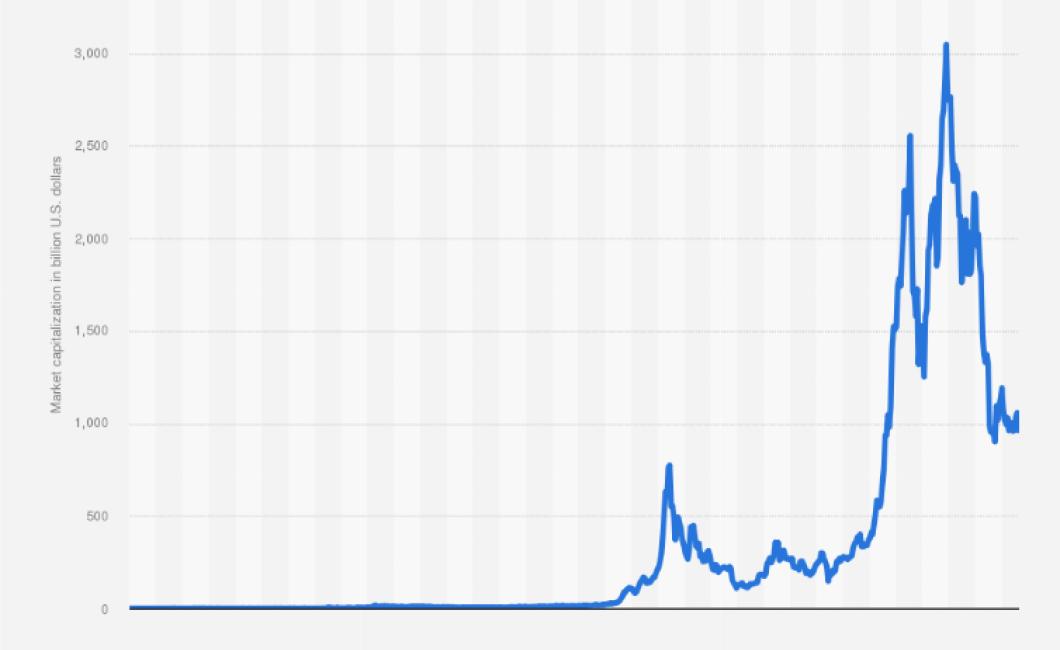

Current Crypto Charts

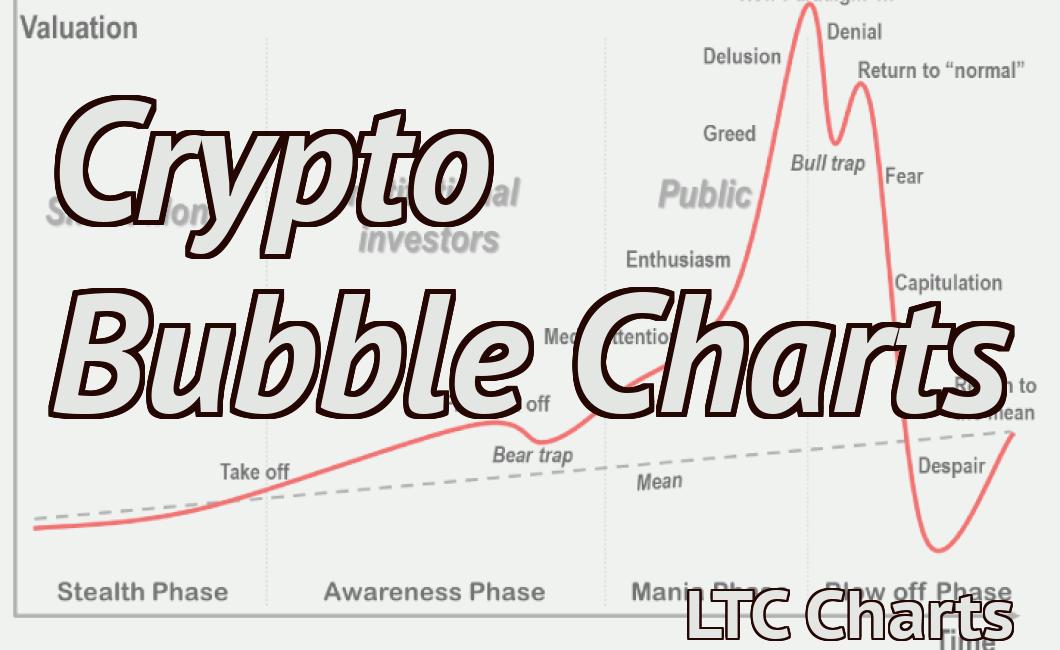

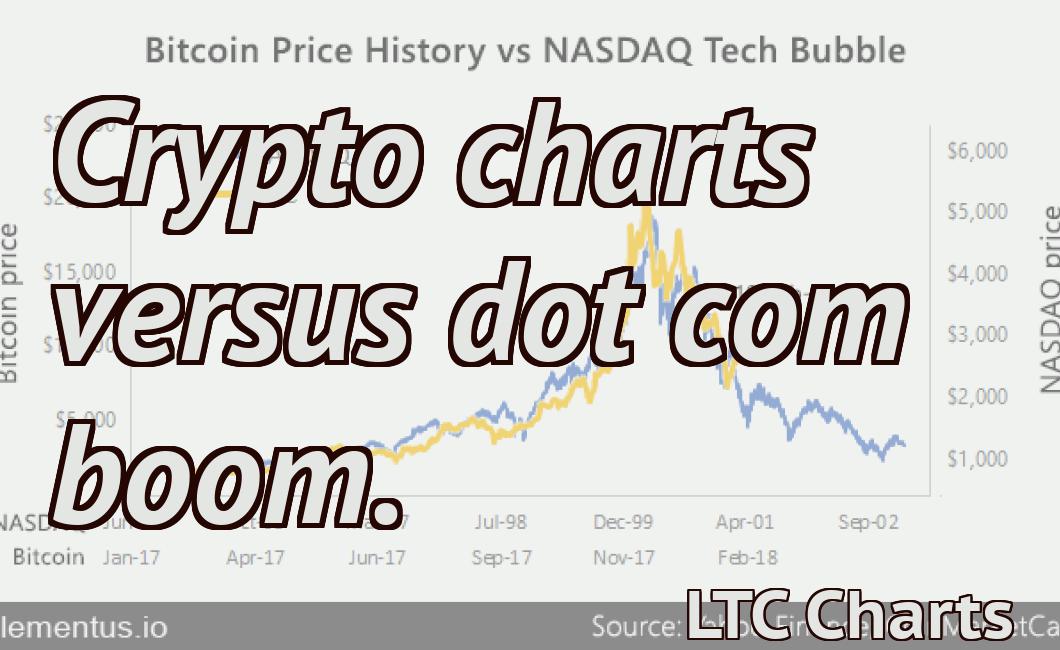

The article covers the current state of the cryptocurrency market, with a focus on the top 10 coins by market capitalization. It includes charts for each coin, as well as a brief description of each one.

Bitcoin (BTC) Price Today – YTD Performance & technical analysis

Bitcoin Price Today: BTC / USD

Name Price 24H (%) $7,527.06 0.12%

Bitcoin has seen some good price action over the past day or so, although it is still down on the week. It is currently trading at around $7,500 on the Bitfinex exchange. This is down from an all-time high of $8,000, but it is still up from where it was a few weeks ago.

Looking at the technical indicators, the RSI is currently at around the 50 level, which is indicating that the market is relatively stable. The MACD is also in the positive territory, indicating that the market is bullish. However, the price is still relatively low, so there is room for further growth.

Overall, Bitcoin is still down on the week, but it is seeing some good price action. There is still room for further growth, so investors should monitor the market closely.

Ethereum (ETH) Technical Analysis and Price Forecast

Ethereum is an open-source, public, blockchain-based distributed computing platform and operating system. It provides a decentralized platform for applications that run exactly as programmed without any chance of fraud or third party interference.

