Daytrading Crypto Charts

If you're interested in day trading cryptocurrencies, you need to be aware of the different types of charts that are available. This article will introduce you to some of the most popular crypto charts and explain how they can be used to your advantage.

How to read crypto charts for day trading

Cryptocurrency charts are great tools for day trading. You can use them to track the prices of cryptocurrencies over time, and to make predictions about how the prices will change in the future.

To use a cryptocurrency chart for day trading, you first need to find a cryptocurrency exchange that offers charts. Once you've found an exchange, open the chart in a new window.

To track the prices of cryptocurrencies, you'll need to look at the chart's price bars. The price bar on the rightmost side of the chart shows the current price of a cryptocurrency, while the price bar on the left shows the price of the cryptocurrency one hour ago.

To make predictions about how the prices of cryptocurrencies will change in the future, you'll need to look at the chart's candles. Candles show the percentage change in the prices of cryptocurrencies over a period of time.

To make predictions, you'll first need to understand how candles work. A candle is a graph of the amount of a cryptocurrency that has been traded over a period of time. The height of a candle corresponds to the amount of bitcoin that was traded for that period of time.

To make predictions, you'll first need to understand how candles work. A candle is a graph of the amount of a cryptocurrency that has been traded over a period of time. The height of a candle corresponds to the amount of bitcoin that was traded for that period of time.

To make predictions, you'll first need to understand how candles work. A candle is a graph of the amount of a cryptocurrency that has been traded over a period of time. The height of a candle corresponds to the amount of bitcoin that was traded for that period of time.

To make predictions, you'll first need to understand how candles work. A candle is a graph of the amount of a cryptocurrency that has been traded over a period of time. The height of a candle corresponds to the amount of bitcoin that was traded for that period of time.

The most important technical indicators for day trading cryptocurrencies

Cryptocurrencies are a volatile investment, and can be risky for day traders. Before trading cryptocurrencies, be sure to do your own research and consult a financial advisor.

Some important technical indicators to watch for when trading cryptocurrencies include the following:

• The cryptocurrency's price relative to other cryptocurrencies. For example, if a cryptocurrency is trading at a higher price than other cryptocurrencies, that may be an indication that there is increased demand for that cryptocurrency.

• The cryptocurrency's market cap. This is the total value of all cryptocurrencies in circulation. A cryptocurrency with a larger market cap may be more valuable than a cryptocurrency with a smaller market cap.

• The cryptocurrency's price trend. This is the pattern of the price of a cryptocurrency over time. For example, if the price of a cryptocurrency is rising rapidly, that may be an indication that the cryptocurrency is overvalued. If the price of a cryptocurrency is falling rapidly, that may be an indication that the cryptocurrency is undervalued.

Chart patterns every day trader should know

A bull market is a market in which prices are rising.

A bear market is a market in which prices are falling.

A day trader should be aware of the following patterns to help make better trading decisions:

A bull market will last longer than a bear market and will eventually reach a peak.

A bull market will have a higher peak than a bear market.

A bear market will have a lower peak than a bull market.

A day trader should be aware of the following technical indicators to help make better trading decisions:

The Relative Strength Index (RSI) is a technical indicator that measures the strength of a stock's price movement over time.

The Commodity Channel Index (CCI) is a technical indicator that measures the direction of the commodity markets.

How to use Fibonacci retracements in cryptocurrency trading

To use Fibonacci retracements in cryptocurrency trading, first find the relevant Fibonacci retracement level. For example, if you are looking to buy Bitcoin, you would use the 50-day Fibonacci retracement level at $6,000.

Then, identify the percentage of increase or decrease that the price has reached above or below the Fibonacci retracement level. For example, if the price of Bitcoin is at $6,090 and the 50-day Fibonacci retracement level is $6,000, then the price has reached 73 percent of its original value. In this case, a buy order would be placed at $6,190.

The best moving averages for day trading crypto

Moving averages (MA) are a technical analysis tool that is used to identify trends and price reversals. They are usually plotted on a chart as lines indicating the average price of a security or commodity over a specific period of time.

There are many different types of moving averages, but the two most commonly used for day trading are the simple moving average (SMA) and the exponential moving average (EMA).

The SMA is a better indicator for short-term trends, while the EMA is better for medium-term trends.

Below are three popular moving averages for day trading crypto:

1. The 50-day Moving Average: This moving average is used to identify short-term trends and is typically plotted on charts as a line stretching from the past 50 days’ worth of data.

2. The 200-day Moving Average: This moving average is used to identify medium-term trends and is typically plotted on charts as a line stretching from the past 200 days’ worth of data.

3. The 5-day Moving Average: This moving average is used to identify short-term trends and is typically plotted on charts as a line stretching from the past 5 days’ worth of data.

How to trade cryptocurrency volatility

Cryptocurrency volatility is a measure of how much the price of a digital asset fluctuates over a given period of time. Volatility can be measured in terms of the standard deviation of prices over a given period.

