypto

Cryptocurrencies are a new and exciting way to make money. Here we provide a beginner's guide to help you get started.

1. What is cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

2. How do I buy cryptocurrencies?

You can buy cryptocurrencies on exchanges or through online wallets.

3. What are the benefits of cryptocurrencies?

Some benefits of cryptocurrencies include:

- They are secure: Cryptocurrencies use cryptography to secure their transactions and to control the creation of new units.

- They are anonymous: Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

- They are low-cost: Cryptocurrencies are decentralized, meaning there is no middleman involved. This makes them cheaper than traditional financial products.

- They are volatile: Cryptocurrencies are new and exciting, and can be volatile in price. This means that you may make money or lose money when you invest in them.

5 easy steps to start trading crypto

1. Create an account with a crypto exchange that offers trading services.

2. Deposit fiat currency into your account.

3. Trade cryptocurrencies on the exchange.

4. Profit!

The difference between good and bad crypto exchanges

There is no one-size-fits-all answer to this question, as the best crypto exchanges will vary depending on your specific needs. However, some key distinctions between good and bad exchanges include:

Good exchanges are reliable and have a good level of customer service. They frequently offer high liquidity and have low fees.

Bad exchanges are unreliable and have poor customer service. They often have low liquidity and high fees.

How to pick the right crypto exchange for you

There are many factors to consider when choosing a crypto exchange. Here are some tips to help you choose the best one for you:

1. Choose an exchange with a wide range of currencies and trading pairs.

2. Make sure the exchange has a good reputation and is secure.

3. Choose an exchange with a user-friendly interface.

4. Look for an exchange that has a variety of features, such as trading tools, margin trading, and cold storage options.

5 things you need to know before investing in crypto

1. Crypto is volatile – This is a big one. Cryptocurrencies are highly volatile and can fluctuate in value significantly over short periods of time. This means that you could lose money investing in crypto, and it’s important to be aware of this before you invest.

2. Crypto is not regulated – Another big thing to remember is that crypto is not regulated by governments or financial institutions. This means that there is a greater risk of losing money if the crypto you invest in becomes worthless.

3. Cryptocurrencies are not backed by anything – This is another important point to remember. Cryptocurrencies are not backed by anything, meaning that they have no intrinsic value. This means that if the value of a cryptocurrency decreases, you could lose money.

4. You need to be able to handle risk – One of the biggest risks associated with investing in cryptocurrencies is the risk of losing your money. If you’re not comfortable with the risk of losing your money, you should probably avoid investing in crypto.

5. Crypto is not for everyone – Crypto is not for everyone, and it’s important to be aware of the risks before you decide to invest. If you’re not comfortable with the risk of losing your money, you may want to avoid investing in crypto.