Defined Charts Crypto

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

Defining Cryptocurrency Charts

Cryptocurrency charts are visual representations of the price movement of a given cryptocurrency. They can be used to help traders and investors understand the performance of a given cryptocurrency over a certain period of time.

Cryptocurrency charts can be divided into two main categories: daily and weekly. Daily charts show the price movement of a cryptocurrency over a 24-hour period. Weekly charts show the price movement of a cryptocurrency over a seven-day period.

The Different Types of Cryptocurrency Charts

There are several types of cryptocurrency charts, but they all have one common goal: to help you understand how the price of a particular cryptocurrency is changing over time.

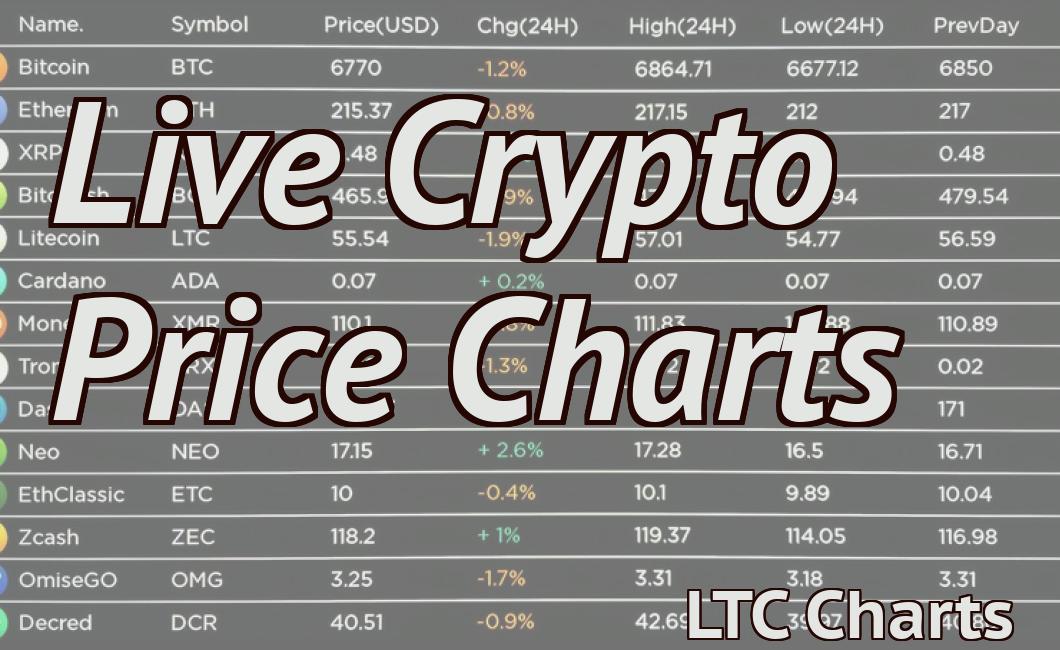

Cryptocurrency Price Charts

Cryptocurrency price charts are the most common type of cryptocurrency chart, and they show you how much the value of a particular cryptocurrency has changed over a specific period of time.

Bitcoin Price Chart

The Bitcoin price chart is one of the most popular cryptocurrency price charts. It shows you how the value of Bitcoin has changed over time, and it also shows how the value of Bitcoin has compared to the value of other cryptocurrencies.

Ethereum Price Chart

The Ethereum price chart is similar to the Bitcoin price chart, but it also shows you how the value of Ethereum has changed over time.

Cryptocurrency Value Charts

Cryptocurrency value charts are similar to cryptocurrency price charts, but they show you how much a particular cryptocurrency is worth in US dollars or another fiat currency.

Bitcoin Value Chart

The Bitcoin value chart is one of the most popular cryptocurrency value charts. It shows you how much the value of Bitcoin has changed over time, and it also shows you how the value of Bitcoin has compared to the value of other cryptocurrencies.

Ethereum Value Chart

The Ethereum value chart is similar to the Bitcoin value chart, but it also shows you how the value of Ethereum has changed over time.

