How to read crypto charts.

If you want to get into the cryptocurrency market, you need to be able to read crypto charts. This guide will teach you how to read the most common type of crypto chart, the candlestick chart.

How to read crypto charts for beginners

Cryptocurrency charts are a great way to learn about the market and understand how different cryptocurrencies are performing.

To read a cryptocurrency chart, first find the currency you're interested in. You can do this by clicking on the currency's symbol on the left side of the chart (for example, BTC).

Then, find the "Open" or "High" price point on the chart. This is the price point at which the majority of buyers were active on the exchange. The higher the price point, the more valuable the currency.

Next, find the "Close" or "Low" price point on the chart. This is the price point at which the majority of sellers were active on the exchange. The lower the price point, the less valuable the currency.

Finally, look at the blue line on the chart to see how the currency is performing over time. The blue line shows the percentage change in value from the "Open" price point to the "Close" price point.

A guide to reading crypto charts

Cryptocurrencies are a digital asset class that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

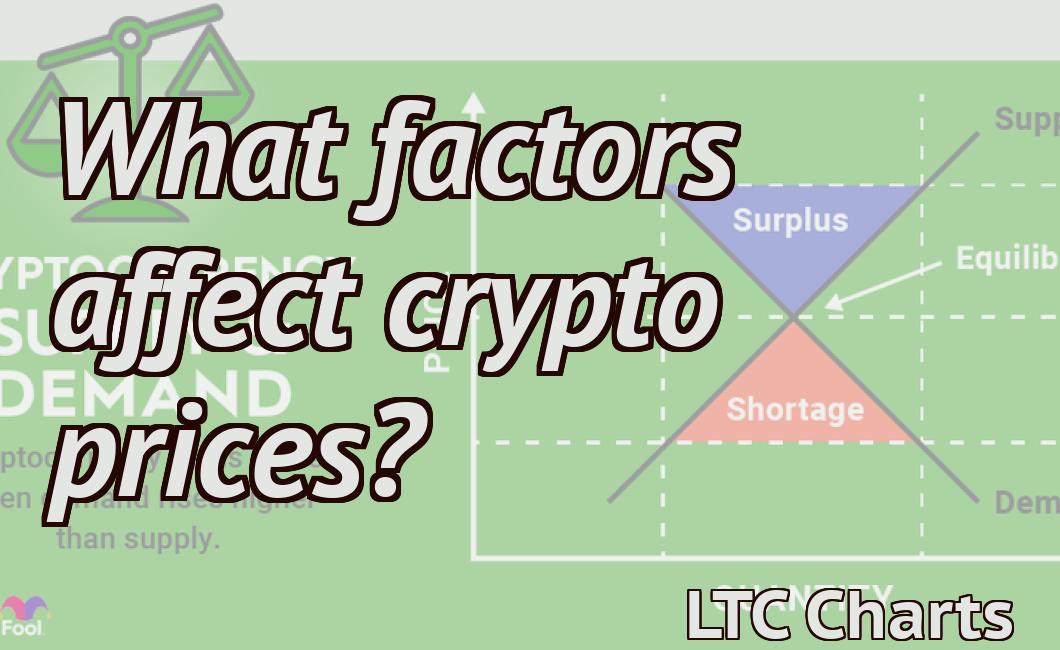

Cryptocurrency prices are based on supply and demand. When demand for a cryptocurrency exceeds available supply, prices will increase. Conversely, when there is a greater demand for a cryptocurrency than available supply, prices will decrease.

Cryptocurrency charts are used to track price movements and market sentiment. The most common type of cryptocurrency chart is the logarithmic chart, which plots price against time in linear fashion. Other types of charts include the candlestick chart and the bar chart.

When interpreting cryptocurrency charts, it is important to understand the order book. The order book is a list of all the active orders placed with the exchanges that trade cryptocurrencies. This list reveals the buy and sell orders of the market participants.

