How to read technical crypto charts.

This article covers the basics of reading technical crypto charts so that you can make informed trading decisions. It explains what common charting indicators and patterns are used by traders to predict price movements, and how to interpret them. With this knowledge, you will be able to better understand what is happening in the market and make more informed trading decisions.

How to Read Technical Crypto Charts for Beginners

Cryptocurrency charts can be a bit confusing for beginners, so here's a step-by-step guide on how to read them:

1. Look at the chart and identify the main currencies being traded.

2. Look at the vertical axis ( Y-axis ). This shows how much money is being traded in that particular currency.

3. Look at the horizontal axis ( X-axis ). This shows how many units of that currency are being traded.

4. Compare the values on the X-axis with those on the Y-axis to see how the currency is performing.

A Beginner's Guide to Reading Technical Crypto Charts

Technical crypto charts are essential for anyone looking to understand the current state of the crypto markets. When studying charts, it is important to first understand technical analysis. Technical analysis is the study of price movement and indicators in order to make informed trading decisions. Technical indicators are used to identify patterns in price movement and can help predict future trends.

There are a few key things to keep in mind when studying technical crypto charts:

1. Look for trends.

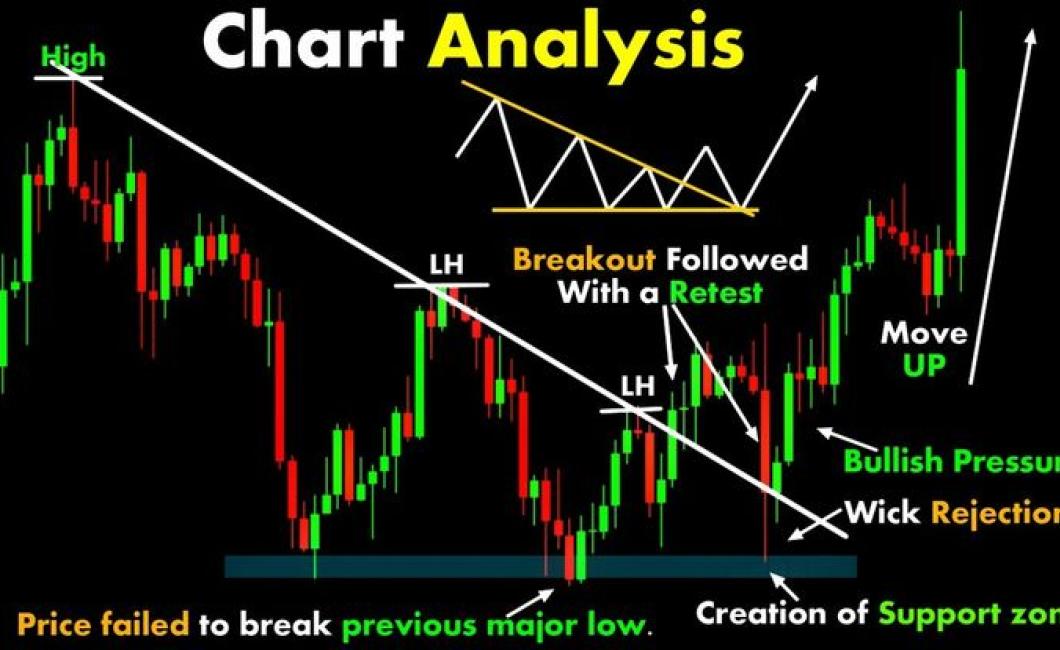

2. Observe chart patterns.

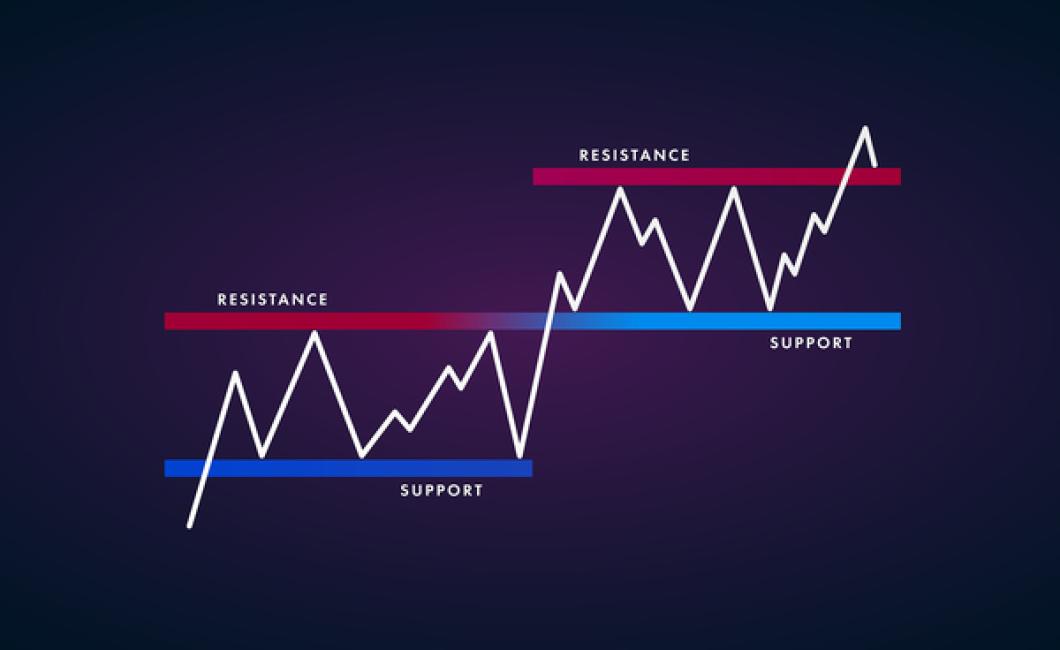

3. Use charting tools to identify support and resistance levels.

4. Use technical indicators to make informed trading decisions.

When studying technical crypto charts, it is important to keep in mind the following tips:

1. Look for trends.

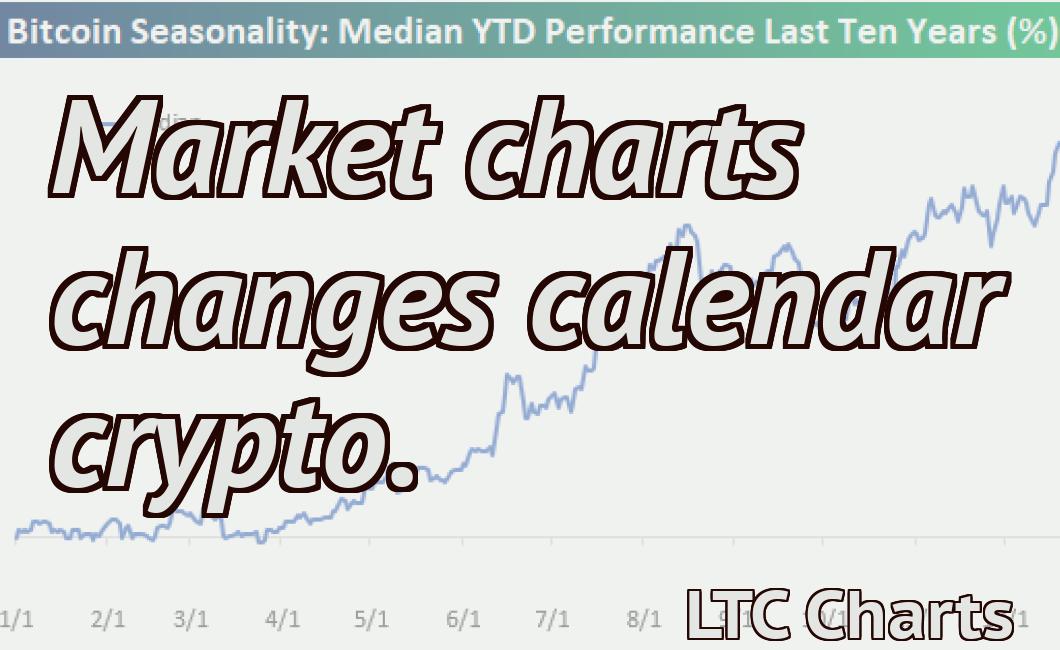

When looking at cryptocurrency charts, it is important to be aware of any overall trends. Trends can be identified by observing how the prices of different cryptocurrencies are moving over time. For example, if you are looking at the prices of Bitcoin, Ethereum, and Litecoin, it is important to watch for any patterns that may be emerging. For example, if you see that Litecoin is consistently dropping in price while Bitcoin and Ethereum are both increasing, this may be an indicator that a bull market is beginning to emerge for Litecoin.