Cryptocurrency Volume Charts

Cryptocurrency volume charts are similar to cryptocurrency value charts, but they show you how much a particular cryptocurrency has been traded over a specific period of time.

Bitcoin Volume Chart

The Bitcoin volume chart is one of the most popular cryptocurrency volume charts. It shows you how much the value of Bitcoin has been traded over a specific period of time, and it also shows you how the value of Bitcoin has compared to the value of other cryptocurrencies.

Ethereum Volume Chart

The Ethereum volume chart is similar to the Bitcoin volume chart, but it also shows you how the value of Ethereum has been traded over a specific period of time.

How to Read Cryptocurrency Charts

Cryptocurrency charts are a way to see how prices are moving over time. In order to read a cryptocurrency chart, you will need to understand some basic terms:

Anatomy of a Cryptocurrency Chart

A cryptocurrency chart is made up of two main parts: the horizontal axis and the vertical axis. The horizontal axis shows how much money a cryptocurrency is worth over time, while the vertical axis shows how much money has been invested in that currency.

There are a few different types of cryptocurrency charts. The most common type is the candlestick chart. Candlestick charts are made up of a series of candlesticks, which are boxes that show the price of a cryptocurrency over a specific period of time.

Another type of cryptocurrency chart is the bar chart. Bar charts show how much money has been invested in a cryptocurrency over a specific period of time.

How to Read Cryptocurrency Charts

To read a cryptocurrency chart, you first need to understand the basics of how cryptocurrencies work. The horizontal axis shows how much money a cryptocurrency is worth over time, while the vertical axis shows how much money has been invested in that currency.

candlestick chart: This type of cryptocurrency chart is made up of a series of candlesticks, which show the price of a cryptocurrency over a specific period of time. Candlestick charts are easy to read, and they are a popular type of cryptocurrency chart.

bar chart: This type of cryptocurrency chart shows how much money has been invested in a cryptocurrency over a specific period of time. Bar charts are harder to read than candlestick charts, and they are less popular than

The Benefits of Using Cryptocurrency Charts

There are many benefits to using cryptocurrency charts. One of the most important reasons to use them is that they can help you to make more informed investment decisions.

Cryptocurrency charts can help you to identify areas of potential growth or decline in a coin’s price. This can help you to make more informed investment decisions.

Cryptocurrency charts can also help you to identify coins that are currently undervalued or overvalued. By doing this, you can potentially make some lucrative investments.

Cryptocurrency charts can also help you to identify coins that are likely to experience price volatility. This can help you to avoid investing in coins that are likely to experience sudden changes in value.

Finally, cryptocurrency charts can also help you to understand the overall trends in the cryptocurrency market. By doing this, you can potentially make more informed investment decisions.

The Basics of Cryptocurrency Charting

When it comes to cryptocurrency charting, there are a few basics you should be aware of.

The first thing to understand is that cryptocurrency charts are not like traditional stock charts. They don’t typically show prices in terms of cents or dollars. Instead, they show prices in terms of digital “coins” or “tokens.”

Secondly, cryptocurrency charts are often designed to show the latest prices and changes over time. This means that they may not always be accurate or up to date.

Finally, cryptocurrency charts can be difficult to understand and use. That’s why it’s important to consult a reliable cryptocurrency charting service if you want to make accurate investment decisions.

The Different Ways to Analyze Cryptocurrency Charts

Cryptocurrency charts are used to track the movement of digital assets such as bitcoin and ether. There are several different ways to analyze cryptocurrency charts, and each has its own advantages and disadvantages.

1. Technical Analysis

Technical analysis is the use of charts and indicators to predict future price movements. The main goals of technical analysis are to identify patterns in the price data and to make predictions about where the asset is likely to go next.

One of the main benefits of using technical analysis is that it can help you make informed decisions about where to place your bets on cryptocurrencies. For example, if you see that a particular digital asset is experiencing strong volatility, then it may be a good idea to sell off your holdings and wait for the coin to calm down.

On the other hand, technical analysis can also be a risky strategy. If you don’t know what you’re looking for, then it can be difficult to identify any patterns in the data. This can lead to losses if you get wrong about the direction of the market.

