Why is crypto consensus driving prices down?

As the crypto market matures, investors are increasingly focused on underlying fundamentals, such as adoption and usage, rather than hype. This is evident in the way that prices have been behaving in recent months, with peaks and troughs corresponding to real-world events. For example, the latest price drop can be attributed to a lack of consensus among developers about the best way to scale the Bitcoin network. Until there is a clear roadmap with broad support, prices are likely to remain volatile.

Why is crypto consensus driving prices down?

Cryptocurrencies are decentralized, digital currencies that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they are not subject to government or financial institution control. As a result, cryptocurrencies are often considered to be volatile and risky investments.

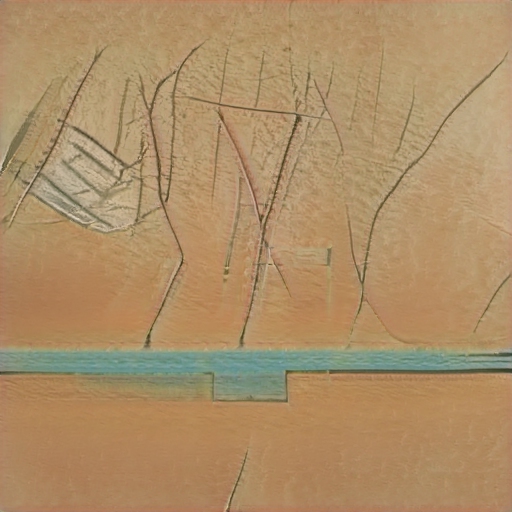

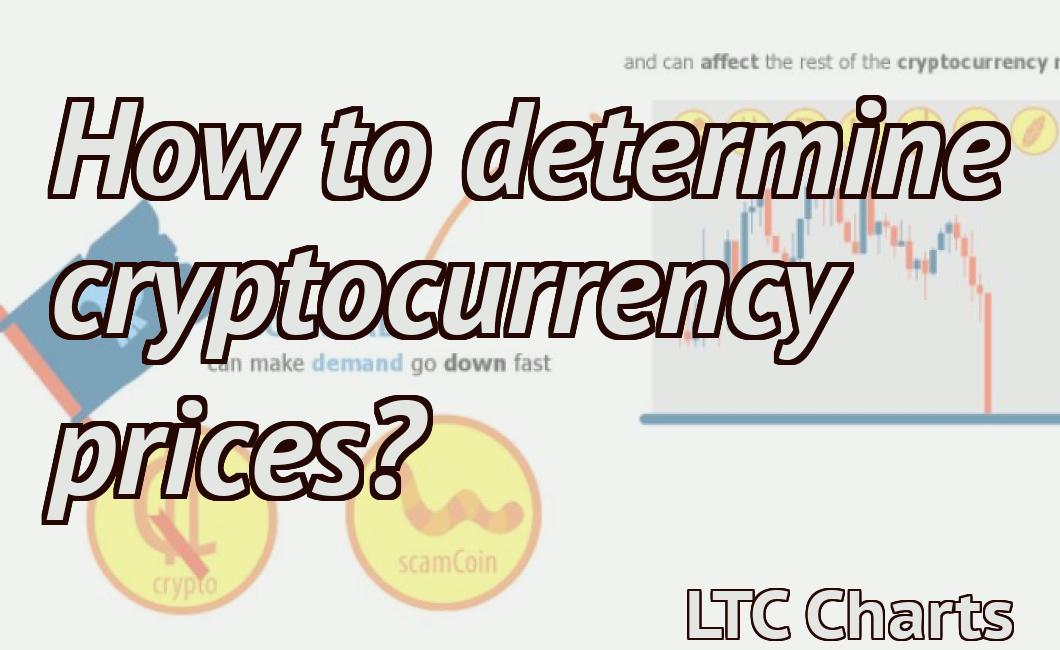

Cryptocurrency prices are typically driven by demand and supply. In the case of cryptocurrencies, demand is generated by investors who believe that cryptocurrencies have the potential to become a valuable investment. Supply is driven by the number of new coins that are created and released into the market. As new coins are created, they become available for purchase on cryptocurrency exchanges. This causes demand to increase, and therefore prices to rise.

