Crypto Charts For Technical Analysis

If you're looking for charts to do your technical analysis on, you've come to the right place. In this article, we'll show you the best crypto charts for TA so that you can make the most informed decisions when trading cryptocurrencies.

How to Use Crypto Charts for Technical Analysis

Crypto charts are a great way to help you analyze and trade cryptocurrencies.

First, find the cryptocurrency you want to trade. Next, find the corresponding chart. For example, if you want to trade Bitcoin, go to Bitcoin’s chart page.

Once you find the chart, look for indicators and patterns. For example, you might look for:

The price of Bitcoin relative to other cryptocurrencies

The amount of Bitcoin trading activity (volume)

The direction of the price trend

The relative strength index (RSI)

Other technical indicators, like the Bollinger Bands or MACD

Once you find an indicator or pattern, try to understand what it means and how it might affect the price of the cryptocurrency.

Then, use that information to make trading decisions.

The Benefits of Using Crypto Charts for Technical Analysis

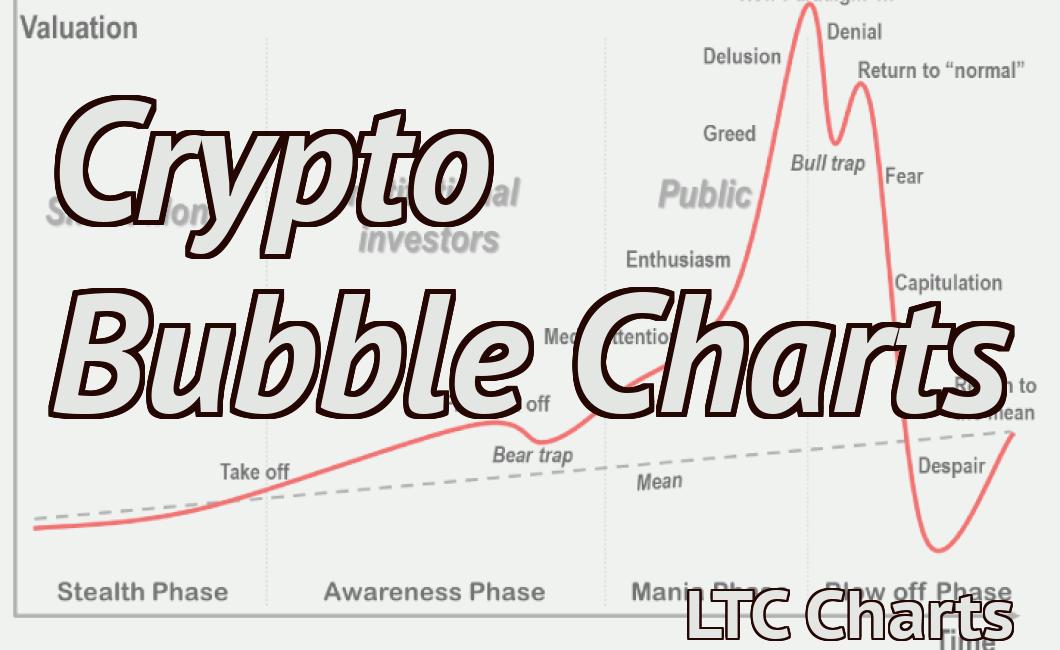

Crypto charts offer a variety of benefits for technical analysis. They can be helpful in analyzing price action, identifying trends, and forecasting future outcomes.

Price Action

Crypto charts can help identify trends in price action. They can show whether the price is going up or down, how high or low it has gone, and when it is likely to reach a certain level.

Trend Identification

Crypto charts can also help identify trends in the market. For example, they can show whether a certain trend is continuing, whether it is inching closer to an end, or whether it has reversed.

Forecasting Future Outcomes

Crypto charts can also be used to predict future outcomes. For example, they can show how the price is likely to move over the next few hours, days, or weeks.

