Crypto Candlestick Charts

Crypto candlestick charts are one of the most popular ways to visualize market data for cryptocurrencies. They offer a clear and concise way to see price action, and can be used to spot trends and make predictions about future price movements.

How to Read Crypto Candlestick Charts

When you're looking at crypto candlestick charts, you want to keep in mind the following things:

The height of the candle. This is the height of the candle at the time it was filled.

The width of the candle. This is the width of the candle at the time it was filled.

The time of the candle. This is the time of the candle at the time it was filled.

The price of the cryptocurrency at the time of the candle.

The Benefits of Crypto Candlestick Charts

Crypto candlestick charts are incredibly valuable for traders and investors because they give you a quick and easy way to see how the price of a digital asset is performing over time.

Crypto candlestick charts also allow you to see how prices are reacting to different events, such as news stories or market movements.

Here are some of the benefits of using crypto candlestick charts:

1. They’re Quick and Easy to Use

Crypto candlestick charts are quick and easy to use, which is great for traders who need a way to track their asset prices quickly.

2. They Can Help You See How Prices Are Reacting to Different Events

Crypto candlestick charts can help you see how prices are reacting to different events, such as news stories or market movements. This can help you make better investment decisions.

3. They Can Help You See Patterns in Price Movement

Crypto candlestick charts can help you see patterns in price movement, which can help you make better investment decisions.

