Crypto prices in euros.

Bitcoin and other cryptocurrency prices have been highly volatile in recent months, but one trend that has been consistent is the appreciation of those prices in euros. On Tuesday, the price of Bitcoin surged to a new all-time high of €8,200 ($9,700), while Ethereum rose to €250 ($290), its highest level since June. The rally in cryptocurrency prices comes as traditional financial markets have been roiled by concerns about the health of the global economy. Investors appear to be using cryptocurrencies as a hedge against economic uncertainty, with the euro being seen as a particularly attractive currency given the current political and economic turmoil in the eurozone.

Crypto Prices in Euros – What to Expect in 2021

Cryptocurrencies are all over the news these days, and with good reason. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Since then, there have been numerous other cryptocurrencies created, some of which are more popular than others.

The value of a cryptocurrency is determined by a number of factors, including demand from buyers and sellers, supply and demand on exchanges, government regulation, and general sentiment among cryptocurrency enthusiasts.

So what does the future hold for cryptocurrencies?

We expect cryptocurrencies to continue to grow in popularity and value over the next few years. This is due in part to the fact that cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Additionally, cryptocurrencies are relatively anonymous, making them attractive to criminals and other individuals who may want to hide their activities.

As a result, we anticipate that the value of cryptocurrencies will continue to increase, reaching unprecedented heights by 2021.

The 5 Best Performing Cryptocurrencies in Europe

Bitcoin

Bitcoin is the most popular cryptocurrency in Europe, with a market share of more than 35%. It is also the most valuable cryptocurrency on the continent, with a price of more than $2,470 per unit.

Ethereum

Ethereum is the second most popular cryptocurrency in Europe, with a market share of more than 18%. It is also the second most valuable cryptocurrency on the continent, with a price of more than $340 per unit.

Bitcoin Cash

Bitcoin Cash is the third most popular cryptocurrency in Europe, with a market share of more than 10%. It is also the third most valuable cryptocurrency on the continent, with a price of more than $1,100 per unit.

Litecoin

Litecoin is the fourth most popular cryptocurrency in Europe, with a market share of more than 7%. It is also the fourth most valuable cryptocurrency on the continent, with a price of more than $220 per unit.

EOS

EOS is the fifth most popular cryptocurrency in Europe, with a market share of more than 5%. It is also the fifth most valuable cryptocurrency on the continent, with a price of more than $5 per unit.

3 European Countries Leading the Crypto Revolution

Cryptocurrencies are becoming more and more popular all over the world. But which European countries are leading the charge when it comes to cryptocurrency adoption?

1. Switzerland

Switzerland has been at the forefront of cryptocurrency adoption for a long time. In fact, the country has been home to some of the earliest and most successful cryptocurrencies.

Switzerland is also one of the few countries that doesn’t have any restrictions on crypto trading. This makes it a perfect place for crypto investors to invest in and trade cryptocurrencies.

2. Estonia

Estonia is another European country that is leading the charge when it comes to cryptocurrency adoption. The country has been very supportive of blockchain technology and cryptocurrencies.

In fact, Estonia was one of the first countries to officially recognize bitcoin as a legal currency. Estonia also has a very favorable tax treatment for cryptocurrency investors.

3. Norway

Norway is another European country that is leading the charge when it comes to cryptocurrency adoption. The country has been very supportive of blockchain technology and cryptocurrencies.

Norway also has a very favorable tax treatment for cryptocurrency investors. This makes Norway a great place to invest in and trade cryptocurrencies.

Why the Euro is a Stronger Currency than Bitcoin

The euro is a stronger currency than bitcoin because it has a larger economic base. The euro has a population of over 27 million people and is used by more countries than bitcoin. Bitcoin has a population of just over 10 million people and is used by only a few countries.

How to Buy Bitcoin and Other Cryptocurrencies in Europe

If you want to buy bitcoin or other cryptocurrencies in Europe, you will need to first find a digital currency exchange. There are a number of exchanges available, so it is important to choose one that is reputable and has good customer service.

Once you have found an exchange, you will need to create a digital currency account. This can be done by providing your name, email address, and a password. You will also need to provide your national ID or a proof of residence.

Once you have created your account, you will need to deposit money into your account. This can be done by transferring money from your bank account or credit card.

Once you have deposited money into your account, you will need to purchase cryptocurrency. This can be done by using your digital currency exchange account to purchase bitcoin or another cryptocurrency.

The Future of Cryptocurrency in Europe – Regulation and Adoption

Cryptocurrencies are still in their early stages of development, so there is no one-size-fits-all approach to regulating them. Some European countries are taking a more cautious approach, while others are more open to the idea.

There is a lot of discussion about how to regulate cryptocurrencies in Europe, but it’s still unclear what the final solution will be. So far, most countries have taken a wait-and-see approach, while others have announced plans to regulate cryptocurrencies.

