How to read candle charts for crypto

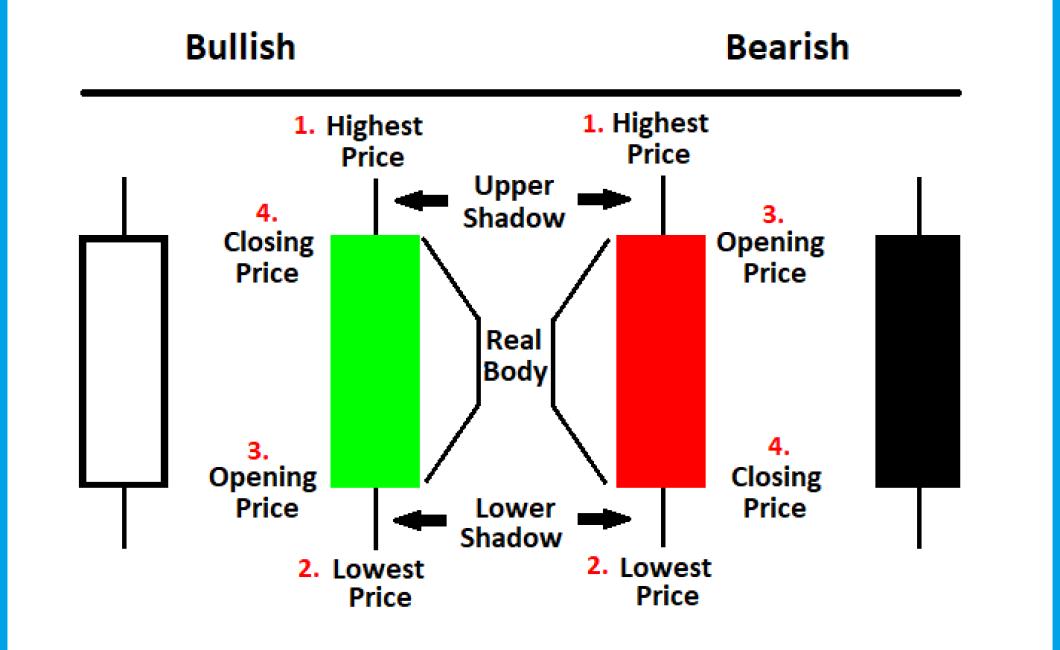

If you want to start reading candle charts for crypto, there are a few things you need to know. First, crypto charts can be complicated and difficult to read. However, with a little bit of practice, you can start to see patterns and make predictions about future price movements. One of the most important things to understand about crypto charts is that they are based on candlesticks. Candlesticks are used to show the open, high, low, and close prices for a given period of time. Each candlestick has a body and two wicks. The body of the candlestick represents the difference between the open and close price. The upper wick represents the high price, while the lower wick represents the low price. When you look at a candle chart, you will notice that the candlesticks are arranged in a particular order. The first candle is always the oldest and is located at the far left of the chart. The most recent candle is located at the far right of the chart. If you want to start predicting future price movements, you need to look for patterns in the candles. For example, if you see a lot of candlesticks with small bodies and long wicks, this could be an indication that prices are about to fall. Alternatively, if you see a lot of candles with large bodies and short wicks, this could be an indication that prices are about to rise. Of course, it's important to remember that no one can predict the future with 100% accuracy. However, by reading candle charts and looking for patterns, you can give yourself a better chance of making accurate predictions.

How to Read Candle Charts Crypto: The Basics

When you're looking at candle charts, you'll notice that they usually have a range of colors, with the darkest color representing the lowest price and the lightest color representing the highest price.

Each candle is also divided into two parts, the "head" and the "body." The head is the top of the candle, while the body is the rest of the candle.

The size of a candle's head relative to its body is a good way to determine how liquid the candle's price is. A large head means that the price is volatile and could go up or down quickly, while a small head indicates that the price is more stable and may not move much.

The color of the candle's flame also tells you something about the candle's price. Green candles indicate a lower price, while red candles indicate a higher price.

How to Read Candle Charts Crypto: A Beginner's Guide

Candle charts are a popular way to visualize cryptocurrency prices. They show the price of a digital asset over time, usually on a weekly, monthly or daily basis.

To read a candle chart, you first need to identify the candles. A candle is a graphical representation of the buying and selling activity on a given day. There are three types of candles: body, head and tail.

The body of a candle shows the total amount of buying activity on that day. The head of a candle shows the highest point of buying activity and the tail of the candle shows the lowest point of buying activity.

You can use these candles to calculate the percentage of the day's overall buying activity. For example, if there was a lot of buying activity in the body of the candle and very little buying activity in the head and tail, then that candle would be classified as being in the green zone. If there was a lot of buying activity in the head and very little buying activity in the body and tail, then that candle would be classified as being in the red zone.

How to Read Candle Charts Crypto: Tips and Tricks

candle charts crypto can be a bit confusing at first. Here are some tips to help you get started:

1. Use a candle chart to track your investments.

2. Look for patterns in the candles.

3. Watch how the prices of different cryptocurrencies change over time.

4. Use candle charts to help you make decisions about your investments.

How to Read Candle Charts Crypto: Common Mistakes

When reading candle charts, it is important to be aware of common mistakes people make when trying to interpret them. Familiarize yourself with the different types of candles and how they are used in order to better understand what is being said.