2. Observe chart patterns.

Chart patterns can be very useful when trying to make informed trading decisions. For example, if you are looking at the prices of Bitcoin, Ethereum, and Litecoin, it is important to pay attention to any patterns that may be emerging. For example, if you see that the prices of Bitcoin and Ethereum are both dropping while Litecoin is increasing, this may be an indicator that a bear market is beginning to emerge for Bitcoin and Ethereum.

3. Use charting tools to identify support and resistance levels.

When studying technical crypto charts, it is important to use charting tools in order to identify support and resistance levels. For example, if you are looking at the prices of Bitcoin, Ethereum, and Litecoin, it is important to observe how these prices are reacting to various support and resistance levels. For example, if you see that the prices of Bitcoin and Ethereum are both bouncing off of a support level while Litecoin remains relatively stable, this may be an indicator that a bull market is beginning to emerge for Bitcoin and Ethereum. However, if you see that the prices of Bitcoin and Ethereum are bouncing off of a resistance level while Litecoin remains relatively stable, this may be an indicator that a bear market is beginning to emerge for Bitcoin and Ethereum.

The Basics of Reading Technical Crypto Charts

Technical crypto charts are used by traders and investors to get an understanding of the price movements of cryptocurrencies. They use a variety of indicators to measure the performance of different cryptocurrencies.

Cryptocurrencies are complex and volatile assets, and technical crypto charts can be difficult to understand. Before you start trading or investing in cryptocurrencies, it is important to learn the basics of technical analysis.

Technical analysis is the use of technical indicators to predict the future price movements of a security. Technical indicators are mathematical formulas that are used to measure the performance of a security.

Some common technical indicators used in technical crypto charts include:

The Relative Strength Index (RSI) is a popular technical indicator that is used to measure the strength of a security's price movement. The RSI is calculated by dividing the percentage change in the price of a security over a specific period of time by the percentage change in the average price over that same period of time.

The Commodity Channel Index (CCI) is another popular technical indicator that is used to measure the trend of a security's price movement. The CCI is calculated by dividing the number of days that a security's price has been above the 20-day moving average by the number of days that a security's price has been above the 100-day moving average.

The MACD is a popular technical indicator that is used to measure the trend of a security's price movement. The MACD is calculated by using the moving average convergence divergence (MAV) and the moving average convergence divergence absolute (MACD-A). The MACD-A is also known as the "signal line."

The Bollinger Bands are a set of two bands that are used to measure the volatility of a security's price movement. The upper band is used to measure the volatility of a security's price movement over a short period of time, and the lower band is used to measure the volatility of a security's price movement over a long period of time.

How to Interpret Technical Crypto Charts

Crypto charts are very important in the world of cryptocurrency. They can help you to understand the market and make better investment decisions.

When interpreting crypto charts, it is important to understand the following:

Cryptocurrencies are digital or virtual assets that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

There are a variety of metrics that can be used to analyze crypto charts. Some of the most common metrics include the following:

Volumes: This statistic displays the total amount of cryptocurrency traded over a given period. It is important to note that this metric does not necessarily reflect the value of the cryptocurrencies. For example, a high volume of trading may indicate that there is a lot of speculation taking place, rather than actual investment.

This statistic displays the total amount of cryptocurrency traded over a given period. It is important to note that this metric does not necessarily reflect the value of the cryptocurrencies. For example, a high volume of trading may indicate that there is a lot of speculation taking place, rather than actual investment. Prices: This statistic displays the price of a given cryptocurrency over a given period. It is important to note that this statistic reflects the value of the cryptocurrencies at the time of the measurement, not the market cap. For example, if Bitcoin prices increase by 10%, this statistic will also increase by 10%. However, if the market cap of Bitcoin increases by 10%, this statistic will increase by 20%.

