How are the crypto prices related?

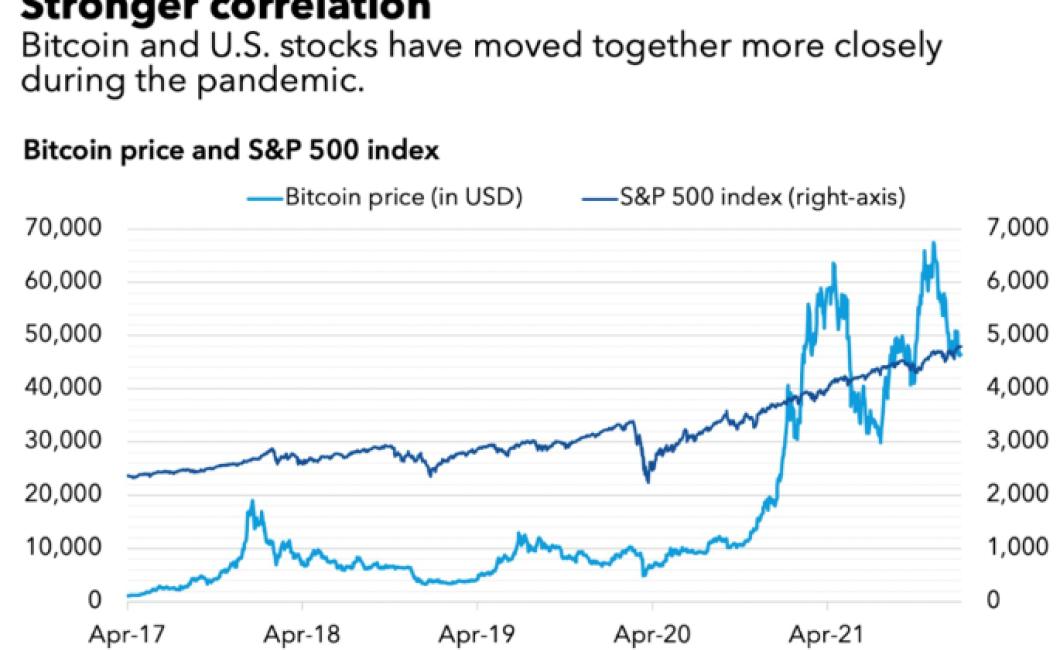

The prices of cryptocurrencies are generally related to the prices of other assets, such as stocks, commodities, and fiat currencies. However, there are also a number of factors that can affect the prices of cryptocurrencies, such as news events, regulatory changes, and market demand.

How the crypto prices are related

The price of a cryptocurrency is related to the number of people who are buying and selling it. The more people are buying and selling it, the higher the price will be.

The relationship between crypto prices

Cryptocurrency prices are determined by supply and demand. Supply is the total number of coins that will be produced in the future and demand is the number of people who want to buy those coins. The more people that want to buy a cryptocurrency, the higher its price will be.

How do crypto prices fluctuate?

Cryptocurrencies are traded on decentralized exchanges and can also be bought and sold on major platforms like Coinbase and Bitstamp. Prices on centralized exchanges like Coinbase and Bitstamp are regulated and subject to market forces, which can cause prices to fluctuate.

What affects crypto prices?

Crypto prices are affected by a variety of factors, including global events, regulatory changes, and the performance of individual cryptocurrencies.

Why do crypto prices change?

Cryptocurrencies are traded on exchanges and can be volatile. Cryptocurrencies are also highly speculative and carry a high degree of risk.

How are crypto prices determined?

Cryptocurrencies are determined by supply and demand. The supply of a cryptocurrency is the total number of coins that will ever be created. The demand for a cryptocurrency is the number of people who are willing to buy it.

What drives crypto prices?

The crypto market is driven by demand and supply. Crypto prices are determined by the relative demand and supply of coins in the market.

What causes crypto prices to rise and fall?

Cryptocurrencies are highly volatile, meaning their prices can change rapidly. This is due to a number of factors, including the supply and demand of Bitcoin and other cryptocurrencies, global economic conditions, news events, and technical analysis.

The factors that influence crypto prices

There are many factors that influence the prices of cryptocurrencies, but some of the more important ones include:

1. Supply and Demand

Cryptocurrencies are built upon a blockchain technology, which allows for a limited number of units to be created. This has led to a demand for cryptocurrencies, as people believe that they hold a valuable asset. As a result, the prices of cryptocurrencies are often determined by the demand for them and the supply of them.

2. Regulatory Changes

Regulatory changes can have a big impact on the prices of cryptocurrencies. If a government decides to crackdown on cryptocurrencies, this could lead to a decrease in demand and an increase in the prices of cryptocurrencies that are legal in that country.

