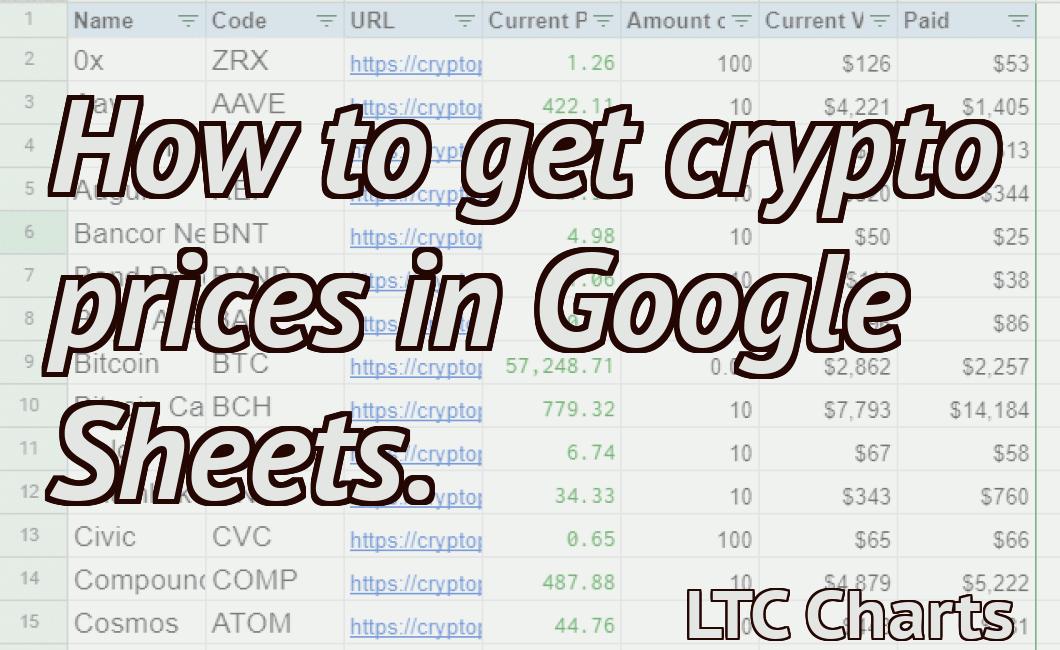

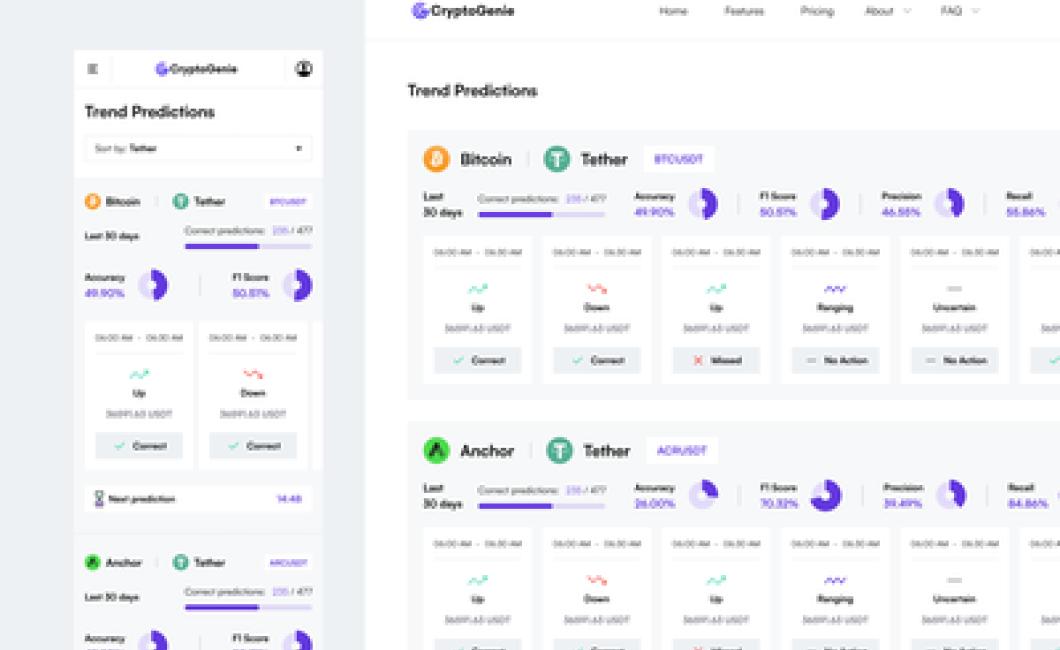

Crypto Prices Predictions Website

The website provides predictions for cryptocurrency prices based on data analysis.

5 Reasons Why Crypto Prices Will Soar in 2021

1. The global economy is slowly but surely recovering.

2. Cryptocurrencies are becoming more and more mainstream.

3. More and more companies are starting to accept cryptocurrencies as a form of payment.

4. Regulatory frameworks are being developed in many countries around the world.

5. The cryptocurrency market is still growing rapidly, which means that there is still a lot of room for growth.

3 Reasons Why Crypto Prices May Crash in 2021

1. Regulatory clampdown:

Regulatory clampdowns are one of the most common reasons why prices of cryptocurrencies and tokens may crash in 2021. For example, in China, where cryptocurrency trading is highly popular, the government has announced a series of measures to regulate and restrict the use of digital tokens. This could lead to a decrease in demand for digital tokens, and consequently a fall in their prices.

