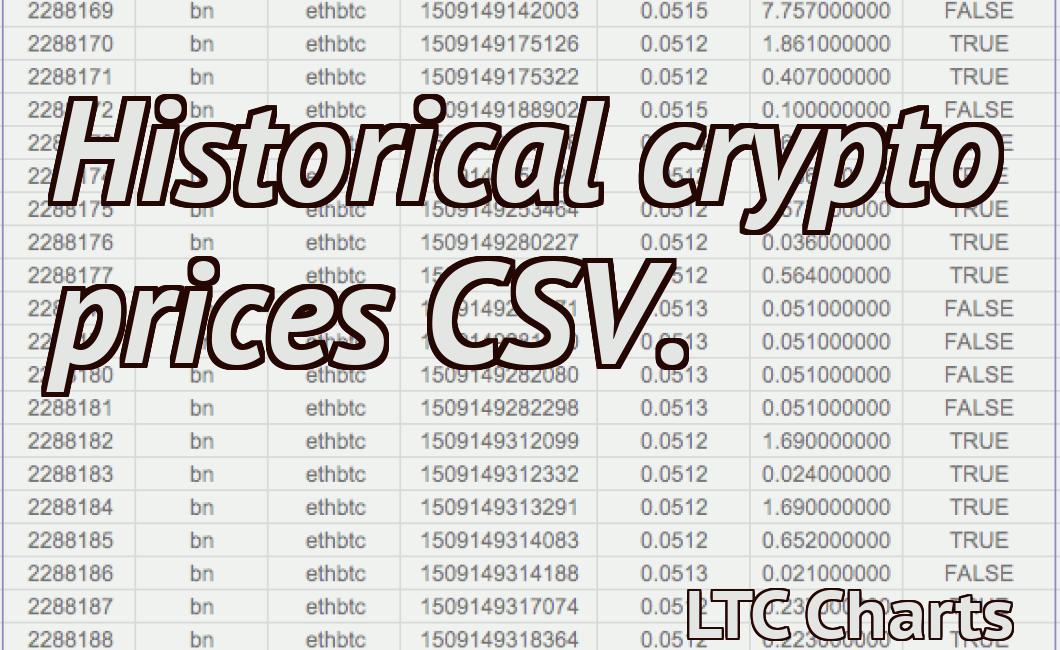

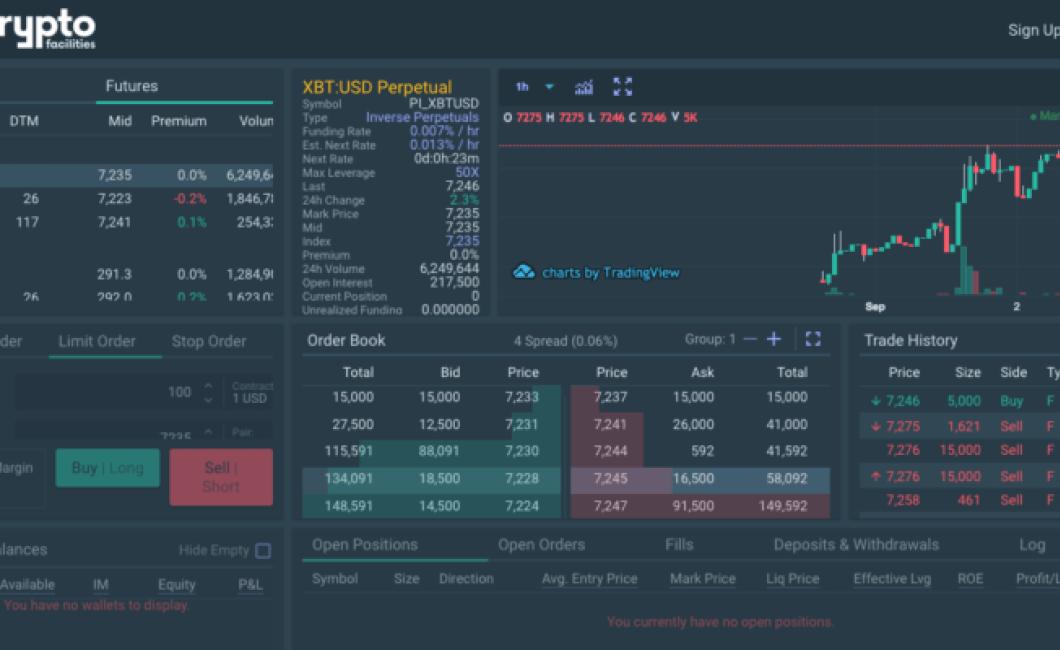

Crypto Facilities Futures Prices

Crypto Facilities Futures Prices describes the different types of futures contracts offered by the company and their current prices.

Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, and EOS Price Analysis

Bitcoin

Bitcoin price declined by 2.5% to $6,600 on January 3, 2019. The downward trend in bitcoin prices has continued throughout the month of January. The market capitalization of bitcoin dropped to $127.1 billion on January 3, 2019. Bitcoin’s market share continued to decline as Ethereum’s market share reached 28.8%.

Ethereum

Ethereum price increased by 2.5% to $491 on January 3, 2019. Ethereum’s market share increased to 28.8% as bitcoin’s market share decreased. Ethereum’s market capitalization increased to $87.2 billion on January 3, 2019.

Litecoin

Litecoin price declined by 6.4% to $176 on January 3, 2019. Litecoin’s market share decreased as Ethereum’s market share increased. Litecoin’s market capitalization decreased to $13.9 billion on January 3, 2019.