This statistic displays the price of a given cryptocurrency over a given period. It is important to note that this statistic reflects the value of the cryptocurrencies at the time of the measurement, not the market cap. For example, if Bitcoin prices increase by 10%, this statistic will also increase by 10%. However, if the market cap of Bitcoin increases by 10%, this statistic will increase by 20%. Circulating Supply: This statistic displays the total number of coins that are available for purchase on the open market. This number is updated every minute.

This statistic displays the total number of coins that are available for purchase on the open market. This number is updated every minute. Volume-to-Price: This statistic compares the volume of a given cryptocurrency to its price. It is useful when trying to determine if a cryptocurrency is overvalued or undervalued.

This statistic compares the volume of a given cryptocurrency to its price. It is useful when trying to determine if a cryptocurrency is overvalued or undervalued. 24-hour Trading Volume: This statistic displays the total amount of cryptocurrency traded in a given day.

What do all those lines on a technical crypto chart mean?

The lines on a technical crypto chart represent prices of digital currencies over time. Cryptocurrencies are often traded on exchanges and can experience wild price swings. These swings can be due to a variety of factors, including news events, market sentiment, and technical analysis.

How to make sense of a technical crypto chart

When analyzing a technical crypto chart, it is important to look at a variety of factors to help you make sense of the data. Some key considerations include:

1. The overall trend of the market – This can be helpful in determining whether the price is heading up or down.

2. The price action – This includes the highs and lows of the market, as well as the general movement of the price.

3. The technical indicators – These are often used to identify potential buying and selling opportunities.

4. The market conditions – This includes factors such as supply and demand, volatility, and economic news.

How to read a candlestick chart for cryptos

A candlestick chart is a graphical representation of the price of a cryptocurrency over time. Each candlestick shows the price, volume (in units), and open, high, low, and close prices for a given day.

How to read a line chart for cryptos

To read a line chart for cryptos, start at the bottom of the chart and work your way up. The horizontal axis represents time and the vertical axis represents price. Each line on the chart shows the price of a specific cryptocurrency over a specific period of time.

How to read a bar chart for cryptos

The horizontal axis represents the number of coins in circulation and the vertical axis represents the price of a coin. For example, a bar that is at the bottom of the chart would represent a low price for the coin and a bar that is at the top of the chart would represent a high price for the coin.

What are the most important technical indicators for crypto charts?

Cryptocurrency charts are important for technical analysis because they provide a snapshot of the current state of the market. The most important technical indicators to watch for on crypto charts include: the price of the cryptocurrency, the volume of trading activity, and the market capitalization of the cryptocurrency.

How to use technical indicators to trade cryptos

There are a number of technical indicators that can be used to trade cryptos. Some of the most popular include the moving average, the Bollinger Bands, and the MACD. Each of these indicators has its own set of pros and cons, so it is important to carefully consider which one to use for a given trade.

A guide to reading and using crypto trading charts

Cryptocurrency trading charts are a valuable tool for understanding the market.

There are many different types of charts, and each has its own benefits and drawbacks.

Here is a guide to help you understand how to read and use crypto trading charts.

1. Technical analysis

Technical analysis is the use of technical indicators to evaluate the price of a security.

Technical indicators include moving averages, Bollinger Bands, and RSI (relative strength index).

Technical analysts use these indicators to identify patterns in the price of a security and make forecasts about future trends.

2. Fundamental analysis

Fundamental analysis is the study of a security's underlying assets and liabilities.

Investors use fundamental analysis to determine whether a security is worth investing in.

They look at factors such as a security's price-to-earnings (P/E) ratio, its dividend yield, and its cash flow.

3. Volume analysis

Volume analysis is the use of historical data to predict future trends in the price of a security.

Volume analysis can help you identify trends in the market and make predictions about future prices.

4. Charting tools

There are many different types of charting tools available online.

Some of the most popular charting tools include TradingView, Cryptohopper, and Coinigy.

Each of these tools has its own set of features and advantages.

5. Trading strategies

A trading strategy is a set of instructions that you follow when trading a security.

Trading strategies can include buying or selling a security at a specific price point, based on the conditions in the market.

6. Trade management

Trade management is the process of monitoring your trades and making adjustments as necessary.

This includes monitoring your portfolio, making sure you are getting the most out of your trading strategy, and managing risk.