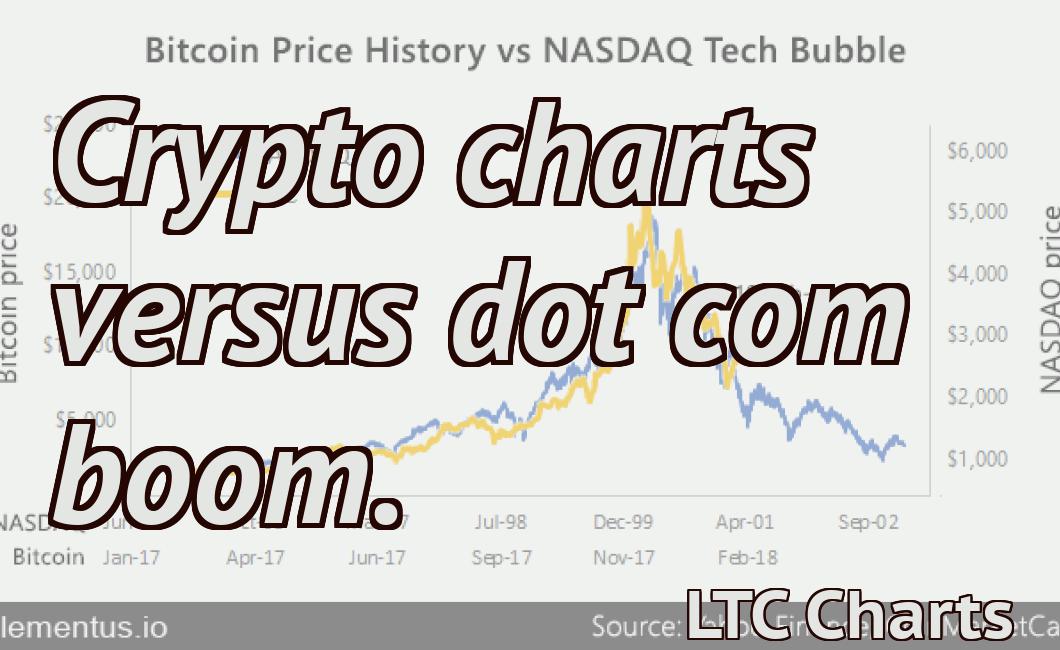

Crypto Bubble Charts

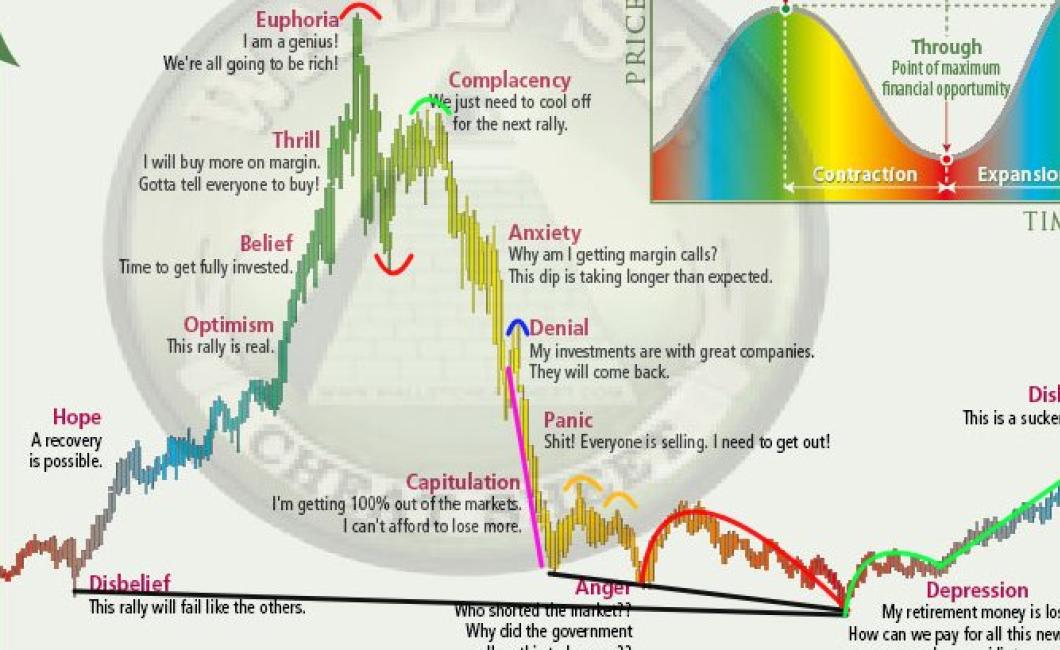

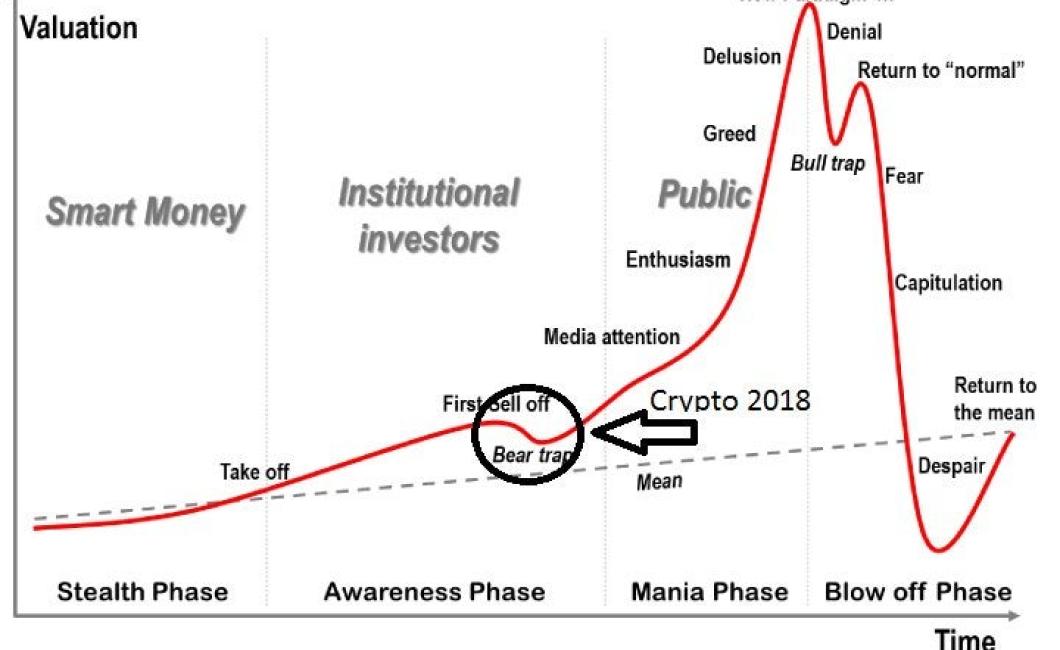

These charts show the growth of the crypto market over the past year. The market has seen incredible growth, but there are concerns that it may be a bubble.

Bitcoin's Price Bubble Could Burst, But That May Not Be A Bad Thing

Bitcoin's price bubble could burst, but that may not be a bad thing.

Bitcoin's price has been on a roller coaster ride over the past few months, with the digital currency trading in a $2,000 range before falling to around $1,600 recently.

Some analysts are worried that the bitcoin price bubble could burst, causing the value of bitcoins to fall. However, this could actually be a good thing for bitcoin, as it would force people to buy the currency at a lower price and drive its adoption as a mainstream payment system.

Some people are also worried that the bitcoin price bubble could lead to financial instability, as investors may lose money if the bubble bursts. However, this is unlikely to happen, as bitcoin is a digital currency and there is no physical asset behind it. In fact, the value of bitcoins could even rise after the bubble bursts, as people may become more confident in the currency's long-term potential.

The Ethereum Bubble Could Be Popping

The Ethereum bubble could be popping, as prices have fallen below $200 for the first time since January.

Ethereum prices have been on a steady decline since the beginning of the year, reaching a low of $176 on Feb. 1. Prices have since rebounded somewhat, but are still down about 20 percent from their January highs.

As of writing, Ethereum is trading at $203, down about 1.5 percent over the last 24 hours.

While it's too early to say for certain that the Ethereum bubble has popped, there are several reasons why prices could be declining.