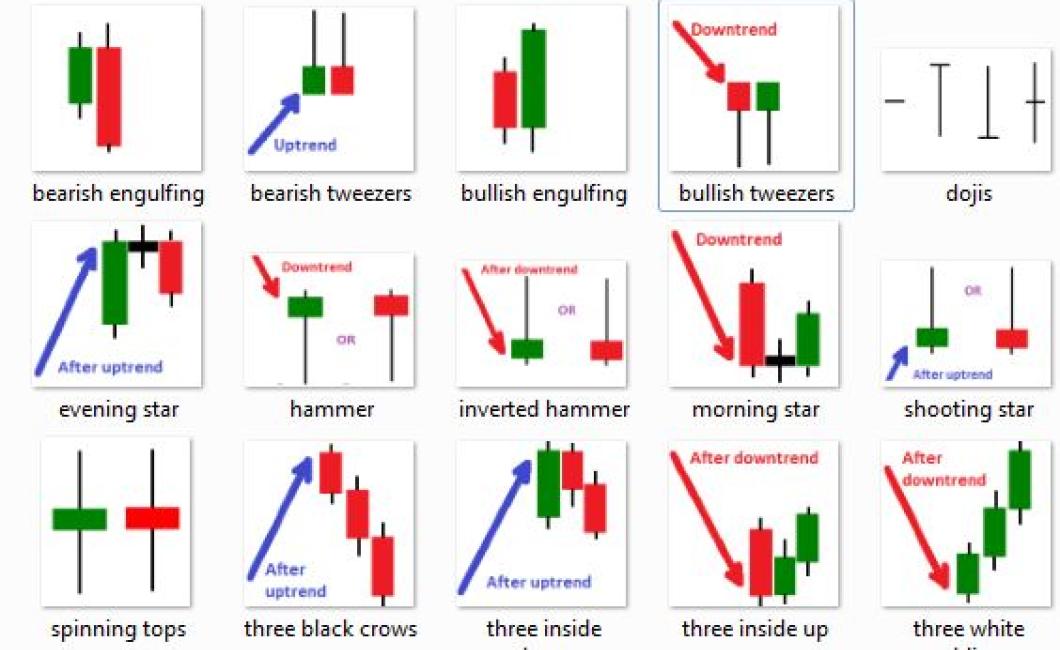

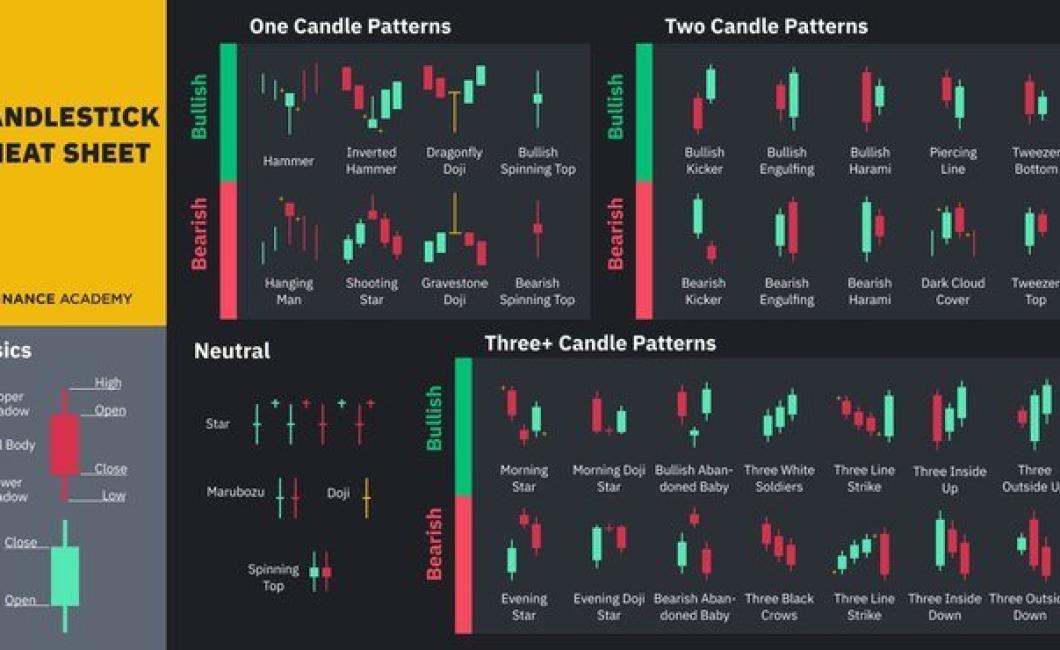

The Different Types of Crypto Candlestick Charts

There are three types of crypto candlestick charts:

1. Open, high, low

2. Close, high, low

3. Total volume

1. Open, high, low

This type of candlestick chart shows the price of a cryptocurrency at open, high and low prices over a given period of time. The height of the candlestick indicates the amount of change in price during that period.

For example, on an Open, high, low candlestick chart, the open price would be at the top, the high price would be at the top right, and the low price would be at the bottom left. The candlestick would then move up and down indicating the price changes during that period.

2. Close, high, low

This type of candlestick chart shows the price of a cryptocurrency at close, high and low prices over a given period of time. The height of the candlestick indicates the amount of change in price during that period.

For example, on a Close, high, low candlestick chart, the close price would be at the top, the high price would be at the top right, and the low price would be at the bottom left. The candlestick would then move up and down indicating the price changes during that period.

3. Total volume

This type of candlestick chart shows the total volume traded for a cryptocurrency over a given period of time. The height of the candlestick indicates the amount of change in volume during that period.

The History of Crypto Candlesticks

Candlesticks are a type of technical analysis used to analyze the behavior of a security over time. They originated in the world of financial markets, where traders use them to identify patterns in price movements.

Cryptocurrencies are unique in that they are not subject to traditional financial market fluctuations. This has led some traders to adopt candlesticks in order to better understand the behavior of these new assets.

