How Do Prices Go Up And Down On Exchanges For Stock Or Crypto

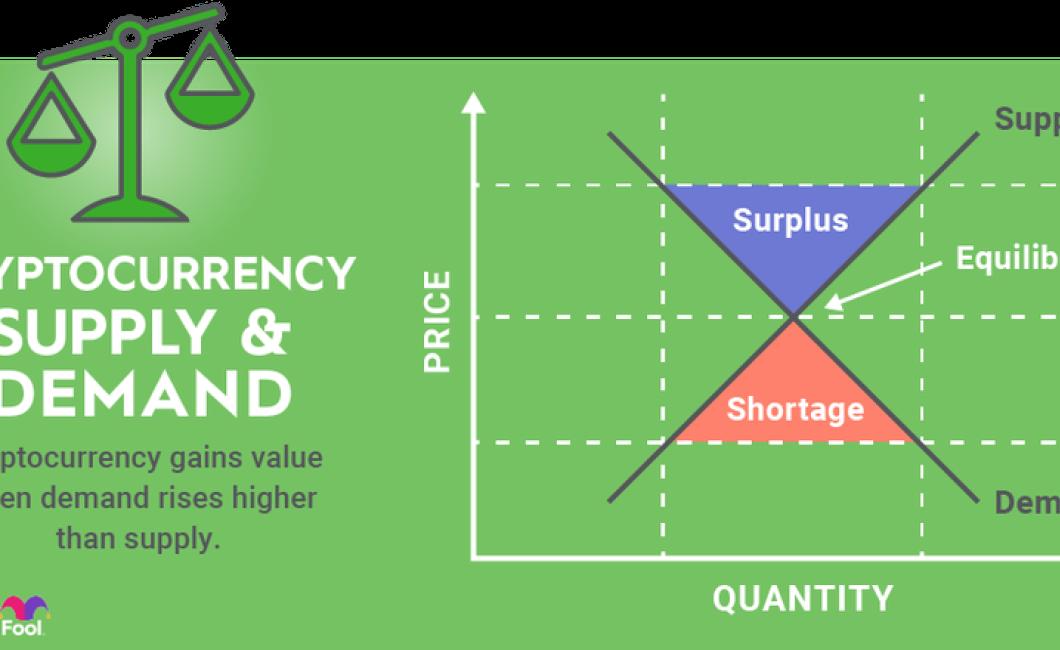

When you buy or sell stocks and cryptocurrencies, you do so through an exchange. Prices for stocks and cryptocurrencies are constantly changing on exchanges. The prices go up when demand for the asset is high and more people are buying than selling. The prices go down when demand is low and more people are selling than buying.

How do prices go up and down on exchanges for stock or crypto?

The price of a stock or cryptocurrency on an exchange can go up or down depending on the supply and demand for that asset. When more people want to buy a stock or cryptocurrency, the price goes up. Conversely, when less people want to buy a stock or cryptocurrency, the price goes down.

How does the stock or crypto exchange rate fluctuate?

The stock or crypto exchange rate fluctuates due to a number of factors including the volume of trade on the exchange, the supply and demand for the particular cryptocurrency, and global economic conditions.

How do market forces affect stock or crypto prices?

Market forces affect stock and crypto prices by influencing the supply and demand for a particular asset. When demand for a particular asset is high, prices will be higher than when demand is low. Similarly, when supply is high, prices will be lower than when supply is low.

What drives prices up or down on exchanges for stock or crypto?

The primary drivers of prices on exchanges for stock or crypto are supply and demand. When there is an increase in demand for a particular stock or crypto, the price will go up. Conversely, when there is an increase in supply of a particular stock or crypto, the price will go down.

How do global events affecting stock or crypto prices?

Global events impacting stock or crypto prices can include political, economic, or social changes. For example, a government could pass new laws that impact the stock market, or a major company could announce a new product that affects the price of a cryptocurrency.

What are the major drivers of stock or crypto prices?

There are a number of major drivers of stock or crypto prices, including global macroeconomic conditions, news events, company earnings, and technical indicators.

How do emotions affect stock or crypto prices?

Actions that are emotionally driven, such as buying on the basis of optimism or panic, tend to have a larger impact on stock prices than actions that are based on reasoned analysis. For example, when the market is down, individuals may sell stocks in order to take profits, which will cause the stock prices to decline. This type of behavior is more likely to occur during times of panic or uncertainty. Conversely, when the market is up, individuals may buy stocks in order to gain wealth, which will cause the stock prices to increase. This type of behavior is more likely to occur during times of optimism or certainty.

How does news affect stock or crypto prices?

There is no definitive answer to this question as the impact of news on stock and crypto prices depends on a variety of factors, including the specific news story and the stock or cryptocurrency market conditions at the time. Some news stories may cause stock prices to rise, while others may cause prices to fall. In some cases, news may have little or no impact on stock or cryptocurrency prices.

What is the psychology behind stock or crypto prices?

There are a few psychological factors that can drive stock or crypto prices. One is the fear of missing out (FOMO), which can cause people to buy stocks or cryptocurrencies when they see others doing so. Another is speculation, which can cause people to buy stocks or cryptocurrencies because they believe that the price will go up.

How do investors' expectations affect stock or crypto prices?

Investors' expectations affect stock or crypto prices in a few ways. First, when investors expect a stock or cryptocurrency to go up in value, they are more likely to buy it. This drives up the price, and the cycle continues until the expectation is reversed and people sell, which then drives the price down. Second, when investors believe that a stock or cryptocurrency is overvalued, they are less likely to buy it, and the cycle stops. Finally, when news about a company or cryptocurrency is released, it can have an immediate effect on prices.

How do herd mentality and FOMO affect stock or crypto prices?

Herd mentality and FOMO affect stock or crypto prices by causing investors to buy or sell cryptocurrencies or stocks based on the beliefs of others, rather than based on their own analysis. This can cause the price of a cryptocurrency or stock to rise or fall rapidly, without regard to whether the investment is actually warranted.