First, there is growing speculation that the Ethereum network will experience significant problems in the coming months. This could lead to a decrease in demand for the cryptocurrency, and therefore lower prices.

Second, Ethereum prices are highly volatile, which could lead to further price declines if buyers become scared off by large swings in prices.

Overall, it's still too early to say for certain whether the Ethereum bubble has popped, but prices are looking increasingly shaky.

Why The Bitcoin Bubble May Not Be A Bad Thing

It is not uncommon for markets to experience bubbles. The Bitcoin bubble may not be a bad thing.

A bubble is a period of time during which the price of an asset or security rises dramatically above its fundamental value. Bubbles often burst, causing significant losses for investors who invested early on.

Bubbles can occur in any market, but they are more common in financial markets. Investors tend to become overexcited about new investments and rush to buy them, even if they are not really worth the money. This creates a situation in which prices are driven up far beyond what is justified by reality.

In the case of Bitcoin, the reason for the bubble may be different. While it is possible that some people are investing in Bitcoins simply because they believe they will become more valuable in the future, others may be doing so because they believe the currency will be used more widely in the future.

If this is the case, then it is possible that the bubble will burst and investors will lose their money, but this could also lead to increased use of Bitcoin as a medium of exchange. This could make it more valuable in the long run.

There is no guarantee that the Bitcoin bubble will burst, and it may even be beneficial in the long run. However, it is still a risky investment and should not be taken lightly.

The Crypto Currency Bubble Is Popping

The Crypto Currency Bubble Is Popping

The crypto currency bubble is popping. Bitcoin, the largest and most well-known digital currency, is down more than 50% from its all-time high of $20,000 set in December. Ethereum, a second largest digital currency, has also taken a beating, falling more than 60% from its high of over $1,400 set in January.

What caused the crypto currency bubble to pop?

There are a few reasons. First, bitcoin and other digital currencies are not backed by any tangible assets, so their value is entirely based on speculation. Second, many people who bought digital currencies expecting them to become mainstream investments have lost a lot of money. Finally, the Chinese government has cracked down on digital currency trading, likely leading to a reduction in demand.

What are the consequences of the crypto currency bubble popping?

The consequences of the crypto currency bubble popping could be significant. If investors lose faith in digital currencies, they may sell off their holdings, causing their prices to decline. This could lead to a wider financial crisis as other investors pull money out of digital currency investments, causing the value of these assets to collapse. In addition, if the vast majority of digital currencies are based on blockchain technology, which is still in its early stages of development, a slowdown or even a complete collapse in their value could lead to a widespread disruption in the technology sector.

Bitcoin's Price Is In A Bubble

Bitcoin's price is in a bubble and will eventually crash.

The Ethereum Price Is In A Bubble

There is no denying that the Ethereum price is in a bubble. However, it is important to keep in mind that bubbles happen for a reason.

When the Ethereum price is in a bubble, it is typically because there is a lot of speculation happening. This is because people are investing in Ethereum because they think that it is going to go up in value.

However, bubbles can eventually burst. This is because the prices of cryptocurrencies are based on speculation. If the prices of cryptocurrencies start to decline, then the value of Ethereum will also decline.

Why The Bitcoin Price May Not Be In A Bubble

There is no one answer to this question, as there are many factors that could contribute to the price of Bitcoin not being in a bubble. Some reasons that could contribute to this include the fact that the fundamentals of Bitcoin remain strong, there is increasing demand for Bitcoin and other cryptocurrencies, and the overall market sentiment surrounding Bitcoin remains positive.

If you are looking to invest in Bitcoin or other cryptocurrencies, it is important to do your own research in order to assess the potential risks and rewards associated with these investments. If you have any questions about Bitcoin or other cryptocurrencies, please feel free to contact a financial advisor.

The Crypto Currency Market Is In A Bubble

The Crypto Currency market is in a bubble, according to some analysts. The reason for this is that the prices of many digital currencies are rising much faster than their underlying economies are growing.

This is causing a lot of people to invest in these currencies without really understanding what they are buying. This is why the prices of many digital currencies are going up, even though they may not have any real value.

It is important to remember that the prices of digital currencies are not actually backed by anything. This means that they could eventually crash, which would cause a lot of people to lose their money.