Bitcoin Cash

Bitcoin Cash price increased by 9.6% to $1,388 on January 3, 2019. Bitcoin Cash’s market share increased as Ethereum’s market share decreased. Bitcoin Cash’s market capitalization increased to $20.9 billion on January 3, 2019.

Ripple

Ripple price increased by 9.1% to $0.286 on January 3, 2019. Ripple’s market share increased as Ethereum’s market share decreased. Ripple’s market capitalization increased to $10.3 billion on January 3, 2019.

EOS

EOS price declined by 10.4% to $5.61 on January 3, 2019. EOS’s market share decreased as Ethereum’s market share increased. EOS’s market capitalization decreased to $11.5 billion on January 3, 2019.

All You Need to Know About Crypto Facilities Futures Prices

Crypto Facilities futures are a new way to trade cryptocurrencies. They are similar to traditional futures contracts, but the contracts are based on cryptocurrencies.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on decentralized exchanges and can also be bought and sold on traditional exchanges.

Cryptocurrencies are not backed by any government or central organization, and their value is highly volatile.

Cryptocurrencies are not legal tender, and their use is not sanctioned by any government.

Cryptocurrencies are difficult to mine, and their supply is limited.

Cryptocurrencies can be used to purchase goods and services.

Cryptocurrencies are not subject to government regulations.

Cryptocurrencies are not subject to taxation.

Cryptocurrencies are not subject to bank regulations.

How Crypto Facilities Futures Prices Affect the Overall Market

Crypto Facilities futures prices have a significant impact on the overall cryptocurrency market. As a result, the prices of other cryptocurrencies are often affected.

For example, if the price of Bitcoin falls, the value of other cryptocurrencies will also likely fall. Conversely, if the price of Bitcoin rises, the value of other cryptocurrencies will likely rise as well.

A Comprehensive Guide to Crypto Facilities Futures Prices

Crypto Facilities futures prices are an important part of the overall cryptocurrency market. They provide traders with a way to bet on the future price of a digital asset.

Cryptocurrencies are complex and volatile assets. Futures allow traders to take a position in the future price of a digital asset without actually owning the asset.

Cryptocurrency futures markets are still in their early stages. This means that there are a limited number of contracts available and the prices for these contracts are often volatile.

This guide will provide you with comprehensive information on the Crypto Facilities futures market. We will explain what Crypto Facilities futures are, how they work, and provide a list of the most popular cryptocurrencies that are traded on this market.

What is a Crypto Facilities futures contract?

A Crypto Facilities futures contract is a financial contract that allows investors to bet on the future price of a digital asset. Contracts are typically denominated in one of the major currencies (e.g. US dollars, euros, Japanese yen, etc.), and have a lifespan of a few days or weeks.

One of the main attractions of Crypto Facilities futures contracts is that they allow traders to take a position without actually owning the underlying asset. This makes them ideal for hedging purposes.

How do Crypto Facilities futures work?

When you buy a Crypto Facilities futures contract, you are essentially betting on the future price of a digital asset. The contract has an expiry date, and once this date has passed, the contract will expire and you will lose your investment.

The price of a Crypto Facilities futures contract is determined by the supply and demand for the underlying asset. The supply consists of the number of contracts that are available for sale, and the demand is determined by the number of traders who are looking to buy the contract.

The value of a Crypto Facilities futures contract is also dependent on the volatility of the underlying asset. This means that the price of a contract can be more or less volatile than the price of the underlying asset.

Which cryptocurrencies are traded on the Crypto Facilities futures market?

The Crypto Facilities futures market is currently dominated by two cryptocurrencies – bitcoin and Ethereum. However, there are a number of other cryptocurrencies that are traded on this market, including Ripple, Bitcoin Cash, Litecoin, and EOS.

The popularity of cryptocurrencies on the Crypto Facilities futures market is likely to continue to grow, as this market provides traders with a way to bet on the future price of these assets without actually owning them.

Everything You Need to Know About Crypto Facilities Futures Prices

Crypto Facilities futures are a derivative product that allows investors to speculate on the price of Bitcoin and other cryptocurrencies. Crypto Facilities futures were launched in December 2017 by a subsidiary of the exchange giant CME Group.

Crypto Facilities futures are traded on a regulated platform and are subject to regulatory oversight. In March 2018, Crypto Facilities received approval from the U.K.’s Financial Conduct Authority (FCA) to operate as a regulated financial service.

Crypto Facilities futures are cash-settled contracts. This means that the underlying asset (Bitcoin or another cryptocurrency) is not delivered until the contract expires.

The Impact of Crypto Facilities Futures Prices on the Cryptocurrency Market

Cryptocurrency futures are becoming more popular as an investment vehicle. They allow traders to speculate on the future price of cryptocurrencies without actually owning any of them.

Cryptocurrency futures were first introduced in December 2017 by CME Group and CBOE Global Markets. The launch of these products was followed by the launch of several other crypto-futures exchanges.

The popularity of crypto futures has led to a significant increase in the price of cryptocurrencies. For example, the price of bitcoin rose from $9,000 in December 2017 to $19,000 in January 2018.

However, the prices of cryptocurrencies can also fall as well. For example, the price of bitcoin fell from $19,000 in January 2018 to $11,000 in February 2018.

The impact of crypto futures prices on the overall cryptocurrency market is difficult to assess. It is likely that the prices of cryptocurrencies will continue to fluctuate depending on the performance of the underlying cryptocurrencies.