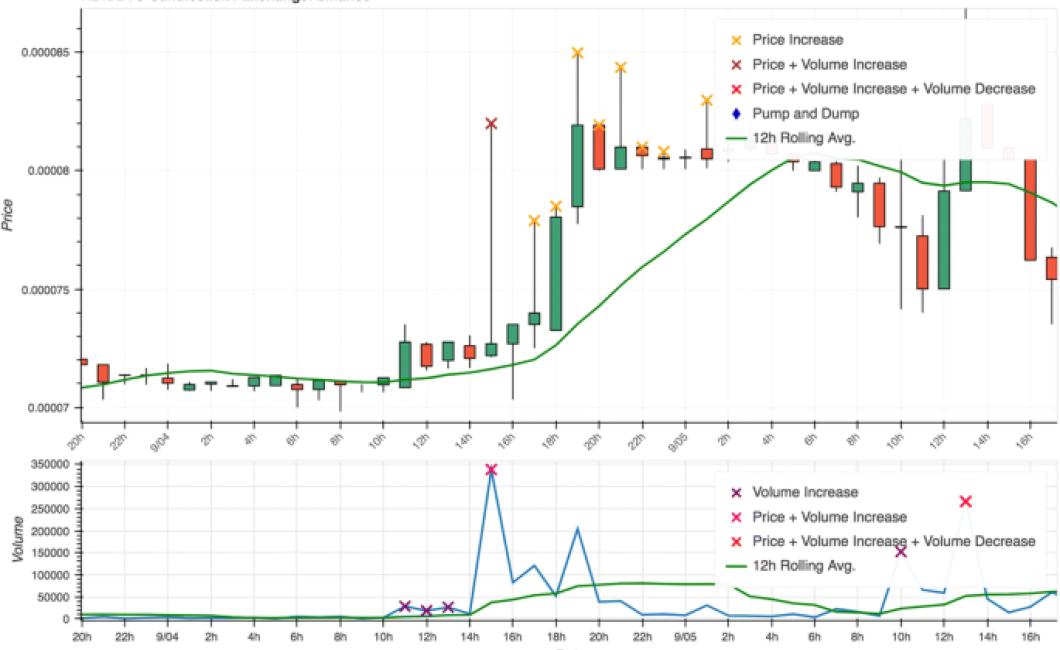

2. Volume Analysis

Volume analysis is another way to track the movement of cryptocurrencies. Volume is simply the number of transactions that have taken place over a given period of time.

One of the main advantages of volume analysis is that it can help you identify which digital assets are experiencing the most demand. This can help you make better investment decisions because you’ll be more likely to find coins that are likely to grow in value.

On the other hand, volume analysis can be somewhat subjective. It’s up to the individual trader to determine which coins are experiencing high volumes and which ones are not. This can lead to mistakes if you don’t have a good understanding of the cryptocurrency market.

3. Cryptocurrency Price Indexes

Cryptocurrency price indexes are another way to track the movement of digital assets. Cryptocurrency price indexes track the average price of a specific digital asset over a period of time.

One of the main benefits of using cryptocurrency price indexes is that they provide a consistent measure of how the market is performing. This makes it easier for traders to track trends and make informed investment decisions.

On the other hand, cryptocurrency price indexes can be somewhat dated. They don’t take into account recent changes in the market, which can lead to inaccurate predictions about future prices.

4. TradingView Charts

TradingView charts are a popular way to analyze cryptocurrency charts. TradingView charts allow you to see all the important data points associated with a given asset, including volume, price, and moving averages.

One of the main benefits of TradingView charts is that they provide a comprehensive view of the market. This makes it easy for traders to understand all the important information associated with a given asset.

On the other hand, TradingView charts can be a bit overwhelming for beginners. They require a good knowledge of technical analysis in order to use them effectively.

5. CoinMarketCap Charts

CoinMarketCap charts are another popular way to analyze cryptocurrency charts. CoinMarketCap charts allow you to see all the important data points associated with a given digital asset, including price, volume, and market capitalization.

One of the main benefits of using CoinMarketCap charts is that they provide a comprehensive view of the market. This makes it easy for traders to understand all the important information associated with a given asset.

