Understand How Crypto Prices

This article will explain how crypto prices are determined and why they fluctuate. You will learn about the different factors that affect crypto prices and how to interpret market data to make informed investment decisions.

How Crypto Prices Work

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. Prices for cryptocurrencies are determined by supply and demand, and can change quickly.

How to Predict Crypto Prices

There is no one definitive answer to this question. Every person has their own method of predicting cryptocurrency prices, and no two predictions are ever exactly the same.

Some people believe that cryptocurrencies are a long-term investment, and that it is important to take into account the overall trend of the market before making a purchase. Others believe that short-term price movements are more important, and that it is best to buy low and sell high.

There is no right or wrong way to predict cryptocurrency prices, and everyone's individual method will probably be different. However, if you want to be able to make informed purchases, it is important to understand how other people approach this topic.

How to Manipulate Crypto Prices

There are a number of different ways to manipulate crypto prices. Some methods are more difficult than others, but all of them have the potential to produce significant effects on prices.

One common way to manipulate prices is to use pump and dump schemes. This involves artificially increasing prices of a cryptocurrency by distributing fake news or propaganda about it, then selling off the tokens when the price rises. This can lead to huge profits for those involved, but it also has the potential to cause serious financial damage to the ecosystem as a whole.

Another method of manipulating prices is to use botnets and other automated trading tools to buy and sell cryptocurrencies at artificially high prices. This can artificially increase demand for a cryptocurrency, driving up its price. However, it can also lead to price crashes if the market becomes saturated with these artificially driven transactions.

Finally, some people may choose to invest in cryptocurrencies for the purpose of speculation rather than using them for practical purposes. This can lead to significant price fluctuations, regardless of any manipulation that may be taking place.

How to Read Crypto Prices

Cryptocurrencies are priced in various ways, but the most common is to use a weighted average price. This takes into account the number of coins available and the trade volume of each coin.

How to Analyze Crypto Prices

Cryptocurrencies are a digital asset class that uses cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. Cryptocurrencies are often considered to be high-risk investments, and their prices can fluctuate rapidly.

To analyze crypto prices, you will need to understand the following concepts:

Cryptocurrency: A digital asset that uses cryptography to secure its transactions and to control the creation of new units.

Bitcoin: The first and most well-known cryptocurrency. Bitcoin is traded on decentralized exchanges and has been responsible for much of the recent growth in the crypto market.

Ether: Ethereum is a cryptocurrency that was created in 2014 and is used as a fuel for smart contracts. Ether is also used to purchase goods and services on decentralized exchanges.

Dollar: The U.S. dollar is the currency of the United States. It is also the primary currency used in global trade.

The Psychology of Crypto Prices

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

The popularity of cryptocurrencies has drawn the attention of investors and speculators. Many people believe that cryptocurrencies are a safe investment, although there is no guarantee of a profit. Cryptocurrencies are often thought of as alternative investments, similar to stocks and bonds.

Cryptocurrencies are traded on digital exchanges and can also be used to purchase goods and services. The value of a cryptocurrency is based on supply and demand, as well as whether other investors believe that the cryptocurrency will remain valuable.

Many people believe that cryptocurrencies are a safe investment, although there is no guarantee of a profit.

There is no central repository for all cryptocurrency holdings, which makes it difficult for authorities to track and seize assets. However, cryptocurrencies are also vulnerable to theft and cyberattacks.

Some people believe that cryptocurrencies are a safe investment, although there is no guarantee of a profit.

The Fundamentals of Crypto Prices

Cryptocurrencies are unique digital tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. The value of a cryptocurrency is determined by supply and demand, and can fluctuate rapidly.

The Technical Analysis of Crypto Prices

Cryptocurrencies are a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The Herd Mentality and Crypto Prices

Cryptocurrencies are often associated with the libertarian and anarchic ideals of free markets and DIY investing. However, there is a growing trend of herd mentality in the crypto world, which can lead to price bubbles and crashes.

The herd mentality is when a group of people start to behave in a similar way, usually because they are influenced by others in the group. This can cause people to overvalue or oversell an asset, leading to a price bubble or crash.

Cryptocurrencies are often seen as a way to escape from governments and financial institutions, which can lead to an increase in demand and prices. However, this can also lead to people becoming overly confident in the cryptocurrency and its future, which can lead to a price bubble.

Price bubbles can form when people underestimate the risks involved in an investment, which can then lead to a rapid increase in prices. This can eventually lead to a crash, where the value of the investment falls back down to its original value.

Historically, price bubbles in cryptocurrencies have often led to crashes. The most famous example is the stock market crash of 1929, which led to the Great Depression. Bitcoin and other cryptocurrencies have also experienced several crashes over the past few years, including the 2017 Cryptocurrency crash and the 2018 Bitcoin Cash crash.