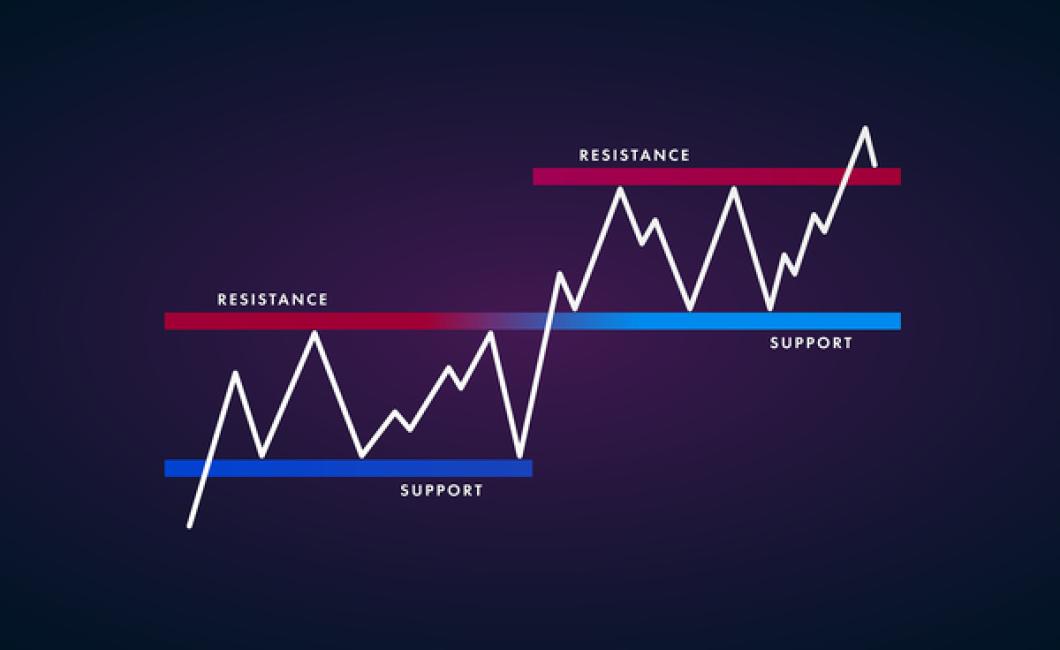

When analyzing cryptocurrency charts, it is important to understand the technical indicators. Technical indicators are used to identify patterns in the market and can help predict future prices. Some common technical indicators include the Bollinger Bands, the MACD, and the RSI.

How to interpret crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

How to make sense of crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, first described in a 2008 paper by Satoshi Nakamoto, is the most well-known and popular cryptocurrency.

How to read crypto charts like a pro

Cryptocurrencies are often traded on digital exchanges and can also be bought and sold through so-called alt coins.

Cryptocurrencies are often traded on digital exchanges, and can also be bought and sold through so-called alt coins.

To trade cryptocurrencies, you will need to open an account with a digital exchange that offers trading services. Once you have an account, you will need to deposit money into your account in order to trade. You can also trade cryptocurrencies by using CFDs (contract for difference).

In order to track the price of a cryptocurrency, you will need to use a cryptocurrency tracking website. These websites will provide you with real-time data on the price of a cryptocurrency, as well as information on all current and past transactions.

The ins and outs of reading crypto charts

Cryptocurrencies are a digital or virtual asset designed to work as a medium of exchange that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Bitcoin is not regulated by any country and it is not subject to financial institution or government control.

Getting the most out of crypto chart reading

Crypto chart reading is a powerful tool that can help you make informed investment decisions. However, to get the most out of it, you need to understand the basics of cryptocurrency trading.

1. Look for trends

One of the most important aspects of crypto chart reading is recognizing trends. When you see a pattern developing, it can help you make informed investment decisions. For example, if you see a cryptocurrency increasing in value over time, that could be a sign that the market is bullish and that you should buy in. Conversely, if you see the value of a cryptocurrency dropping over time, that could be a sign that the market is bearish and that you should sell.

2. Compare prices

Another important aspect of crypto chart reading is comparing prices. When you see two cryptocurrencies with similar values, that could be a sign that the market is stable and that you should buy both cryptocurrencies. Conversely, if one cryptocurrency is much more expensive than the other, that could be a sign that the market is unstable and that you should wait to buy.

3. Watch for news announcements

Cryptocurrency markets are often volatile, which means that prices can change quickly. In addition, news announcements can have a big impact on the prices of cryptocurrencies. For example, if a major financial institution starts investing in cryptocurrencies, that could cause prices to rise. Conversely, if a major financial institution starts banning cryptocurrencies, that could cause prices to fall.

4. Consider your investment goals

One of the biggest factors affecting your investment success is your investment goal. If you’re looking to make quick profits, then you may want to invest in cryptocurrencies that are volatile and risky. On the other hand, if you’re looking to build a long-term investment portfolio, then you may want to invest in cryptocurrencies that are less volatile and riskier.

How to become a crypto chart reading expert

1. Understand how cryptocurrency charts work.

Cryptocurrency charts are a visual representation of how valuable a cryptocurrency is over time. They’re used to determine whether or not a cryptocurrency is overvalued or undervalued.