How to Use Cryptocurrency Candlesticks

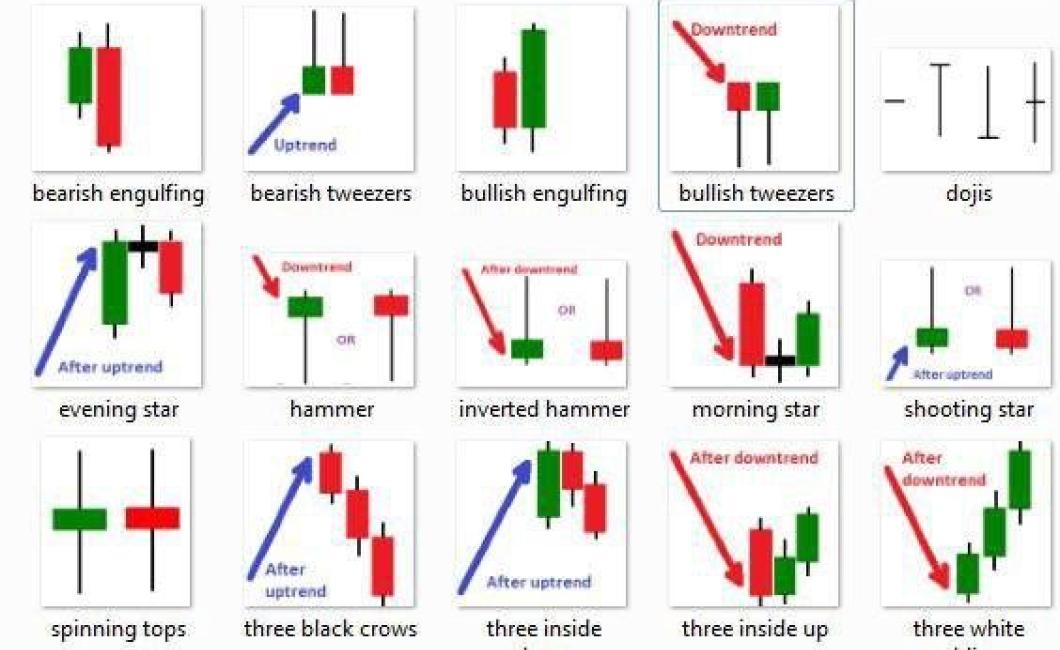

Candlesticks can be used to identify important patterns in cryptocurrency prices. The key is to pay attention to the candles that are close to each other and to the overall trend.

Here are four tips for using cryptocurrency candlesticks:

1. Identify Support and Resistance Levels

It's important to identify support and resistance levels in order to find areas where prices may or may not fall or rise. Look for areas where prices have been stable for a period of time or where they have recently broken out from a previous trend.

2. Follow the Overall Trend

It's important to keep an eye on the overall trend in order to determine whether prices are headed up or down. Look for brief moments of consolidation followed by a more pronounced uptrend or downtrend.

3. Watch the Close Candle

The close candle is often the most important candle in terms of determining the overall trend. Watch how the candle closes relative to the other candles in the chart and whether it matches or exceeds the closing price of the previous candle.

4. Use Multiple Charts

It's often helpful to use multiple charts in order to get a more complete understanding of the market. For example, you can use a chart to track the price of Bitcoin, Ethereum, and other cryptocurrencies at the same time.

How to Create Your Own Crypto Candlestick Chart

To create your own crypto candlestick chart, you will need to gather some data about the prices of cryptocurrencies over time. You can use a variety of sources to gather this information, including online exchanges, cryptocurrency wallets, and news sites.

Once you have the data, you will need to create a candlestick chart. To do this, you will first need to select a time period for your chart. You can choose to chart the prices of cryptocurrencies over a one-day, week, month, or year period.

Next, you will need to select the type of candlestick chart you would like to use. There are three types of candlesticks you can use: open, close, and high/low.

To create an open candlestick chart, you will first need to select the start and end dates for your chart. The start date will be the day the first price point occurred, while the end date will be the day the last price point occurred.

To create a close candlestick chart, you will first need to select the start and end dates for your chart. The start date will be the day the first price point occurred, while the end date will be the day the last price point occurred.

To create a high/low candlestick chart, you will first need to select the start and end dates for your chart. The start date will be the day the first price point occurred, while the end date will be the day the highest or lowest price point occurred.

The Advantages of Using Crypto Candlestick Charts

Crypto candlestick charts are a great way to analyze cryptocurrency prices. They provide a visual representation of the price action over a specific period of time. They are also an efficient way to identify patterns and trends in the market.

Here are some of the advantages of using crypto candlestick charts:

They are easy to understand.

They are effective in detecting patterns and trends.

They can help you make informed decisions.

The Disadvantages of Using Crypto Candlestick Charts

One of the main disadvantages of using crypto candlestick charts is that they can be difficult to interpret. Additionally, they may not be as accurate as other types of charts when it comes to depicting real-time market movements.

Why You Should Use Crypto Candlestick Charts

Crypto candlestick charts are a great way to visually track the performance of a digital asset over time.

They can help you identify patterns and trends in price movements, and can provide valuable insights about the health of a cryptocurrency market.

Here are some reasons why you should start using crypto candlestick charts:

1. They can help you identify patterns and trends in price movements.

Crypto candlestick charts can help you identify patterns and trends in price movements. This can help you better understand the health of a cryptocurrency market.

2. They can provide valuable insights about the health of a cryptocurrency market.

Crypto candlestick charts can provide valuable insights about the health of a cryptocurrency market. This can help you make informed decisions about whether to invest in a particular cryptocurrency or not.

3. They can help you improve your trading skills.

Crypto candlestick charts can help you improve your trading skills. This is because they can help you identify patterns and trends in price movements. This can help you make more informed and profitable trading decisions.