2. Economic slowdown:

An economic slowdown is another common reason why cryptocurrency prices may crash in 2021. If the global economy experiences a downturn, people may become less interested in investing in cryptocurrencies and tokens. This could lead to a decrease in demand for these assets, and a consequent fall in their prices.

3. A bubble burst:

Finally, a bubble burst is another possible reason why cryptocurrency prices may crash in 2021. If investors become overly optimistic about the future of cryptocurrencies and tokens, they may be tempted to invest more money than they can afford to lose. This could lead to a sudden decrease in their prices, as well as a lot of chaos and confusion in the market.

6 Unique Ways to Predict Crypto Prices

There are many ways to predict the price of cryptocurrencies. Some rely on fundamental analysis, others use technical analysis. Here are six unique methods for predicting crypto prices.

1. Fundamental Analysis

Fundamental analysis is the study of the underlying economics and financial conditions of a company or asset. It looks at the company’s revenue, earnings, assets, liabilities, and other important factors to determine whether it is a good investment.

Cryptocurrencies are often bought on the basis of their potential future value. Investors may look at factors such as the number of users, the amount of coinage in circulation, and the popularity of the coin. They may also look at factors such as security and regulatory considerations.

2. Technical Analysis

Technical analysis is the study of patterns in financial data that can indicate future trends. This can include looking at prices, volume, and other factors to try to predict what will happen next.

Many people believe that technical analysis can help predict cryptocurrency prices. Technical indicators such as the Bollinger Bands and MACD can be used to track changes in price.

3. Predictions from Existing Investors

Many people believe that predictions from existing investors are the most accurate way to predict cryptocurrency prices. These predictions may come from financial news sources, online forums, or personal blogs.

4. Predictions from Predictive Data Services

Predictive data services use artificial intelligence (AI) to make predictions about future events. They may use historical data to make predictions about future cryptocurrency prices, market movements, or other events.

5. Predictions from Algorithmic Trading Systems

Algorithmic trading systems use computer code to make predictions about future prices. They may use technical analysis or other methods to try to predict where the market is going.

6. Predictions from Analysts

Analyst predictions are often more accurate than predictions from other sources. These predictions may come from financial news sources, online forums, or personal blogs.

How to Use Technical Analysis to Predict Crypto Prices

Technical analysis is a key component of any successful cryptocurrency trading strategy. By studying technical indicators such as the relative strength index (RSI), moving averages, and candlesticks, you can help predict future prices.

When using technical analysis, it is important to keep in mind that not all indicators are created equal. Some, such as the RSI, are more effective at predicting short-term movements while others, such as the moving averages, are better at predicting long-term trends. It is also important to be aware of the different types of charts available and how to read them.

There are four main types of charts used in technical analysis:

The chart below shows the price of Bitcoin over the past year.

The chart above shows the price of Bitcoin over the past 24 hours.

The chart below shows the price of Bitcoin over the past 7 days.

The chart below shows the price of Bitcoin over the past 30 days.

How to Use Fundamental Analysis to Predict Crypto Prices

When you are looking to make a prediction about the future value of a cryptocurrency, it is important to understand how fundamental analysis works. Fundamental analysis is a method of analyzing securities by focusing on their underlying economic fundamentals. These fundamentals can include things like revenue, profit, asset value, and liquidity.

When you are using fundamental analysis to predict the future value of cryptocurrencies, you should focus on three key factors: the technology behind the coin, the market demand for that coin, and the overall health of the cryptocurrency ecosystem.

When it comes to the technology behind a cryptocurrency, you should pay attention to the underlying blockchain technology. Some coins may have better technology than others, and this may impact the future value of the coin. For example, Bitcoin has a better technology behind it than Ethereum.

When it comes to market demand, you should look at how popular the coin is currently. If the coin is not very popular, then the future value of the coin may be lower. On the other hand, if a coin is very popular, then the future value of the coin may be higher.

Finally, you should also consider the overall health of the cryptocurrency ecosystem. If there are any major problems with the cryptocurrency ecosystem, then the future value of the coin may be lower.

How to Use Sentiment Analysis to Predict Crypto Prices

Sentiment analysis is a technique that can be used to predict the price of cryptocurrencies. The technique is based on the analysis of the public comments made about a particular cryptocurrency.

The first step in using sentiment analysis to predict the price of a cryptocurrency is to identify the sentiment of the comments made about that cryptocurrency. There are a number of methods that can be used to identify sentiment, including keyword analysis, social media analysis, and content analysis.

Once the sentiment of the comments has been identified, the next step is to determine which sentiment indicators are most relevant to predicting the price of a cryptocurrency. There are a number of sentiment indicators that can be used, including bullishness, bearishness, volatility, and popularity.

Finally, the sentiment of the comments can be used to predict the price of a cryptocurrency. By using a combination of sentiment indicators and the sentiment of the comments, it is possible to predict the price of a cryptocurrency with a high degree of accuracy.