Some countries, like Switzerland, are taking a more tolerant approach. Switzerland is one of the few countries that doesn’t have any specific laws regulating cryptocurrencies. However, the Swiss Financial Market Supervisory Authority (Finma) has warned people not to invest in cryptocurrencies and warned companies that they may have to register as crypto-exchanges if they want to do business with Swiss customers.

In contrast, other European countries, like France, are taking a more aggressive stance. France announced plans to implement specific regulations for cryptocurrencies and digital assets in early 2018. The French financial regulator, the Autorité des marchés financiers (AMF), has warned investors that cryptocurrencies are highly speculative and riskier than traditional investments, and that they should only invest money that they can afford to lose.

It’s still unclear how much regulation will be implemented, and how it will impact the adoption of cryptocurrencies in Europe. However, it’s clear that there is a lot of discussion going on about how to best regulate cryptocurrencies in Europe.

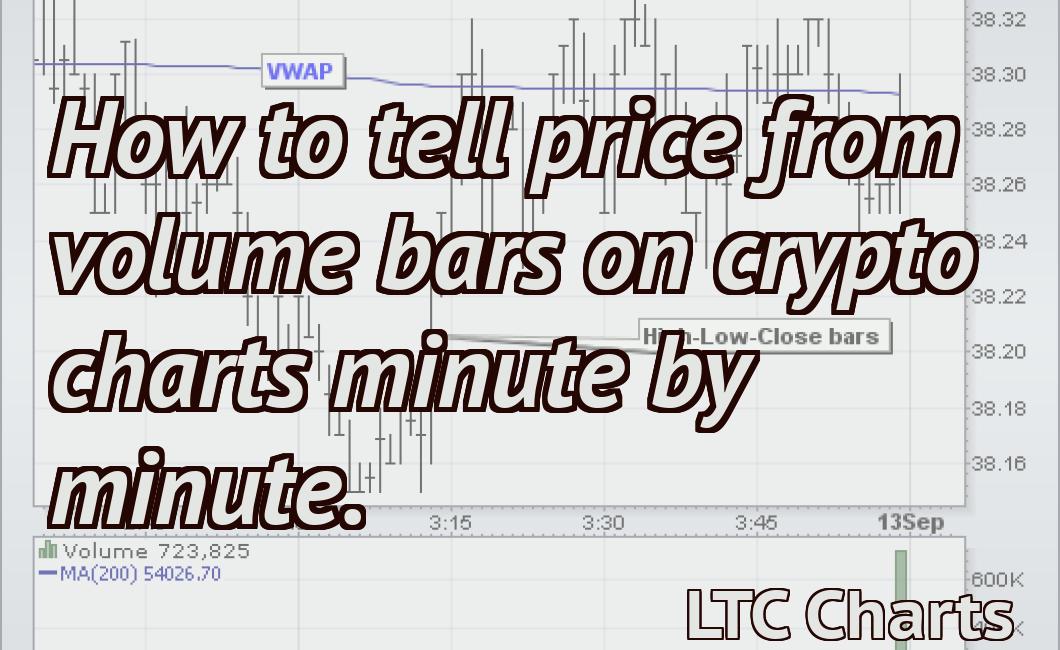

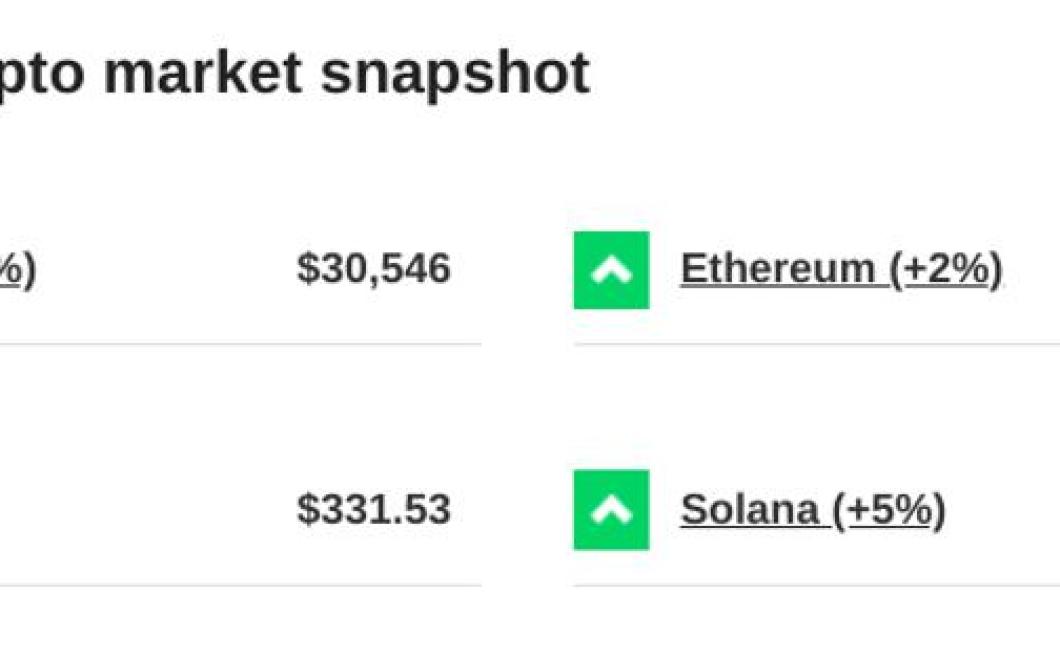

Bitcoin and Ethereum Price Analysis – Europe Leads the Way

Bitcoin and Ethereum prices are continuing to climb in value, with both currencies hitting new all-time highs this week. Europe is leading the way in terms of price growth, with Bitcoin reaching a value of $8,600 on Thursday and Ethereum reaching a value of $1,320.