2. Study the different types of cryptocurrency charts.

There are three main types of cryptocurrency charts: technical, fundamental, and hybrid.

Technical charts are used to predict future price movements. Fundamental charts look at a cryptocurrency’s historical price movements to determine its value. Hybrid charts combine both technical and fundamental analysis.

3. Learn how to read cryptocurrency charts.

Cryptocurrency charts are complex, so it takes some time to learn how to read them correctly. Start by studying the different types of charts and learning the indicators that are used on them. Then, practice analyzing charts to determine whether a cryptocurrency is overvalued or undervalued.

The ultimate guide to reading crypto charts

Cryptocurrency charts are an essential tool for any cryptocurrency trader. A good understanding of technical analysis will help you make informed investment decisions.

In this guide, we’ll teach you how to read crypto charts and use technical analysis to make informed investment decisions.

We’ll start by explaining what indicators are used in technical analysis and how to use them to make investment decisions. We’ll then move on to outlining the different types of charts and how to read them. Finally, we’ll give you a comprehensive guide to using technical analysis to trade cryptocurrencies.

Let’s get started!

What is technical analysis?

Technical analysis is a form of analysis that uses quantitative measures to analyze the financial performance of securities, commodities, or other economic objects.

Technical analysts use a variety of indicators to identify market trends and make investment decisions. These indicators can include price charts, moving averages, and volume data.

How do I use technical analysis to trade cryptocurrencies?

There are a few key things you need to know before you start using technical analysis to trade cryptocurrencies.

First, you need to understand how cryptocurrencies work. Cryptocurrencies are virtual tokens that use blockchain technology. This means that each token is unique and has its own set of rules and regulations.

Second, you need to understand how technical analysis works. Technical analysis is based on the premise that markets can be analyzed using simple principles that can be explained in easily understood terms.

Third, you need to understand how to read cryptocurrency charts. Cryptocurrency charts are often divided into three main sections: the supply chain, the transaction log, and the market data.

Fourth, you need to understand how to use technical analysis to trade cryptocurrencies. Technical analysis can help you identify patterns in market data and make informed investment decisions.

Let’s take a closer look at each of these key points.

How do cryptocurrencies work?

Cryptocurrencies are virtual tokens that use blockchain technology. This means that each token is unique and has its own set of rules and regulations.

Cryptocurrencies are based on mathematics and computer code, rather than physical assets like gold or silver. This makes them immune to political or economic fluctuations.

How do I use technical analysis to trade cryptocurrencies?

Technical analysis is based on the premise that markets can be analyzed using simple principles that can be explained in easily understood terms.

Technical analysts use a variety of indicators to identify market trends and make investment decisions. These indicators can include price charts, moving averages, and volume data.

Technical analysis can help you identify patterns in market data and make informed investment decisions.

For example, you might see a pattern in the price of a cryptocurrency that suggests the market is about to experience a change in direction. This would allow you to buy the cryptocurrency before the market goes down, and sell it after the market goes up.

How do I read cryptocurrency charts?

Cryptocurrency charts are often divided into three main sections: the supply chain, the transaction log, and the market data.

The supply chain is usually the first section of a cryptocurrency chart. It displays information such as the number of coins in circulation and the amount of new coins being created every day.

The transaction log is the second section of a cryptocurrency chart. It displays information such as the number of transactions made on the network and the amount of money being exchanged every day.

The market data section is the third section of a cryptocurrency chart. It displays information such as the price of a cryptocurrency and the volume of trading activity.

Your complete guide to reading crypto charts

Crypto charts are used to track the performance of various cryptocurrencies.

To read a crypto chart, you first need to find the currency you're interested in. Once you've found the currency, you need to find the right crypto chart.

There are a few different types of crypto charts available, so it's important to know what type you're looking for.

The most common type of crypto chart is the graph. This type of chart plots the performance of a cryptocurrency against time.

Another common type of crypto chart is the candle. This type of chart plots the performance of a cryptocurrency against another currency, such as USD or BTC.

Finally, there's the line chart. This type of chart plots the performance of a cryptocurrency against a fiat currency, such as USD or EUR.

Once you've found the type of crypto chart you're looking for, you need to find the currency you're interested in.

Once you've found the currency, you need to find the right crypto chart.

There are a few different types of crypto charts available, so it's important to know what type you're looking for.

The most common type of crypto chart is the graph. This type of chart plots the performance of a cryptocurrency against time.

Another common type of crypto chart is the candle. This type of chart plots the performance of a cryptocurrency against another currency, such as USD or BTC.

Finally, there's the line chart. This type of chart plots the performance of a cryptocurrency against a fiat currency, such as USD or EUR.