Ethereum was proposed by Vitalik Buterin in late 2013. Development was funded by an online crowdsale that took place from July to August 2014. "Eth" is an initialism formed from the first two letters of "Ethereum", "Geth" and "Parity".

Ethereum is based on a proof-of-work/proof-of-stake hybrid consensus algorithm. Ethereum uses a virtual machine, the Ethereum Virtual Machine (EVM), to execute scripts using an international network of public nodes. "Gas", an internal transaction pricing mechanism, determines how much an individual can spend.

Ethereum has been described as a digital gold, a global platform for smart contracts and decentralized applications, and a world computer. Ethereum is used by companies and individuals to run applications that run exactly as programmed without any possibility of fraud or third party interference.

Bitcoin Cash (BCH) Technical Analysis and Price Forecast

Bitcoin Cash (BCH) is a digital asset and a payment system based on the bitcoin blockchain. The BCH token is created as a result of the hard fork of the bitcoin network on August 1, 2017. Bitcoin Cash has a current supply of 21 million tokens and a circulating supply of 17.9 million tokens. The BCH price is determined by the supply and demand of the token.

Bitcoin Cash Price Prediction

According to the current market conditions, Bitcoin Cash is likely to reach a value of $2,500 by the end of the year. The long-term outlook for the BCH token is positive, with a forecast value of $10,000 by the end of 2020.

Litecoin (LTC) Technical Analysis and Price Forecast

Litecoin is trading at $56.39 as of writing this article, which is down 1.1% in the last 24 hours. The coin has a market cap of $3.3 billion and is ranked fourth by market capitalization.

