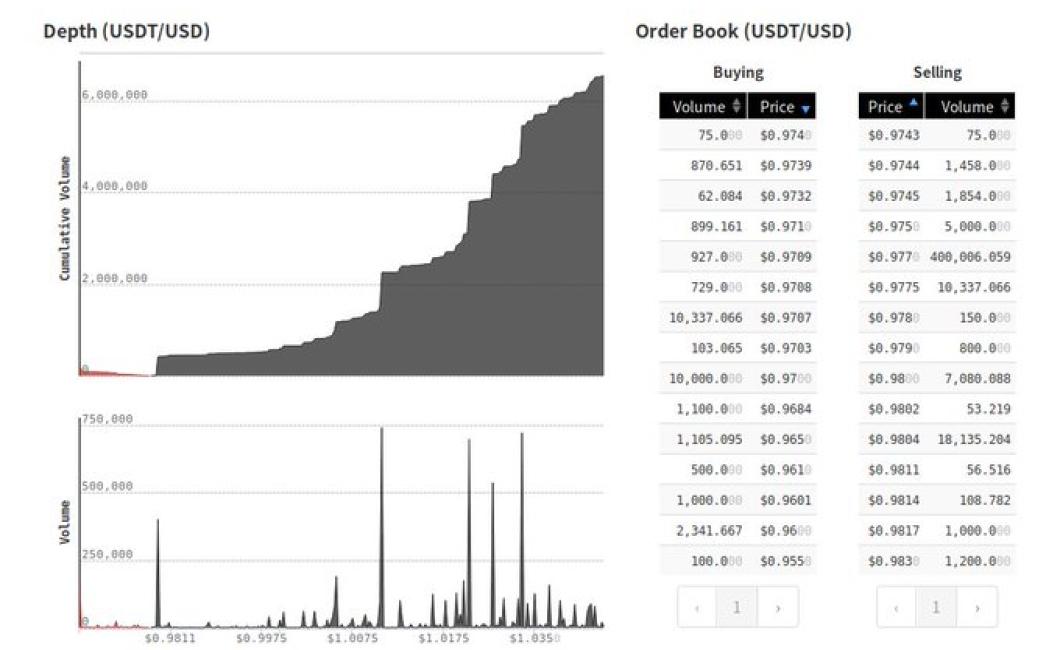

Market Depth Charts Crypto

Market depth charts for crypto assets show the distribution of buy and sell orders at different price levels. This information can be used to assess market liquidity, identify trading opportunities, and make informed decisions about when and how to enter or exit a trade.

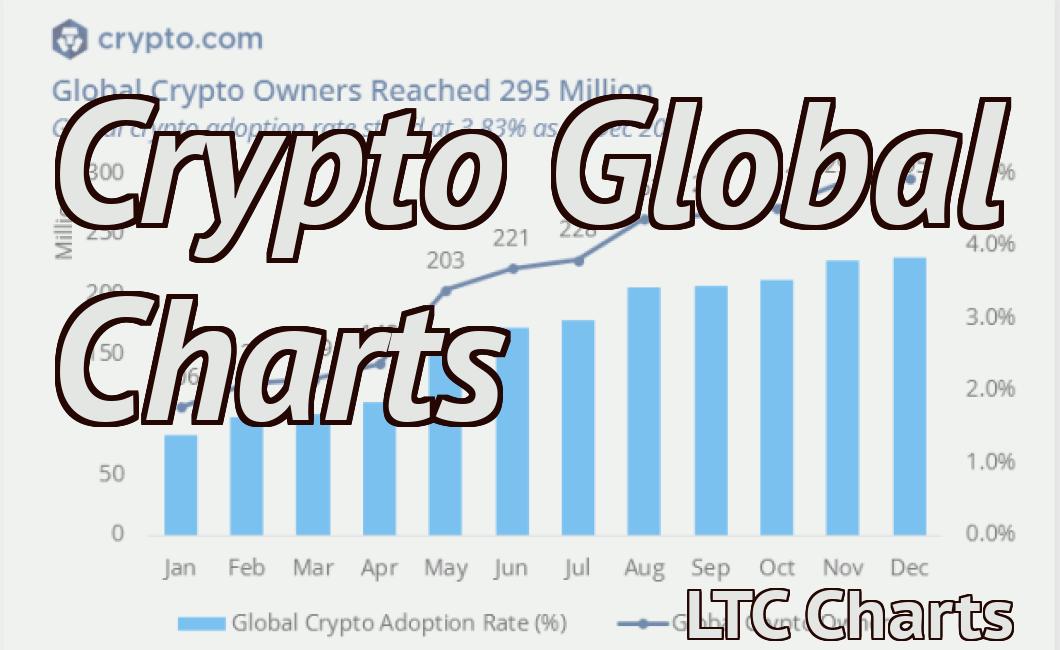

Examining the market depth of popular cryptocurrencies

In this section, we will be examining the market depth of popular cryptocurrencies. We will be looking at the market capitalization, 24-hour trading volume, and circulating supply of the top five cryptocurrencies by market cap.