3. Cryptocurrency Trends

Cryptocurrencies are often driven by trends. For example, if there is a lot of excitement about a particular cryptocurrency, then the prices of that cryptocurrency are likely to go up. Similarly, if there is a lot of fear about a particular cryptocurrency, then the prices of that cryptocurrency are likely to go down.

How investors can profit from changes in crypto prices

There are a few ways in which investors can profit from changes in crypto prices.

1) Buy and hold: One way to profit from changes in crypto prices is to buy and hold cryptocurrency. This strategy entails investing in a cryptocurrency over a long period of time, with the hope that its price will rise.

2) Trade: Another way to profit from changes in crypto prices is to trade cryptocurrencies. This involves investing in a specific cryptocurrency and then selling or buying it based on the price of other cryptocurrencies.

3) Invest in altcoins: Altcoins are cryptocurrencies that are not typically considered to be as valuable as Bitcoin and Ethereum. Because of this, altcoins can be more volatile than Bitcoin and Ethereum, which means that their prices can change more quickly.

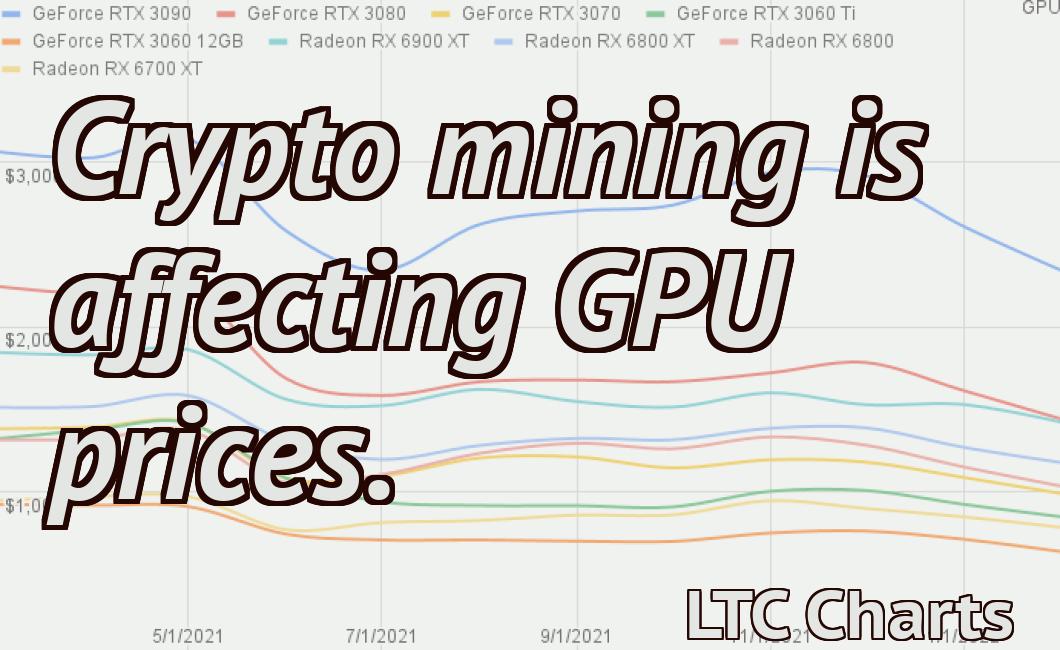

4) Mine cryptocurrencies: Another way to profit from changes in crypto prices is to mine cryptocurrencies. This involves using special software to process and secure new coins as they are created.

What to watch for when investing in cryptos

Cryptocurrencies are complex investments and it can be difficult to determine what to watch for when investing in them. Here are some key factors to consider when investing in cryptos:

1. Regulatory uncertainty

Cryptocurrencies are still relatively new and there is a lot of uncertainty around their legal status. This means that they may be subject to different regulations in different countries, which could affect their price and how easily they can be traded.

2. Volatility

Cryptocurrencies are highly volatile and can be very sensitive to news and events. This makes them risky investments, but also means that they can be very lucrative if the right conditions are present.

3. Security

Cryptocurrencies are often associated with high levels of security. However, this is not always the case and there have been a number of cases of cryptocurrency exchanges being hacked. If you are investing in cryptocurrencies, make sure you are doing so responsibly and ensure that you have appropriate precautions in place.

How to make money from changes in cryptocurrency prices

There is no one-size-fits-all answer to this question, as the best way to make money from changes in cryptocurrency prices will vary depending on your personal circumstances and expertise. However, some tips on how to make money from changes in cryptocurrency prices include investing in cryptocurrencies or tokens that are tied to a specific asset, trading cryptocurrencies and tokens, and becoming a cryptocurrency analyst.