1. Not understanding the types of candles

There are three main types of candles: bullish, bearish, and neutral.

Bullish candles indicate that the price of the underlying asset is expected to go up in the near future. Bearish candles indicate that the price of the underlying asset is expected to go down in the near future. Neutral candles indicate that there is no clear trend and the price of the underlying asset could go either way.

2. Not understanding the use of candles

Candles are used to indicate the strength or weakness of an underlying trend. They are often used in conjunction with other indicators such as moving averages or Bollinger bands in order to provide a more complete picture of the market.

3. Not understanding the significance of individual candles

Individual candles can be significant in indicating the direction of the market overall, but they should not be taken as gospel. Always read the entire candle chart in order to get a complete picture of what is happening.

How to Read Candle Charts Crypto: Advanced Strategies

Candle charts are a great way to understand the dynamics of crypto markets. They can help you identify important trends, spot opportunities, and make informed investment decisions.

To read candle charts effectively, you need to understand three key concepts: candles, moving averages, and Fibonacci retracements.

Candles

A candle is a graphical representation of the opening and closing prices for a given cryptocurrency. Each candle consists of two parts: the body and the wick. The body shows the current price, and the wick indicates the price change over the previous 24 hours.

Moving averages

Moving averages are a technical indicator used to predict future prices. They calculate the average price over a certain period of time and use this information to forecast future prices.

Fibonacci retracements

Fibonacci retracements are a technical analysis tool that can help you identify potential support and resistance levels. They work by calculating the percentage difference between the previous two prices.

How to Read Candle Charts Crypto: What to Look For

When reading candle charts crypto, it is important to look for certain indications. Some of the most important indicators to look for include:

1) MACD (moving average convergence divergence/divergence) - This indicator is used to help identify oversold and overbought conditions in a security. When the MACD line is in a negative territory, this typically indicates that the security is oversold, and when it is in a positive territory, this typically indicates that the security is overbought.

2) RSI (relative strength index) - The RSI is a technical indicator that measures the performance of a security compared to the rest of the market. When the RSI is above the 50 mark, this typically indicates that the security is oversold and when it is below the 50 mark, this typically indicates that the security is overbought.

3) Stochastic Oscillator (SO) - The SO is used to measure the overall trend of a security. When the SO is above the 20 mark, this typically indicates that the security is in an uptrend, and when it is below the 20 mark, this typically indicates that the security is in a downtrend.

How to Read Candle Charts Crypto: Key Points

Candle charts are a popular way to analyze cryptocurrency prices.

The key points to remember when reading candle charts are:

-The height of the candle (the vertical distance between the bottom of the candle and the price at which it was sold)

-The width of the candle (the horizontal distance between the top of the candle and the price at which it was sold)

-The duration of the candle (the time it took for the candle to move from the bottom to the top)

How to Read Candle Charts Crypto: Benefits

Candle charts crypto can be used to gain insights into the movement of a cryptocurrency’s price over time. Candle charts crypto can also be used to identify potential support and resistance levels in the market. Candle charts crypto can also be used to identify potential buy and sell points in the market.

How to Read Candle Charts Crypto: Drawbacks

There are a few things to keep in mind when reading candle charts crypto.

First, candle charts are not reliable indicators of future price movement. They are often used as a way to visualize trends, but they cannot be used to predict future prices.

Second, candle charts can be misleading because they only show the direction of price movement and not the magnitude of the movement. For example, if the price of a cryptocurrency is moving up and to the right, but the candle is only half-way up, it may look like the price is moving slowly, but in reality, the price is actually moving rapidly.

Third, candle charts do not always accurately reflect the buying and selling activity of buyers and sellers. For example, if there is a lot of buying activity on one side of the chart, but little or no selling activity, the candle chart may show a consistent trend in the opposite direction, even if the actual price is moving somewhat randomly.

How to Read Candle Charts Crypto: Pros and Cons

When it comes to reading candle charts, there are pros and cons to consider.

The pro side of candle charts is that they can be very helpful when trying to determine the direction of a cryptocurrency's price. Candle charts can help you identify areas of support and resistance, which can help you make better trading decisions.

However, candle charts can also be time-consuming to create and may not always be accurate. Additionally, candle charts may not be as useful when it comes to altcoins, which are often more volatile than traditional cryptocurrencies.

Ultimately, it is important to take into account both the pros and cons of candle charts before making any trading decisions.

How to Read Candle Charts Crypto: Final Thoughts

Candle charts are a great way to get a quick snapshot of the current state of a crypto market. However, there are a few things to keep in mind when interpreting candle charts:

1. It is important to take into account the volume of a coin when analyzing the chart. Large volumes can indicate that the coin is being actively traded, while low volumes may indicate that the coin is not as popular.

2. It is also important to look at the open, high, and low prices when analyzing a candle chart. The open price is the price at which the candles were opened, and the high and low prices are the highest and lowest prices at which the candles have been traded.

3. Finally, it is important to remember that candles can be influenced by a number of factors, including news events, market conditions, and user sentiment. So, always keep an eye on the overall trend of the candle chart before making any decisions.