Market capitalization

Bitcoin (BTC) is the most popular cryptocurrency and has a market capitalization of $151.5 billion as of September 1, 2018. Ethereum (ETH) is second with a market capitalization of $41.4 billion. Ripple (XRP) is third with a market capitalization of $29.1 billion. Bitcoin Cash (BCH) is fourth with a market capitalization of $14.8 billion. Litecoin (LTC) is fifth with a market capitalization of $10.5 billion.

24-hour trading volume

Bitcoin (BTC) is the most popular cryptocurrency and has the highest 24-hour trading volume of $6,683,728,000 as of September 1, 2018. Ethereum (ETH) is second with a 24-hour trading volume of $2,227,000,000. Ripple (XRP) is third with a 24-hour trading volume of $1,813,000,000. Bitcoin Cash (BCH) is fourth with a 24-hour trading volume of $1,362,000,000. Litecoin (LTC) is fifth with a 24-hour trading volume of $693,000,000.

Circulating supply

Bitcoin (BTC) has the highest circulating supply of 21 million coins as of September 1, 2018. Ethereum (ETH) has the second highest circulating supply of 18 million coins. Ripple (XRP) has the third highest circulating supply of 17.8 billion coins. Bitcoin Cash (BCH) has the fourth highest circulating supply of 16.9 billion coins. Litecoin (LTC) has the fifth highest circulating supply of 11.7 billion coins.

How to interpret market depth charts for cryptocurrency trading

There are a few different ways to interpret market depth charts for cryptocurrency trading.

The first way to interpret a market depth chart is to look at the total number of coins available for trading. This can be useful if you are looking for a broad overview of the market.

Another way to look at a market depth chart is to look at the total dollar value of coins being traded. This can be useful if you are looking for an indication of how active the market is.

Finally, you can also look at the percentage of the total market volume that is being traded. This can be useful if you are looking for an indication of how volatile the market is.

What market depth can tell us about cryptocurrency prices

Market depth, or the number of different cryptocurrencies that are being traded at any given moment, can tell us a lot about cryptocurrency prices. For example, if there are a lot of new cryptocurrencies being created, and few of them are being traded, this could indicate that the prices of those cryptocurrencies are relatively low. Conversely, if there are a lot of cryptocurrencies being traded, this could indicate that the prices of those cryptocurrencies are relatively high.

The importance of market depth in cryptocurrency trading

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. As a result, cryptocurrencies are sometimes seen as a safer and more efficient way to conduct transactions than traditional currency.

Cryptocurrencies are traded on decentralized exchanges, which makes it difficult for investors to know the true price of a cryptocurrency. The depth of market liquidity is an important factor in determining the price of a security. The greater the liquidity, the more easily buyers and sellers can find each other and the higher the price of the security.

Cryptocurrencies with high liquidity tend to be more stable in price and are easier to trade. Cryptocurrencies with low liquidity are more volatile and can be more difficult to trade.

How to use market depth charts to your advantage

When you are considering a trade, it is important to understand the different types of market depth charts.

A candlestick chart is used to plot the open, high, low and close prices for a given security. The horizontal axis shows the time period, while the vertical axis shows the price.

A bar chart is used to plot the number of shares traded over a given time period. The horizontal axis shows the time period, while the vertical axis shows the number of shares traded.

A Relative Strength Index (RSI) is used to measure the momentum of a security. The RSI is calculated by taking the average of the closing prices over a specific time period. A high RSI indicates that the security is oversold, and a low RSI indicates that the security is overbought.

The benefits of market depth analysis in cryptocurrency trading

There are many benefits to market depth analysis in cryptocurrency trading. These benefits include:

1. Market depth analysis can help traders identify opportunities and avoid potential losses.

2. Market depth analysis can help traders identify which coins and tokens are worth investing in.

3. Market depth analysis can help traders build a better understanding of the cryptocurrency market.

4. Market depth analysis can help traders make more informed investment decisions.

Market depth: A key indicator of cryptocurrency market health

Cryptocurrency market depth is a metric that measures how many different cryptocurrencies are available for purchase. A healthy cryptocurrency market depth indicates that there are a variety of different cryptocurrencies available for purchase and that buyers have access to a wide range of options. A deep market also indicates that buyers are confident in the cryptocurrency and believe that it has a long-term future.

How market depth affects cryptocurrency prices

The depth of the market refers to the number of buyers and sellers of a particular cryptocurrency at any given moment. The greater the depth, the more liquid the market is and the easier it is to buy and sell cryptocurrencies.

As more buyers and sellers enter the market, the price of a cryptocurrency tends to increase. Conversely, if the depth of the market is low, there are fewer buyers and sellers and the price of a cryptocurrency tends to decrease.