It is important to be aware of the herd mentality in the crypto world and to be prepared for any potential price bubbles or crashes. This is especially important for investors who are not familiar with cryptocurrencies or are not experienced in trading them.

FOMO and the Fear of Missing Out on Crypto Prices

Cryptocurrencies are famously volatile and can be highly volatile in price. Cryptocurrencies are also often traded on exchanges which can be difficult for some people to access and use. This can lead to people feeling anxious and worried about missing out on potential profits.

This is known as FOMO (Fear of Missing Out). FOMO can be a very powerful motivator, especially when it comes to investing in cryptocurrencies. However, it can also be a very dangerous thing, as it can lead to people losing money unnecessarily if they are not careful.

It is important to be aware of FOMO and the fear of missing out on cryptocurrency prices. If you are feeling anxious or worried about missing out on potential profits, it is best to wait until the price has stabilised before investing.

The Dark Side of Crypto Prices

Cryptocurrencies have been in the news a lot lately, and for good reasons. The prices of some of the biggest cryptocurrencies have been on a tear, reaching new all-time highs. While this is great news for those who invested early, it has also created a lot of controversy.

One of the main concerns is that these prices are completely unregulated. This means that there is no guarantee that they will remain high, or that they are actually worth anything. Additionally, many people believe that cryptocurrencies are a Ponzi scheme. This is because they are based on the false assumption that they will become more valuable over time.

However, while there are definitely dangers associated with investing in cryptocurrencies, there are also some benefits. For example, they are very difficult to track and tax. This means that criminals and corrupt officials cannot easily track and take advantage of them. Additionally, they are not subject to the same financial regulations as traditional currencies. This means that they can be used to buy goods and services that are not available with conventional currencies.

The stories behind the headlines: what's really driving crypto prices?

Cryptocurrencies have seen wild price fluctuations in recent months, with prices for some of the biggest digital coins soaring and then crashing.

There are a number of reasons for this volatility, including market concerns about regulatory developments, technical issues with platforms, and intense speculation.

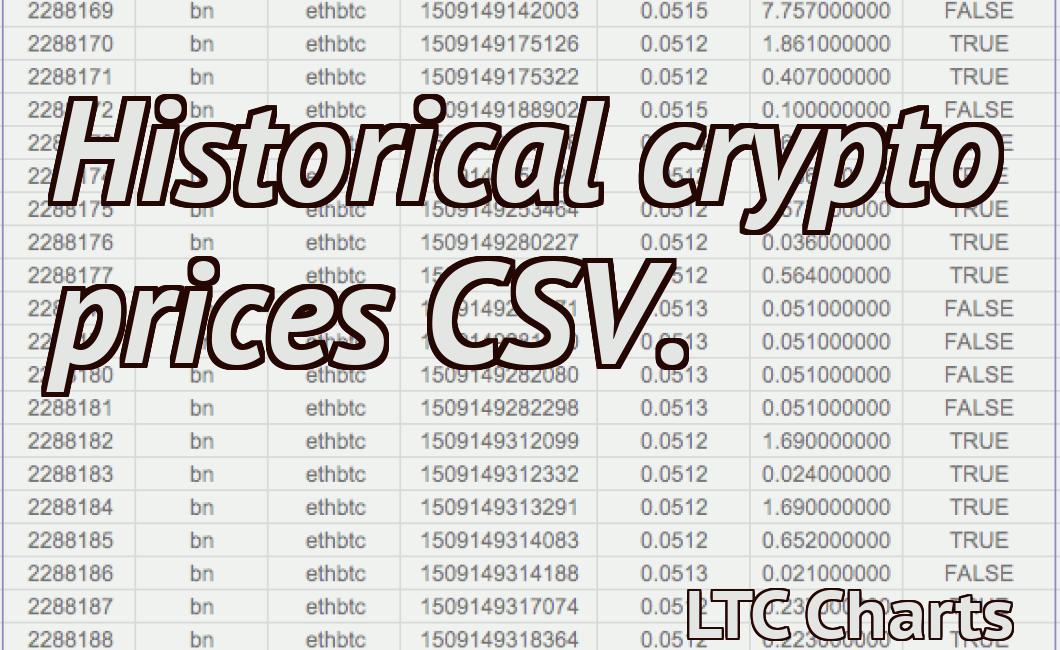

But one of the key drivers of price volatility is actually the supply and demand for cryptocurrencies.

As new coins are created, they enter the market and start to compete with each other for attention. This creates pressure on prices as more and more people try to get their hands on the new coins.

At the same time, there is a limited amount of Bitcoin and other cryptocurrencies that can be created, so the demand for them is also limited. This means that the price of cryptocurrencies can go up or down depending on how much interest there is in buying and selling them.