Trading cryptocurrency trends with price action

Cryptocurrency trends can be used to identify potential buying and selling opportunities. It is important to remember that cryptocurrency prices are highly volatile and can often move rapidly in either direction.

Therefore, it is important to use caution when trading cryptocurrency trends. Always consult with a financial advisor before making any decisions.

Candlestick patterns for day trading cryptocurrencies

There are many different types of candlestick patterns that can be used for day trading cryptocurrencies. Some of the most common candlestick patterns include the engulfing candle, the pivot high/low, and the reversal candle.

The engulfing candle is usually a bullish pattern that indicates that the price of a cryptocurrency is about to rise. The pattern consists of two candles, the first of which is small and close to the price floor, while the second is large and above the price floor.

The pivot high/low is a bullish pattern that indicates that the price of a cryptocurrency is about to rise or fall. The pattern consists of two candles, the first of which is high and close to the price peak, while the second is low and close to the price valley.

The reversal candle is a bearish pattern that indicates that the price of a cryptocurrency is about to decline. The pattern consists of two candles, the first of which is small and close to the price ceiling, while the second is large and below the price ceiling.

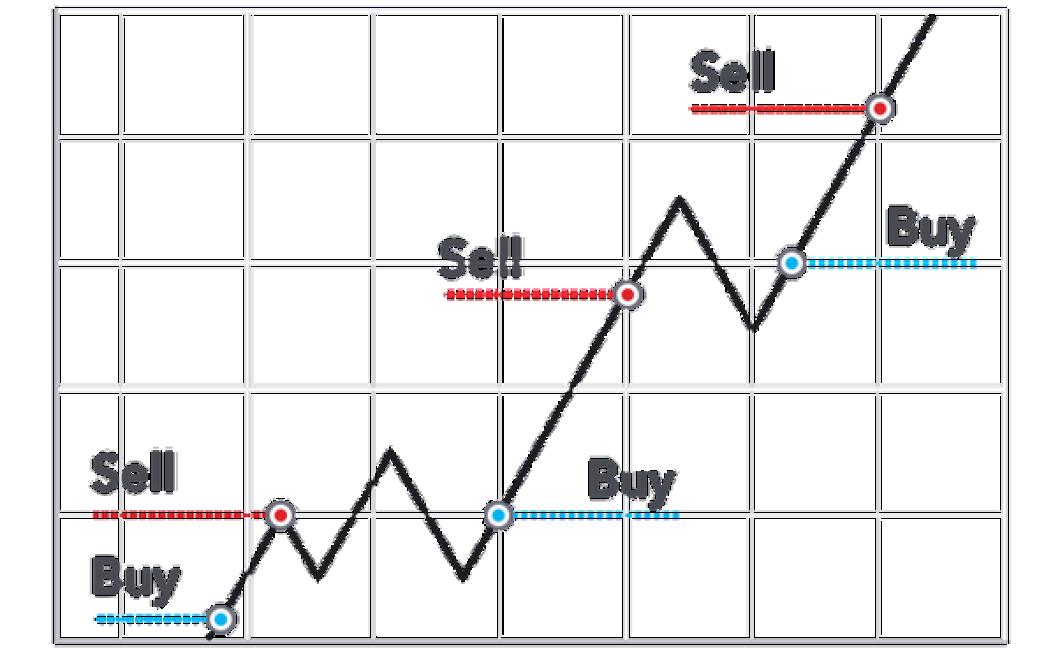

Using support and resistance levels in cryptocurrency trading

Cryptocurrencies are largely traded on decentralized exchanges and can fluctuate rapidly in price. As such, it is important to understand support and resistance levels in order to make informed trading decisions.

Support levels are defined as points where the price of a cryptocurrency is expected to stay in the near future. If the price of a cryptocurrency falls below the support level, traders may expect the currency to decline further. Conversely, if the price of a cryptocurrency rises above the support level, traders may expect the currency to continue rising.

Resistance levels are points where the price of a cryptocurrency is expected to stay in the future. If the price of a cryptocurrency falls below the resistance level, traders may expect the currency to decline further. Conversely, if the price of a cryptocurrency rises above the resistance level, traders may expect the currency to continue rising.

Risk management for day trading cryptocurrencies

There are a few key things you need to do in order to mitigate risk when day trading cryptocurrencies.

1. Educate yourself about the risks.

Before you start day trading cryptocurrencies, it is important to understand the risks involved. Do your own research to learn about the various types of risks associated with this market and how to mitigate them.

2. Use a trading platform that offers proper protection.

A good trading platform will offer you various types of protection, including margin trading, stop losses, and buy orders. Use these features to protect yourself from excessive losses.

3. Use a well-reputed exchange.

When you are trading cryptocurrencies, it is important to use a reputable exchange. Make sure to do your research before choosing an exchange, as there are a number of scam exchanges out there.

4. Only trade what you can afford to lose.

When day trading cryptocurrencies, it is important to remember that you are playing with money. Only trade what you are comfortable losing. Do not invest more than you are willing to lose.