Bitcoin Price Analysis

Bitcoin prices have continued to rise in value this week, reaching a value of $8,600 on Thursday. This represents a 12% increase over the past week and a 37% increase over the past month.

Ethereum Price Analysis

Ethereum prices have also continued to rise in value this week, reaching a value of $1,320 on Thursday. This represents a 17% increase over the past week and a 49% increase over the past month.

Can the Euro Zone Handle a Bitcoin Boom?

There is no guarantee that a Bitcoin boom will occur within the Euro Zone. Some countries within the Euro Zone are more likely to experience a Bitcoin boom than others. Countries such as Spain, Italy, and Greece have a history of being more open to new technologies and investments, which could lead to a greater demand for Bitcoin. Other countries, such as Germany, may be more resistant to changes in currency and may not see the potential benefits of a Bitcoin boom.

European Central Bank Warns Against Buying Bitcoin

The European Central Bank has warned against the risks of buying Bitcoin and other cryptocurrencies, according to a report from The Telegraph.

The ECB’s warning comes after the price of Bitcoin plummeted by more than 50% this year, and as more people invest in cryptocurrencies, the risks of a bubble are becoming increasingly apparent.

The ECB is not the only financial institution warning against investing in Bitcoin and other cryptocurrencies. Earlier this year, the Bank of England warned against the risks of investing in cryptocurrencies, and earlier this month, the US Securities and Exchange Commission issued a warning to investors about the risks of investing in digital currencies.

Despite the warnings, more people are investing in cryptocurrencies, and the price of Bitcoin remains high.

The ECB’s warning may have a limited effect on the investment decisions of individual consumers, but it could have a larger impact on the broader market for cryptocurrencies. If more financial institutions start warning about the risks of investing in cryptocurrencies, it could lead to a decline in their value.

The Pros and Cons of Investing in Cryptocurrency for Europeans

The pros and cons of investing in cryptocurrency for Europeans vary depending on the person. For some, investing in cryptocurrency offers the potential for high returns, while others see it as a risky investment.

Pros of Investing in Cryptocurrency for Europeans

1. High Returns.

Cryptocurrency can offer high returns, depending on the digital currency you invest in. For example, Bitcoin has seen returns of up to 1,000 percent in some cases. This means that if you invested $10,000 in Bitcoin five years ago, you would now have over $200,000.

2. Low Fees.

Cryptocurrency investments typically have low fees, which means that you can make money without having to pay a lot of money in commissions.

3. Security.

Cryptocurrencies are often considered to be more secure than traditional investments. This is because cryptocurrencies are not subject to government or financial institution control.

4. Greater Freedom.

Cryptocurrencies allow you to more freely move your money around the world. This is because cryptocurrencies are not subject to government or financial institution control.

5. Independence from Institutions.

Cryptocurrencies are independent of traditional institutions, such as banks. This means that you can more easily access your money if you want to.

6. Privacy.

Many people consider cryptocurrencies to be more privacy-friendly than traditional investments. This is because cryptocurrencies are not subject to government or financial institution control.

7. Greater Flexibility.

Cryptocurrencies allow you to more easily conduct transactions than traditional investments. This is because cryptocurrencies are not subject to government or financial institution control.

8. Greater Inclusion.

Cryptocurrencies are often more inclusive than traditional investments. This is because they are available to a wider range of people than traditional investments.

9. Greater Interaction with the World.

Cryptocurrencies allow you to more easily interact with the world than traditional investments. This is because cryptocurrencies are not subject to government or financial institution control.

10. Greater Acceptance.

Cryptocurrencies are more commonly accepted than traditional investments. This is because they are not subject to government or financial institution control.

5 Reasons Why Europeans Shouldn't Ignore Cryptocurrency

1. Cryptocurrencies are not just for criminals.

2. Cryptocurrencies are not just for investors.

3. Cryptocurrencies are not just for tech-savvy people.

4. Cryptocurrencies are not just for people who like to gamble.

5. Cryptocurrencies are not just for people who want to get rich quick.

Cryptocurrency Prices in Euros – What to Expect

Cryptocurrency prices in euros are highly volatile and can change rapidly. The price of a single bitcoin, for example, has fluctuated between €1,000 and €10,000 over the past few months.