Litecoin is a digital asset and payment system based on a open source protocol and is similar to Bitcoin. It was created by Charlie Lee, a former Google employee, and released as open source software in October 2011. Litecoin uses scrypt as its proof-of-work algorithm.

The main reason for Litecoin’s recent decline is likely due to the SEC’s announcement that it will be reviewing whether or not to approve a Bitcoin exchange-traded fund (ETF). This news has caused the price of Bitcoin to decline, as investors shift their money to other cryptocurrencies in anticipation of the decision.

However, we believe that Litecoin will continue to decline in value, especially given that Bitcoin has been experiencing significant volatility recently. For example, Bitcoin dropped from $20,000 to $7,000 in just a few weeks. Litecoin is likely to follow suit, so long as Bitcoin remains a volatile investment.

We therefore predict that Litecoin will drop below $50 in the near future, and could even reach as low as $40 if Bitcoin continues to experience significant volatility.

Ripple (XRP) Technical Analysis and Price Forecast

Ripple (XRP) is a digital asset and a payment network created by Ripple. It is considered to be a digital asset and a virtual currency. Ripple is a decentralized network and it uses a consensus algorithm. Ripple is used to process transactions and it is considered to be the third largest digital asset. The price of Ripple has increased in the past year and it is expected to increase in the future.

Ripple has a current market capitalization of $31.5 billion and it is expected to increase in the future. The price of Ripple is expected to increase in the future and it is expected to reach $40.00 by the end of 2020. The price of Ripple is expected to increase in the future and it is expected to reach $100.00 by the end of 2021.

Stellar (XLM) Technical Analysis and Price Forecast

Stellar (XLM) is a digital asset that operates using the Stellar protocol. Stellar is a decentralized platform that enables instant, low-cost financial transactions between people in different countries.

As of September 6th, 2018, Stellar had a market cap of $5.9 billion and was ranked as the 5th most valuable blockchain by market capitalization.

In this Stellar price analysis, we will be looking at the following:

1. What is Stellar?

2. What is the Stellar protocol?

3. What are the benefits of using the Stellar protocol?

4. What are the risks associated with using the Stellar protocol?

5. How does Stellar work?

6. What are the prices for Stellar?

7. What are the future prospects for Stellar?

What is Stellar?

Stellar is a digital asset that operates using the Stellar protocol. The Stellar protocol allows for fast and low-cost transactions between people in different countries.

What is the Stellar protocol?

The Stellar protocol is a decentralized platform that enables instant, low-cost financial transactions between people in different countries. Transactions are processed through the use of smart contracts and blockchain technology.

The benefits of using the Stellar protocol include:

1. Low-cost transactions: The Stellar protocol allows for fast and low-cost transactions between people in different countries.

2. Decentralized platform: The Stellar protocol is a decentralized platform, which means that it is not subject to any single point of control.

3. Scalability: The Stellar protocol is scalable, meaning that it can handle large volumes of transactions.

4. Security: The Stellar protocol is secure, meaning that it is designed to protect against cyber-attacks.

5. Interoperability: The Stellar protocol is interoperable, which means that it can be used with other blockchain platforms.

6. Sustainable: The Stellar protocol is sustainable, meaning that it has a low carbon footprint.

7. Liquidity: The Stellar protocol is liquid, meaning that it has a high liquidity level. This makes it easy to buy and sell Stellar tokens.

What are the risks associated with using the Stellar protocol?

There are a number of risks associated with using the Stellar protocol. These include:

1. Inability to scale: The Stellar protocol is not currently able to handle large volumes of transactions. This could lead to its demise as a viable digital asset platform.

2. Cyber-attacks: Cyber-attacks could lead to the loss of funds or data belonging to users of the Stellar platform.

3. Lack of liquidity: The availability of liquidity could be limited, which could make it difficult for users to buy and sell Stellar tokens.

4. Poor user experience: Poor user experience could lead to the abandonment of the Stellar platform by users.

5. Regulatory uncertainties: The regulatory landscape surrounding the Stellar platform is unclear, which could lead to increased regulatory pressures.

6. Price volatility: The price of Stellar tokens could be volatile, which could make them difficult to trade.

7. Inability to scale: The Stellar platform may not be able to handle the large volumes of transactions that are needed to become a mainstream digital asset platform.

What are the future prospects for Stellar?

The future prospects for the Stellar platform are positive. The platform has a number of advantages over other digital asset platforms, which could make it one of the most popular options in the future. These include:

1. Low-cost transactions: The low cost of transactions on the Stellar platform could make it a popular choice for online payments.

2. Scalability: The scalability of the Stellar network could make it a popular choice for businesses that need to process large volumes of transactions.

3. Interoperability: The interoperability of the Stellar network could make it a popular choice for businesses that need to work with other blockchain platforms.

4. Sustainability: The sustainability of the Stellar network could make it a popular choice for businesses that need to operate in a low-carbon environment.