The Different Types of Crypto Charts for Technical Analysis

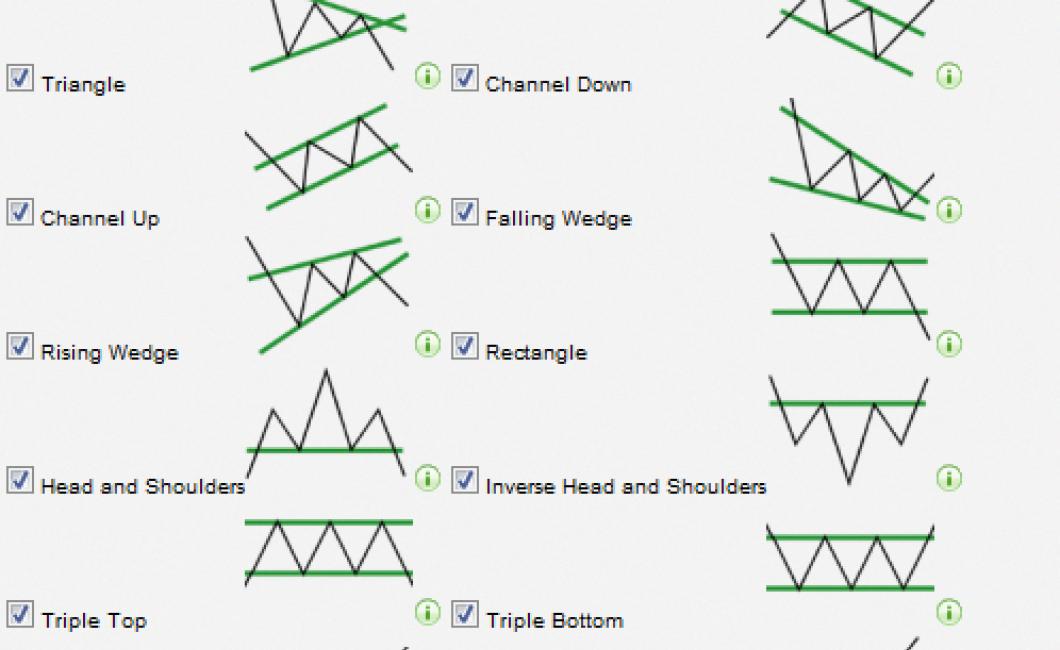

There are a lot of different types of crypto charts that can be used for technical analysis. Some of the more common types of crypto charts include:

1. Candle Stick Chart

A candle stick chart is usually used to show the volatility of a cryptocurrency over time. It shows the price of a cryptocurrency over a period of time, and the height of each candle corresponds to the price of the cryptocurrency at that specific point in time.

2. OHLC Charts

OHLC charts are used to show the price movement over time of a cryptocurrency. They show the price at intervals of 10 minutes, and the color of the bar corresponds to the percentage increase or decrease in value over the last 10 minutes.

3. Volume Charts

Volume charts are used to show the amount of activity over time for a cryptocurrency. They show the total volume traded over a certain period of time, and the color of the bar corresponds to the percentage increase or decrease in volume over the last period of time.

The Most Popular Crypto Charts for Technical Analysis

1. Bitcoin Price Chart (BTC)

2. Ethereum Price Chart (ETH)

3. Ripple Price Chart (XRP)

4. Bitcoin Cash Price Chart (BCH)

5. Litecoin Price Chart (LTC)

6. Cardano Price Chart (ADA)

7. NEO Price Chart (NEO)

8. IOTA Price Chart (MIOTA)

9. TRON Price Chart (TRX)

10. EOS Price Chart (EOS)

The Pros and Cons of Using Crypto Charts for Technical Analysis

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

There are several reasons why analysts and traders may find cryptocurrency charts useful. First, cryptocurrency prices are often volatile and can be very sensitive to small changes in market conditions. Cryptocurrencies are also relatively new and their prices are often highly sensitive to early adopters and speculators. Cryptocurrency charts can help analysts and traders identify patterns in market activity and predict future price movements.

However, there are also several drawbacks to using cryptocurrency charts for technical analysis. First, cryptocurrency prices are often not readily available in real-time, making it difficult to track movements minute-by-minute. Second, cryptocurrency prices are often highly volatile and can be subject to large swings in price. This makes it difficult to identify trends or predict future price movements. Finally, cryptocurrency charts are not widely accepted by the investing community, making it difficult to find reliable data sources.

7 Tips for Using Crypto Charts for Technical Analysis

Crypto charts are a great way to understand the technical behavior of a cryptocurrency.

1. Use a consistent time frame.

It can be helpful to use a time frame that is similar to how you would use traditional stock charts. For example, you might use daily, weekly, or monthly charts.