On the other hand, CoinMarketCap charts can be a bit overwhelming for beginners. They require a good knowledge of technical analysis in order to use them effectively.

The Various Indicators Used in Cryptocurrency Charting

Cryptocurrency prices are measured in units of currency called units of cryptocurrency. The most common unit of cryptocurrency is the bitcoin. Other units of cryptocurrency include the bitcoin cash, ethereum, and litecoin.

Many cryptocurrency charting tools display different indicators to help analyze price trends. Some of the most common indicators used to measure cryptocurrency prices include the following:

The 24-hour trading volume

The market capitalization

The number of active addresses

The number of transactions

Technical Analysis of Cryptocurrency Charts

The purpose of this section is to provide a comprehensive overview of cryptocurrency charts and how to use them to make informed investment decisions.

Cryptocurrency charts are a great way to get an overview of the overall sentiment of the market and see how prices are moving over time.

When looking at cryptocurrency charts, it is important to keep in mind that they are not a guarantee of future returns, and should only be used as a tool to help you make informed investment decisions.

In addition, it is important to remember that cryptocurrency markets are often very volatile, and can quickly change in price. Therefore, it is always important to do your own research before investing in any cryptocurrency.

Fundamental Analysis of Cryptocurrency Charts

Cryptocurrency charts are an essential part of any cryptocurrency trader’s arsenal. They can help you track the price of a specific cryptocurrency over time, spot trends, and identify potential investment opportunities.

The following are three fundamental analysis techniques that you can use to analyze cryptocurrency charts:

1. Price Movement

One of the most important aspects of cryptocurrency charts is the price movement. This is especially important when looking for long-term investment opportunities.

Cryptocurrencies tend to move in waves. When the price is high, it will usually go down a little bit before recovering. This is called a “corrective wave”. When the price is low, it will usually go up a little bit before recovering. This is called a “deviant wave”.

2. Volume

Another important aspect of cryptocurrency charts is volume. This is because it can indicate whether there is interest in the cryptocurrency market.

When the volume is high, it means that there is a lot of demand for the cryptocurrency. When the volume is low, it means that there is a lot of supply for the cryptocurrency.

3. Trend

Finally, another important aspect of cryptocurrency charts is the trend. This is especially important when trying to spot short-term investment opportunities.

Cryptocurrencies tend to move in waves and trends can be identified by looking at the direction of the price movement and the size of the waves.

How to Trade Using Cryptocurrency Charts

Cryptocurrency charts are an essential tool for anyone interested in trading cryptocurrencies. By following a few simple steps, you can easily create your own cryptocurrency charts and start trading.

1. Choose a Cryptocurrency to Trade

The first step is to choose a cryptocurrency to trade. There are a number of options available, so it is important to choose one that you are interested in. Some of the most popular cryptocurrencies include Bitcoin, Ethereum, and Litecoin.

2. Create a Cryptocurrency Chart

The next step is to create a cryptocurrency chart. This will allow you to track the price of your chosen cryptocurrency over time. You can use different tools to create your chart, such as TradingView or CoinMarketCap.

3. Trade Based on Your Chart

Once you have created your cryptocurrency chart, you can then start trading based on it. This will allow you to make profitable trades based on the movements of the cryptocurrency.

Using Cryptocurrency Charts to Make Better Trading Decisions

Cryptocurrency charts can be very helpful when it comes to making better trading decisions. By understanding where a cryptocurrency is heading, you can make more informed decisions when buying and selling.

Here are some tips on how to use cryptocurrency charts:

1. Look at the overall trend.

The first thing you should do is look at the overall trend. This will show you whether the cryptocurrency is heading up or down. If the trend is positive, then buying is likely a good idea. If the trend is negative, then selling may be a better option.

2. Check the price action.

Next, you should check the price action. This will show you whether the cryptocurrency is making large or small moves. If the moves are large, then buying is likely a good idea. If the moves are small, then selling may be a better option.

3. Consider the news.

Finally, consider the news. This will help you to determine whether the cryptocurrency is getting more or less popular. If the news is good, then buying is likely a good idea. If the news is bad, then selling may be a better option.