However, as cryptocurrencies become more popular, there is increased demand for them from miners who use them to create new coins. This has caused prices to decline as more coins are created than can be sold on exchanges.

How does crypto consensus affect prices?

Cryptocurrency prices are determined by supply and demand. When new bitcoins are created, the number of available bitcoins decreases. This decreases the value of a bitcoin since it becomes less rare and more plentiful. Conversely, when people sell bitcoins, the number of available bitcoins increases, increasing the value of a bitcoin.

What is the impact of crypto consensus on prices?

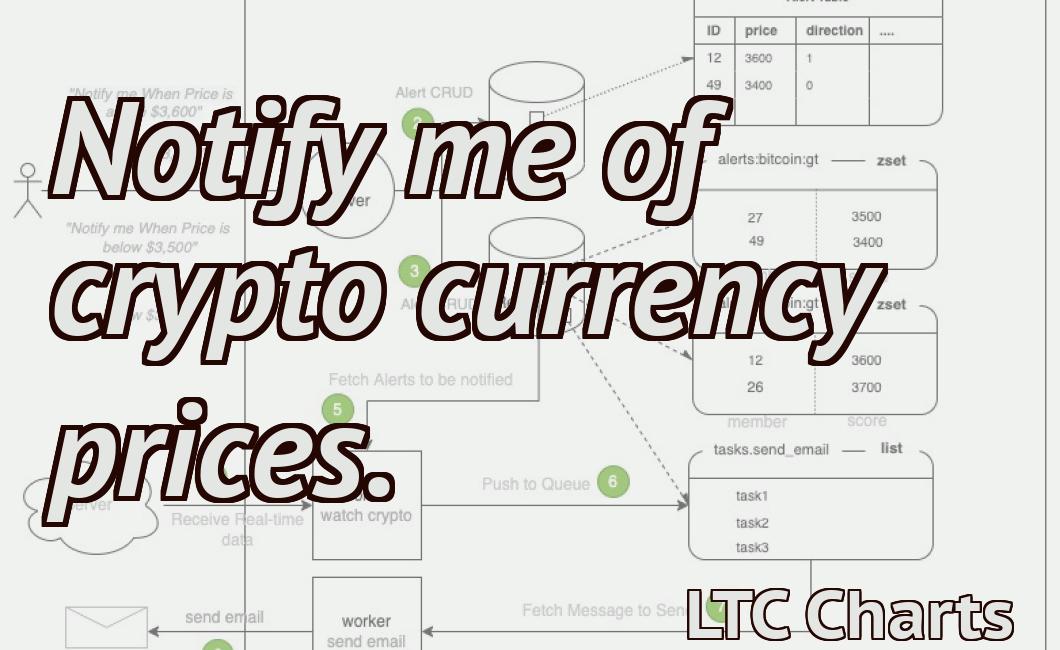

Crypto consensus is the process by which a distributed network of computers reaches a consensus on the state of the blockchain. This process is used to ensure that all nodes in the network are sharing the same set of information.

The impact of crypto consensus on prices is that it ensures that the blockchain is accurate and secure. This is important because it ensures that people can trust the data on the blockchain and that transactions can be processed without any delays.

Is crypto consensus to blame for falling prices?

There is no one-size-fits-all answer to this question, as the reasons for low cryptocurrency prices may vary depending on the specific cryptocurrency and its overall market conditions. However, some experts have suggested that crypto consensus issues may be partially to blame for the recent decline in prices.

As Bitcoin and other cryptocurrencies have grown in popularity, some miners and developers have developed alternative versions of the blockchain that are not accepted by all other miners and users. This "fork" of the blockchain can create a situation in which two different versions of the cryptocurrency exist, with different prices and corresponding value. If a large number of users and miners adopt one version of the blockchain over the other, this can lead to a decline in the value of the cryptocurrency associated with that version of the blockchain.