2. Look for trends.

When looking at crypto charts, it can be helpful to identify trends. For example, if you see a cryptocurrency trending up, it can be a good indication that the cryptocurrency is doing well. On the other hand, if a cryptocurrency is trending down, it might be an indication that the cryptocurrency is in trouble.

3. Check for support and resistance levels.

It can be helpful to check for support and resistance levels on crypto charts. For example, if you see a cryptocurrency reaching a certain price point, it might be a sign that the price is likely to stay around that level for a while. Conversely, if a cryptocurrency is resisting attempts to reach a certain price point, it might be an indication that the price is likely to go down from there.

4. Look for volume indicators.

Volume indicators can be helpful when trying to understand the behavior of a cryptocurrency. For example, if you see a lot of buying and selling activity around a cryptocurrency, it could be an indicator that the cryptocurrency is doing well. Conversely, if you see little to no buying or selling activity around a cryptocurrency, it could be an indicator that the cryptocurrency is not doing well.

5. Check for price correlation.

It can be helpful to check for price correlation on crypto charts. For example, if you see that two cryptocurrencies are moving in tandem, it could be an indication that the two cryptocurrencies are likely to go up or down together. Conversely, if two cryptocurrencies are moving in opposite directions, it could be an indication that the two cryptocurrencies are likely to go their separate ways.

How to Read Crypto Charts for Technical Analysis

When technical analysis is used for cryptocurrency charts, it is important to understand what indicators are being used and how to read them.

Some of the most common technical indicators used for cryptocurrency charts are price action, candlestick patterns, and volume.

Price Action

Price action is the most basic form of technical analysis and can be used to determine whether a cryptocurrency is over or undervalued.

The main indicator used to measure price action is the moving average. Moving averages are created by taking a set number of samples and plotting the average price over that period of time.

If the moving average is above the current price, it is considered bullish and if it is below the current price, it is considered bearish.

Candlestick Patterns

Candlestick patterns are used to indicate whether a cryptocurrency is in a buying or selling mood.

A bullish candlestick pattern is formed when the price goes up sharply and then closes above the previous candle’s closing price. This indicates that buyers are back in control and that the price is likely to continue rising.

A bearish candlestick pattern is formed when the price goes down sharply and then closes below the previous candle’s closing price. This indicates that sellers are back in control and that the price is likely to continue falling.

Volume

Volume is another important indicator used for technical analysis. Volume shows how many transactions are being made in a given period of time.

If there is a lot of volume happening, it is likely that there is a lot of interest in the cryptocurrency and that it is likely to continue rising.

The Best Timeframes for Using Crypto Charts for Technical Analysis

Cryptocurrency charts are a great way to track the price of a specific cryptocurrency over time. There are a number of different timeframes that can be used when analyzing cryptocurrencies, and each one has its own advantages and disadvantages.

1-Day Chart

The 1-day chart is the most basic form of cryptocurrency charting, and it allows you to see the price of a cryptocurrency over a single day. This chart is good for tracking short-term movements, and it is often used to analyze basic trends.

The disadvantage of using the 1-day chart is that it is not very reliable for tracking long-term trends. Additionally, it is not as useful for analyzing large-scale movements.

3-Month Chart

The 3-month chart is a more advanced form of cryptocurrency charting, and it allows you to see the price of a cryptocurrency over a three-month period. This chart is good for tracking longer-term trends, and it is often used to analyze larger-scale movements.

The disadvantage of using the 3-month chart is that it is not as useful for tracking short-term movements. Additionally, it is not as reliable for tracking large-scale movements.

6-Month Chart

The 6-month chart is a more advanced form of cryptocurrency charting, and it allows you to see the price of a cryptocurrency over a six-month period. This chart is good for tracking longer-term trends, and it is often used to analyze larger-scale movements.

The disadvantage of using the 6-month chart is that it is not as useful for tracking short-term movements. Additionally, it is not as reliable for tracking large-scale movements.

1-Year Chart

The 1-year chart is a more advanced form of cryptocurrency charting, and it allows you to see the price of a cryptocurrency over a one-year period. This chart is good for tracking long-term trends, and it is often used to analyze larger-scale movements.

The disadvantage of using the 1-year chart is that it is not as useful for tracking short-term movements. Additionally, it is not as reliable for tracking large-scale movements.