How does crypto consensus influence prices?

Cryptocurrencies are based on a distributed ledger called a blockchain. Cryptocurrencies use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are created as a reward for a process known as mining. Miners are rewarded with new cryptocurrency units as they verify and approve transactions. The number of new units created is limited by the supply of cryptocurrency coins in circulation. This prevents inflation and allows for a more stable value for coins.

Cryptocurrency prices are influenced by a number of factors, including global demand, political events, and technical analysis. Global demand is affected by economic conditions and the popularity of cryptocurrency platforms. Political events can affect the value of cryptocurrencies by changing public opinion or affecting the perception of risk. Technical analysis is used to forecast future prices and can be based on a variety of factors, including supply and demand, news, and technical indicators.

What role does crypto consensus play in prices?

Crypto consensus is a process by which a network of nodes agrees on the validity of a transaction. Consensus helps to ensure that a network is functioning correctly and that transactions are processed in a timely manner.

What is the relationship between crypto consensus and prices?

The relationship between crypto consensus and prices is complex and not well understood. Some believe that high prices are directly related to the level of crypto consensus, while others believe that consensus is unrelated to prices. There is no clear answer, and research into the matter is still ongoing.

How does crypto consensus affect the price of Bitcoin?

The price of Bitcoin is determined by supply and demand. When more people want to buy Bitcoin, the price goes up. When less people want to buy Bitcoin, the price goes down.

What is the effect of crypto consensus on altcoins?

Cryptocurrency is based on a decentralized system where users can interact and transact without the need for a third-party. This system is achieved through the use of cryptography to secure the transactions and to control the creation of new units. Cryptocurrencies are also secured through a set of rules and protocols that are enforced by the blockchain network.

The main benefit of using a decentralized system is that it eliminates the need for a third-party. This eliminates the risk of fraud or other issues. Additionally, it allows for faster transactions and reduced costs. The downside is that it can be more difficult to track and handle transactions.

How does crypto consensus impact the cryptocurrency market?

Cryptocurrency markets are highly sensitive to news and events that could impact the security and stability of the underlying blockchain technology. For example, if a major cryptocurrency exchange were to be hacked, this event could trigger a wave of selloffs in the affected cryptocurrencies. In order to ensure that the cryptocurrency market remains resilient in the face of such events, cryptocurrency networks use a process called "crypto consensus" to ensure that all nodes are agreeing on the correct state of the blockchain.

Is crypto consensus good or bad for prices?

Cryptocurrencies are built on a blockchain technology which allows for secure, decentralized transactions. Cryptocurrencies are based on a distributed database where transactions are verified and recorded using cryptography. Cryptocurrencies use a peer-to-peer network to confirm transactions and add them to a public ledger. This allows for secure, tamper-proof transactions.

Cryptocurrencies are built on a blockchain technology which allows for secure, decentralized transactions. Cryptocurrencies are based on a distributed database where transactions are verified and recorded using cryptography. Cryptocurrencies use a peer-to-peer network to confirm transactions and add them to a public ledger. This allows for secure, tamper-proof transactions.

While consensus mechanisms like Proof of Work or Proof of Stake can be used to ensure that nodes follow the rules of the network, they can also create a race to the bottom where miners seek to solve problems first in order to earn rewards. This can lead to increased electricity consumption and higher environmental impact, as well as decreased security.

While consensus mechanisms like Proof of Work or Proof of Stake can be used to ensure that nodes follow the rules of the network, they can also create a race to the bottom where miners seek to solve problems first in order to earn rewards. This can lead to increased electricity consumption and higher environmental impact, as well as decreased security.

What is the future of crypto prices with consensus?

There is no one definitive answer to this question. Some people believe that cryptocurrencies will eventually be replaced by more traditional forms of currency, while others believe that the popularity of cryptocurrencies will only continue to grow. Ultimately, it is impossible to predict the future prices of cryptocurrencies with certainty, but consensus algorithms likely have a significant role to play in their long-term success or failure.